Equity markets have risen strongly year-to-date, with cyclical sectors leading the charge. Financials and industrials stocks, in particular, have raced ahead, reflecting both solid earnings delivery and renewed investor

confidence in the outlook for global growth. Technology names in the US have also been a standout, supported by the ongoing surge in optimism around artificial intelligence. These sectors have been among the

primary drivers of the rally in global equities, both this year and over the past three and five years. Economically sensitive stocks are now pricing in a stronger growth environment but are not always reflecting

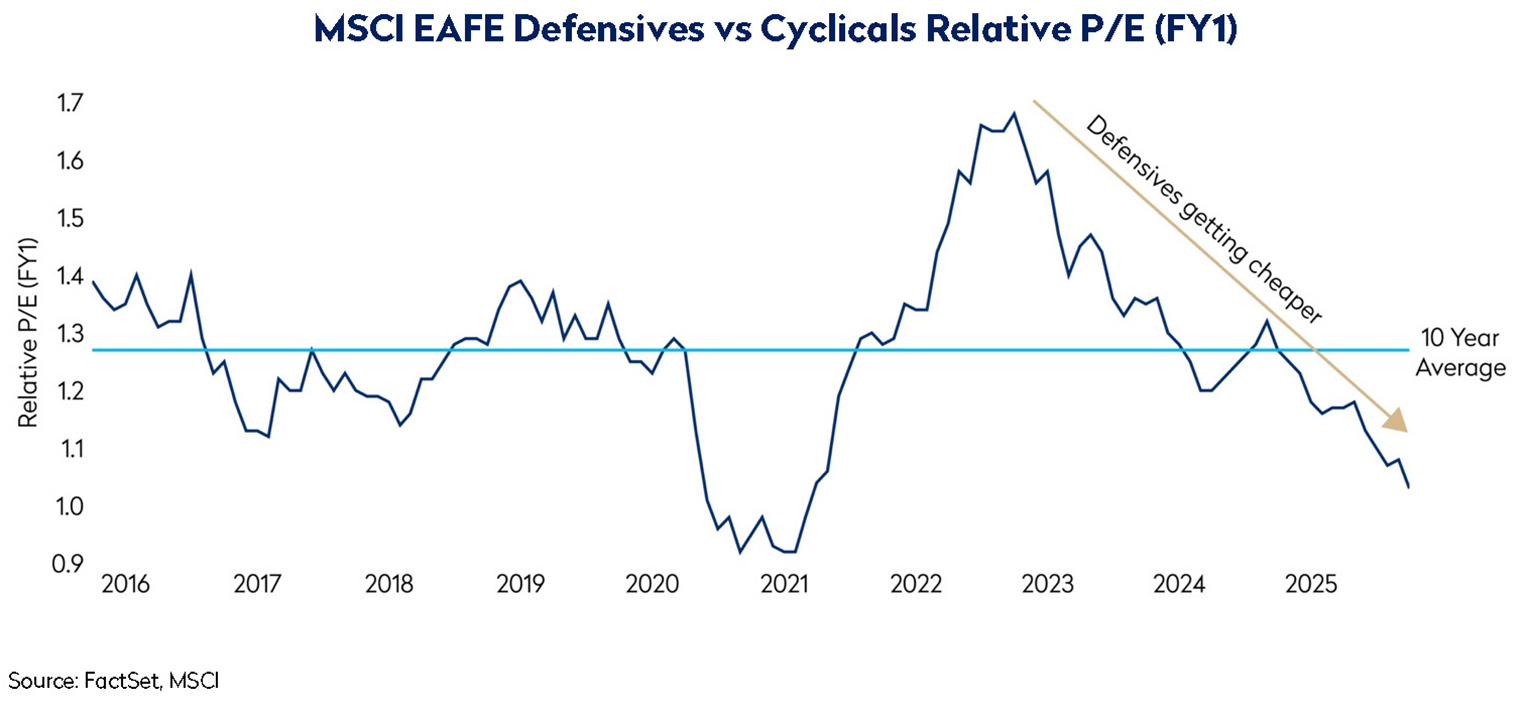

the ongoing risks to valuations – from geopolitical tensions to rising global debt burdens and the impact of higher long-term bond yields. In contrast, the valuations of certain classically defensive stocks, which looked full a few years ago, once again look very attractive, while also typically offering more compelling risk profiles. This is also apparent in the relative valuations of defensives more broadly in MSCI EAFE, which trade close to historic lows compared to the more cyclically exposed sectors¹.

