Economic perspective on the pandemic: real costs and some recovery

As we muddle our way through the pandemic, the acute phase of both illness and government support looks to be subsiding, with governments, businesses and individuals now focused on the adjustment to a world where COVID-19 becomes endemic. Compared to two years ago, a significant proportion of the world’s population has some form of immunity against COVID-19 (whether via vaccination or infection), real GDP in the developed world is now roughly back to pre-pandemic levels and while there have been differences in the pace of recovery, earnings and dividends have begun to recover sharply across major developed markets.

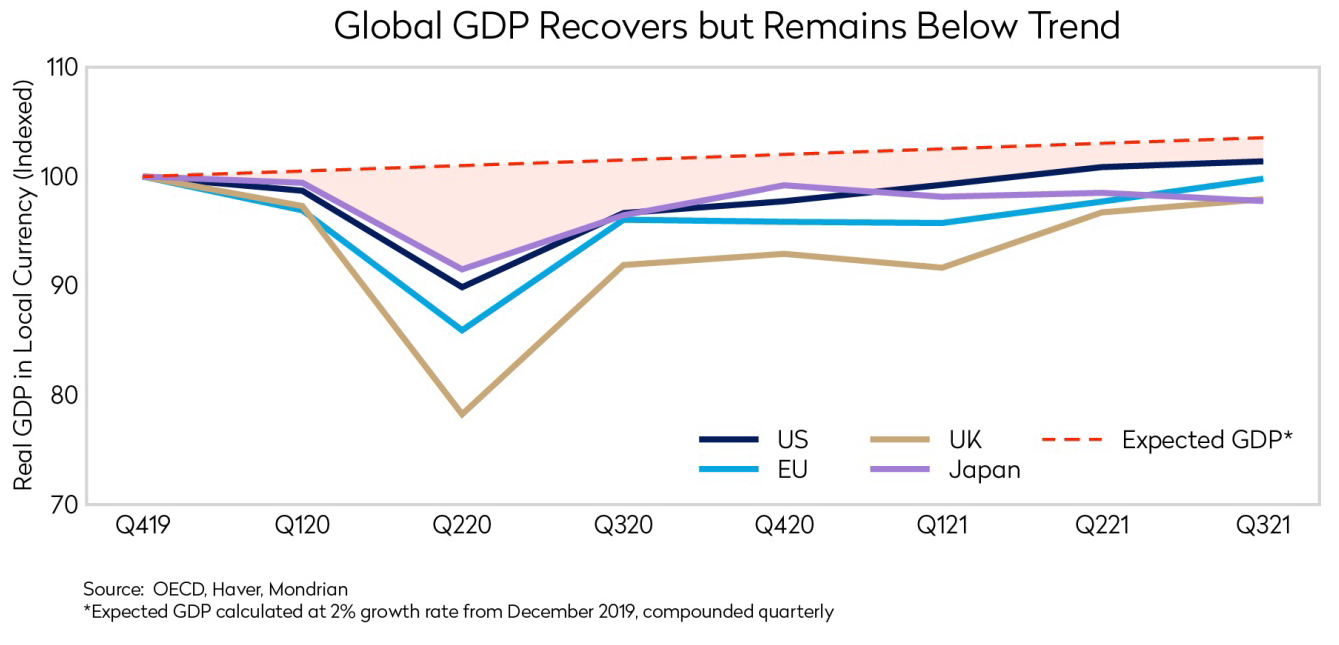

The economic costs, reflected by the shaded area in the exhibit above, have been real and heavy, and both the economic and social costs will be with us for years to come. Stock markets have, against many cogent expectations, responded positively to this world. As investors with a strong lens on valuation, our objective is to understand what implications this somewhat anomalous situation brings to the market outlook and investors’ future returns.

Pandemic narratives have resulted in significant multiple expansion in “growth” segments of the market

When we look closely at the underlying market earnings and dividend data, coupled with our normalized expectations of long-term post-pandemic economic growth, we believe that the data continue to support our central case expectation from March 2020 that the cost of the pandemic would eventually be about 5% of aggregate lost economic value.