Since we place significant weight on the risk-adjusted returns for any investment, this bifurcation has led to a shift in the portfolio’s sector allocation, in particular within the consumer staples sector. In addition to our significant existing overweight to the utilities sector, we have increased the portfolio’s² exposure to consumer staples materially over the past eighteen months. The portfolio’s overweight position in defensive sectors this year is the highest it has been since 2016.

During 2025, a period in which cyclical stocks have outstripped defensive names, the utilities sector has been a rare defensive sector to have outperformed, as investors have rewarded domestically-oriented “safe havens” with earnings momentum that also offer long-duration growth from structural trends such as electrification, decarbonization and AI-led increases in power demand. The overweight exposure to the utilities sector has added to portfolio returns this year.

We continue to see attractive opportunities in the sector, particularly in regulated names (such as Snam, the Italian gas utility) and integrated utilities (such as Enel, the Italian utility, and SSE, the UK utility) with a high regulated component. We believe the regulated and quasi-regulated exposures of these businesses provide a narrow range of outcomes, and the portfolio’s skew to the UK and Italian regulatory regimes offers protection against macroeconomic shocks, such as higher inflation or interest rates, due to the embedded adjustment mechanisms in these markets (albeit with a lag). We also believe these companies, particularly Enel and SSE, have strong secular growth tailwinds due to their exposure to electricity distribution. As electricity grids will require significant investments to be able to cope with the greater decentralization and intermittency driven by the increasing share of renewable power generation, the regulated asset base for these companies – upon which they get remunerated – should also grow materially over time. We believe current valuations fail to reflect the attractive risk-adjusted returns for these names due to fears, which we believe are exaggerated, around asset duration in the case of Snam, and a combination of power price risk and concerns on future returns in renewables for Enel and SSE.

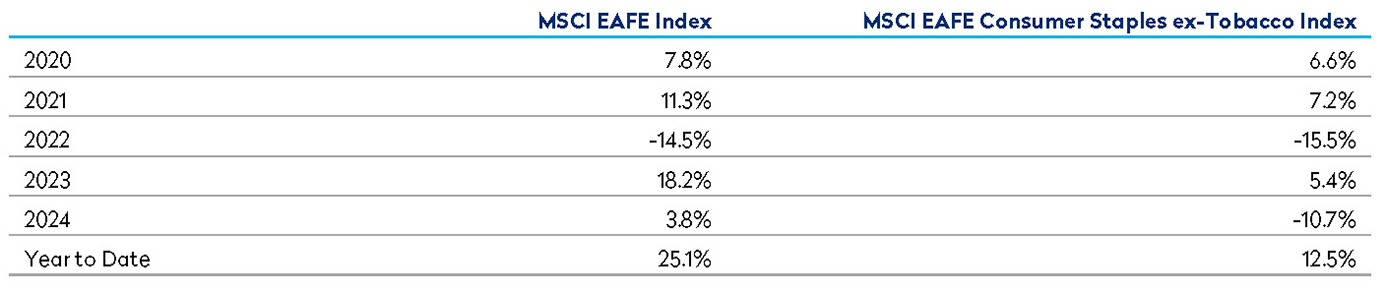

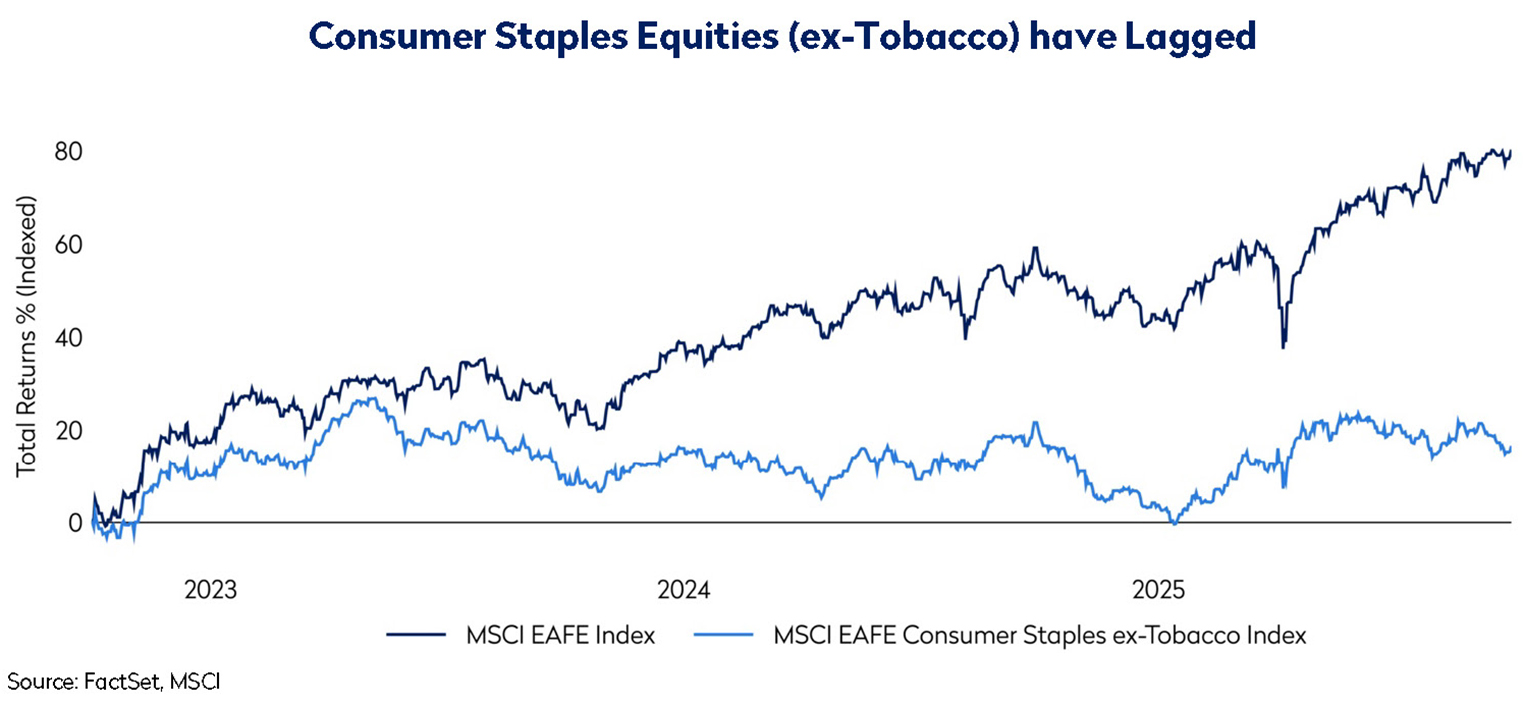

The consumer staples sector has been among the weakest performers over the past three and five years. While most industry groups within the sector have materially lagged, one area where we identified value a few years ago – and which has since delivered strong outperformance – is tobacco, a group of securities that was once deeply out of favor. In addition to holding a position in Imperial Brands (since Q1 2021), we also initiated a position in British American Tobacco in Q3 2024. In our view, the market has significantly underappreciated the durability of cash flows from these companies’ traditional combustibles businesses and, in turn, their ability to return cash to shareholders. For example, Imperial Brands has returned circa £6bn to shareholders via a combination of dividends and share buybacks over the last three financial years, equivalent to circa 40% of the company’s market capitalization at the time of our initiation in Q1 2021, whilst also reducing leverage. We believe valuations in this sub-sector of the market remain attractive, in spite of the strong outperformance over the past three years, given an improving regulatory environment in the US, robust medium-term earnings growth driven by strong pricing in cigarettes, an increasingly successful transition to reduced-risk products as well as front-end loaded cash returns that support the skew of outcomes.

Elsewhere in the consumer staples sector, share price performance has generally been much weaker. This largely reflects disinflation, a weak consumer and – in some cases – a normalization of pandemic-affected

consumption patterns. All three factors have weighed on organic growth and profit margins, and this, in turn, has compressed valuation multiples. In this context, we have added new positions to the portfolio, including Pernod Ricard, the second largest Western spirits company, and Nestlé, where the business mix is dominated by pet food and coffee.