At the time, we acknowledged that the value destruction would not necessarily be distributed evenly. What has surprised us is that while actual costs have been more similar in developed markets than we might have expected, the reaction in different markets has diverged dramatically.

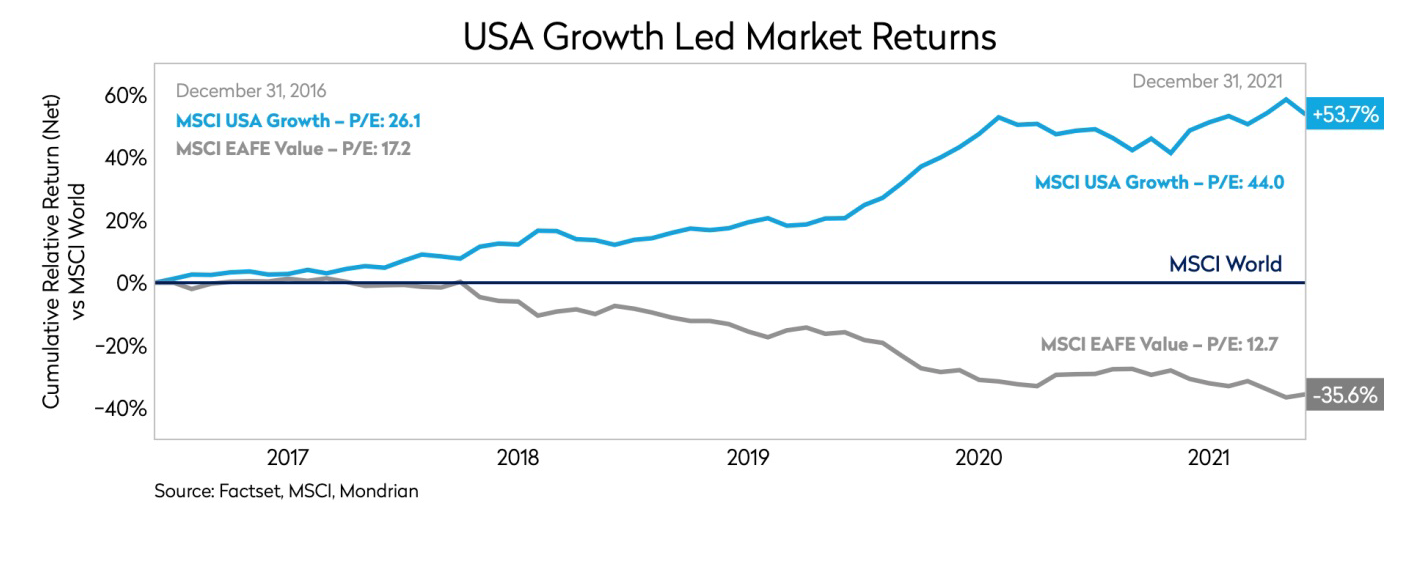

The chart below illustrates the bifurcation in market returns over the past five years and the multiple expansion that has created this return divergence. Over the pandemic, investors have built on the “low-interest-rate-growth market” that developed post the financial crisis, and focused even more narrowly on those areas of the economy that they perceive to be pandemic winners: the US market and the technology sector being the most obvious. We acknowledge the importance of new technologies and continue to have exposure to the sector, but we believe that investors’ price-insensitive exuberance around select segments of the technology sector, especially in the face of the related fear of technological disruption, is creating mis-pricing and presenting opportunities in certain markets and sectors where valuations look appealing, even with extremely conservative assumptions. A bifurcation of opportunity has opened up: while the starting point today is much more stretched in many major segments of the market, other areas unexpectedly look very attractive.