Nestlé and Pernod Ricard have strong market positions in attractive product categories which are characterized by relatively stable volume growth, strong brand power, as well as opportunities for premiumization in developed markets, and for increased penetration in emerging markets. In line with the wider sector (ex-tobacco), valuation multiples have fallen quite precipitously, albeit from historically elevated levels. This derating has been triggered, at least in part, by a drop-off in earnings from an unsustainable, coronavirus-related high-point, a phenomenon that we have seen play out in various guises across other segments of the market (e.g. luxury, autos).

Despite the sector’s derating and our view that it is currently undervalued, we remain mindful of the associated investment risks. Most obviously, the growth in GLP-1s remains an overhang – although, as more time goes by since these drugs came to market, we seem to be getting a better picture of how GLP-1 users are actually behaving. Mondrian’s DDM methodology provides a framework which lends itself to capture such risks. We utilize scenario analysis to model a range of expected outcomes to better understand the skew in returns. We believe there is a high probability that these consumer staples names are undervalued, even allowing for the possibility that business performance falls short of our base case expectations (a positive skew).

Today, Nestlé and Pernod Ricard are trading at historically low valuation levels. Nestlé remains at a modest premium to the broad equity market, but it is important to note that they own a very valuable c.20% equity

stake in highly rated L’Oréal, the French cosmetics and beauty company. If we strip-out L’Oréal from the rest of Nestlé, then the price-to-earnings multiple on the consolidated business is only c.14.5x, rather than 16.5x. In our view, if Nestlé and Pernod Ricard can gradually return to a more predictable pattern of low-to-mid single digit organic revenue growth, potentially with some moderate margin expansion, the upside for shareholders will be significant. In addition, given the low start-point for valuations, the generally stable end-market demand (more so for Nestlé), and the healthy profit margins for these companies, the skew of outcomes appears favorable.

Conclusions

Mondrian’s discipline in adhering to its long-term value philosophy has allowed us to produce attractive long-term real returns, and consistent return characteristics, capturing strong upside in rising markets while

offering meaningful downside protection in weaker periods. Our asymmetric return profile is supported by our long-term cash flow–driven methodology, reinforced by scenario analysis to assess the full spectrum of risks. Despite recent market strength, led largely by cyclical stocks, we continue to find compelling opportunities – particularly in defensive segments. This has driven our overweight exposure to areas such as consumer staples. We believe cyclical stocks are, in many cases, priced using overly optimistic assumptions, while the defensive holdings in our portfolio offer attractive valuations and resilient characteristics that position us well for strong future returns. By applying a bottom-up, consistent, and disciplined investment approach – focused on identifying value, understanding risk, and resisting the noise of short-term market developments – we aim to deliver attractive, risk-adjusted returns over the long term.

Disclosures

¹ Defensive sectors include communication services, consumer staples, health care, real estate and utilities; cyclical sectors include consumer discretionary, energy, financials, industrials, information technology and materials.

² All references to portfolio positioning and transactions are based on the International Equity Value Opportunities Representative Account.

Views expressed were current as of the date indicated, are subject to change, and may not reflect current views. All information is subject to change without notice. Views should not be considered a recommendation to buy, hold or sell any investment and should not be relied on as research or advice.

This document may include forward-looking statements. All statements other than statements of historical facts are forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results to differ materially from those reflected in such forward-looking statements.

Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing, or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent.

This material is for informational purposes only and is not an offer or solicitation with respect to any securities. Any offer of securities can only be made by written offering materials. The information set forth herein is a summary only and does not set forth all of the risks associated with the investment strategy described herein.

The information was obtained from sources we believe to be reliable, but its accuracy is not guaranteed, and it may be incomplete or condensed.

It should not be assumed that investments made in the future will be profitable or will equal the performance of any security referenced in this document. Examples of securities will represent only a small part of the overall portfolio and are used to illustrate our investment approach. Any holdings are subject to change and may not feature in any future portfolio. More information on holdings is available on request.

Unless otherwise stated, all returns are in USD.

All references to index returns assume the reinvestment of dividends after the deduction of withholding tax and approximate the minimum possible re-investment, unless the index is specifically described as a “Gross” index

Past performance is not a guarantee of future results. An investment involves the risk of loss. The investment return and value of investments will fluctuate.

Mondrian Investment Partners Limited is authorized and regulated by the Financial Conduct Authority (Firm Reference Number: 149507).Mondrian Investment Partners Limited is also registered as an Investment Adviser with the Securities and Exchange Commission (registration does not imply any level of skills or training).