Attractive valuation opportunities within international markets

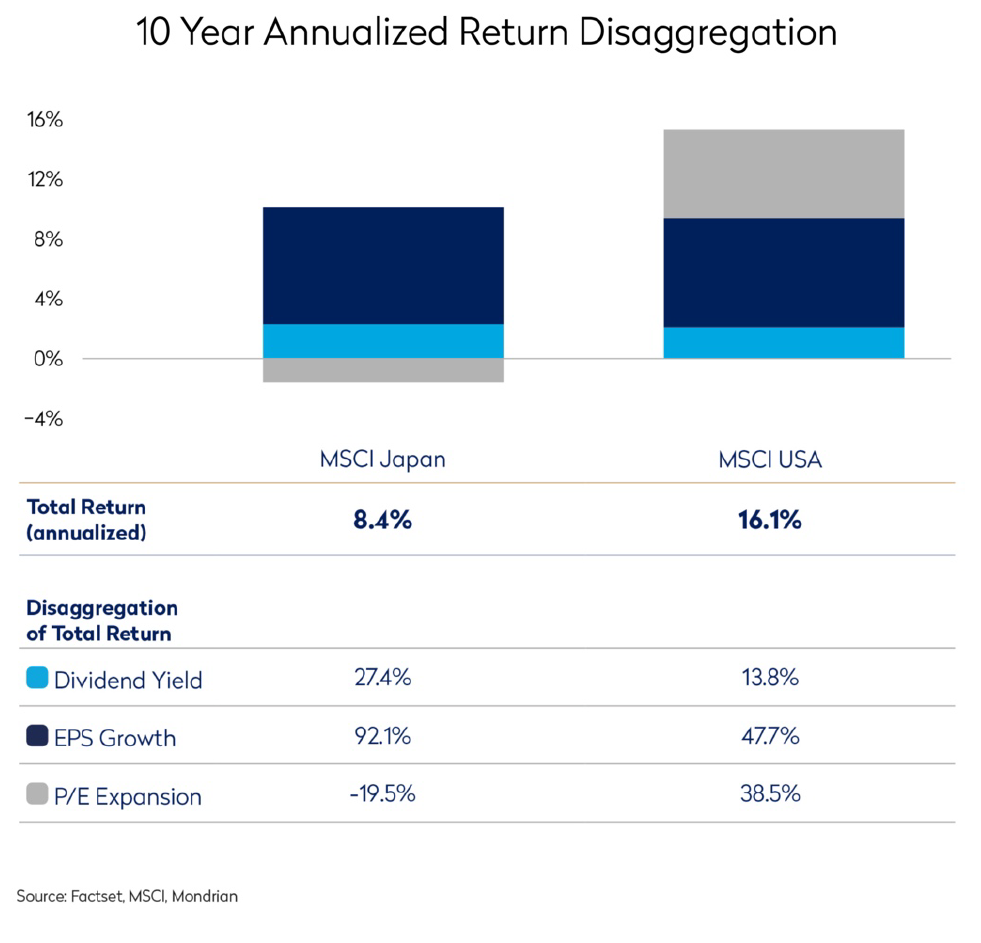

While multiple expansion has become the norm in the US, markets outside the US have experienced multiple contraction. The contrasting experiences of investors in Japan and the US over the past ten years are illustrated below.

While the Japanese market has offered a slightly higher yield and Japanese investors have benefitted from slightly higher earnings per share growth (including the impact of share buybacks) over this time frame, returns in Japan have been almost half that of returns from the US market. This is because multiple expansion in the US has been responsible for almost 40% of the market return over the past ten years, while in Japan, despite very strong corporate earnings, multiples have contracted. Moreover, while the Japan experience is striking, given the overall strength of underlying earnings and dividends, it is not unique: a similar contraction of multiples has occurred in most international markets.

Last quarter we focused our Investment Outlook on Japan, a market that we continue to have strong conviction on and have gradually added to in the past couple of years. We believe that this market is attractive, and recent macro-economic developments further support our investment thesis.

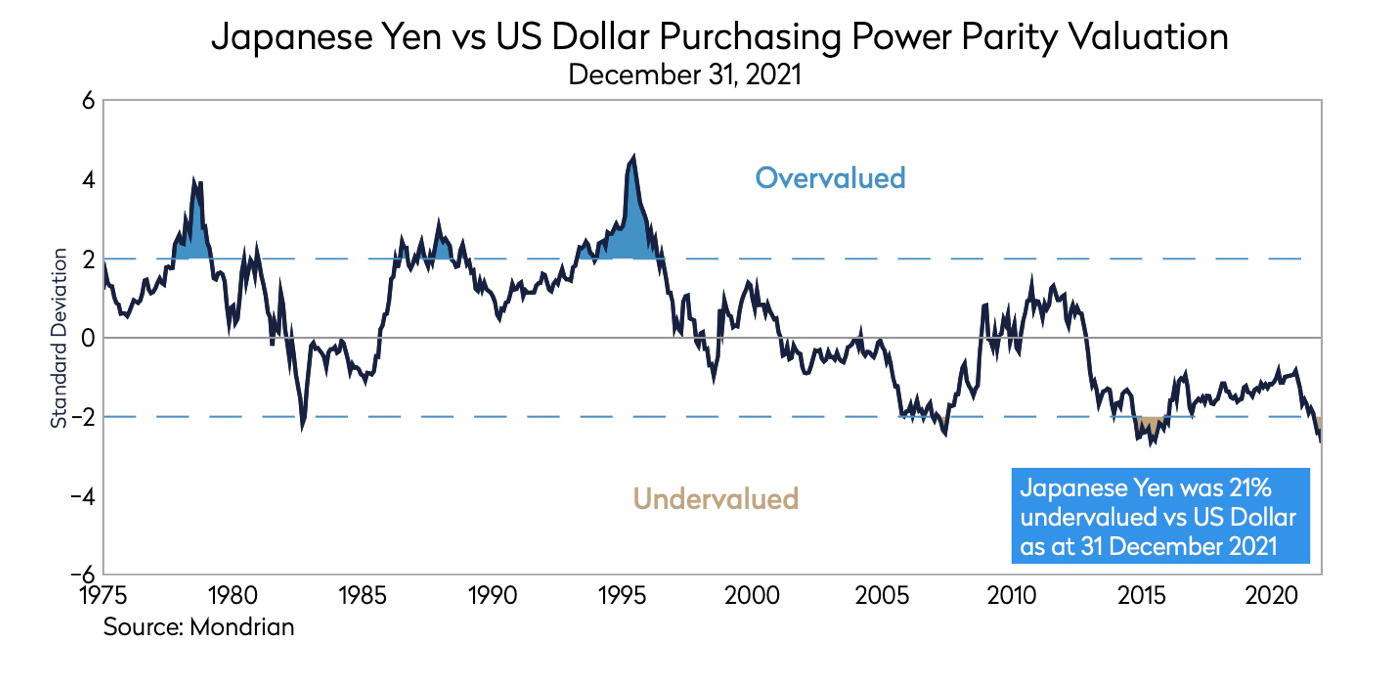

Yen significantly undervalued against the US dollar

The yen has continued to weaken against the US dollar (falling 10% in 2021) as rising inflation elsewhere in the world, especially in the US, and expectations of higher US interest rates have weighed on the currency. With inflation differentials heavily supporting the underlying value of the yen, these developments have resulted in the yen becoming even more undervalued against the US dollar and further underpin both the current competitiveness of Japanese businesses and future US dollar returns for investors.

Portfolio changes in the period have been driven by valuations and our longer term views

The Japanese market lagged last year, as we discussed in the previous Outlook, with investors concerned about the slow start to the vaccine rollout, the uncertainty of domestic politics and a pull-back from Bank of Japan ETF buying. Sundrug and MatsukiyoCocokara, two of the top Japanese drug retailers, struggled in 2021 with higher-margin cosmetic sales in their downtown stores soft due to Work from Home restrictions. Sundrug, one of the most defensive stocks in the portfolio at the onset of the Covid crisis, was particularly weak. We have steadily added to our position in this attractively valued, low-cost nationwide operator with peer-leading operating margins, which is poised to benefit from post-pandemic growth as inbound tourism to Japan returns and domestic cosmetic demand rebounds with more people returning to their offices. At current market valuations, it is rare to find names such as this that are not only geared to the reopening trade, but also provide strong defensive characteristics at an attractive valuation.

Over the course of the past twelve months, as markets have risen and valuation multiples have continued to expand, in particular in the technology sector and the more pro-cyclical areas of the market, Mondrian’s Global Equity strategy has, following strong returns, reduced exposure to and, in some cases, exited certain stocks such as Alphabet, DuPont, Cisco and Exxon. While the overweight exposure to the utility sector detracted from returns, the portfolio benefited from the strength of the utilities stocks in the portfolio in 2021: Red Electrica, Duke Energy, SSE and Naturgy added to returns last year and we have consequently reduced exposure to the sector. We have used this opportunity to add to several COVID-19 laggards such as pharmaceutical stocks Sanofi, GlaxoSmithKline and AbbVie, as well as to other areas of the market which lagged in 2021, including consumer staples stocks such as the domestic Japanese names (for example, the drug retailers discussed above).

At extreme multiples, valuation is key to future long-term returns

Historically there has been a strong inverse correlation between the starting valuation (the price paid) and the future return of stocks. A decade of easy money, with interest rates trending to record low levels, coupled with quantitative easing and, more recently, substantial fiscal stimulus, has distorted that relationship. While earnings and dividends have continued to recover some of the pandemic damage, they remain below our pre-COVID expectations and markets have been driven more by multiple expansion. As a fundamental, cash-flow focused manager, this is exciting as it opens up substantial stock-picking opportunities. Our aim has been to achieve a minimum 5% real return for our clients within a structured scenario analysis framework, focusing on managing uncertainty and increasing the probability of achieving good, long-term absolute real returns. Although the economic costs of the pandemic are real and potentially long-lasting, some equity markets have significantly exceeded our long-term expected real returns. At current valuations, markets seem complacent, attaching a high probability to the best case scenario in some segments of the market. While markets may become treacherous, we continue to maintain our discipline in adhering to our time-tested investment philosophy and are confident that the resumption of a more normal market environment will benefit the relative returns of our value-oriented, defensive portfolios.

Views expressed were current as of the date indicated, are subject to change, and may not reflect current views.

Views should not be considered a recommendation to buy, hold or sell any security and should not be relied on as research or investment advice. It should not be assumed that investments made in the future will be profitable or will equal the performance of any security referenced in this paper.

The information was obtained from sources we believe to be reliable, but its accuracy is not guaranteed and it may be incomplete or condensed. All information is subject to change without notice.

This document may include forward-looking statements. All statements other than statements of historical facts are forward- looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results or performance to differ materially from those reflected in such forward-looking statements.

The material is for informational purposes only and is not an offer or solicitation with respect to any securities. Any offer of securities can only be made by written offering materials, which are available solely upon request, on an exclusively private basis and only to qualified financially sophisticated investors.

Past performance is not a guarantee of future results. An investment involves the risk of loss. The investment return and value of investments will fluctuate. There can be no assurance that the investment objectives of the strategy will be achieved.

This document is solely owned by and the intellectual property of Mondrian Investment Partners Limited. It may not be reproduced either in whole, or in part, without the written permission of Mondrian Investment Partners Limited.

Mondrian Investment Partners Limited, Sixty London Wall, Floor 10 | London EC2M 5TQ | United Kingdom |+44 207 477 7000 • Philadelphia +1 215 825 4500 • www.mondrian.com

Registered office as above. Registered number 2533342 England. For your security and for training purposes, telephone conversations may be recorded.

Mondrian Investment Partners Limited is authorized and regulated by the Financial Conduct Authority. Mondrian Investment Partners is a trademark of Mondrian Investment Partners Limited.