The Japanese equity market increasingly stands out as undervalued

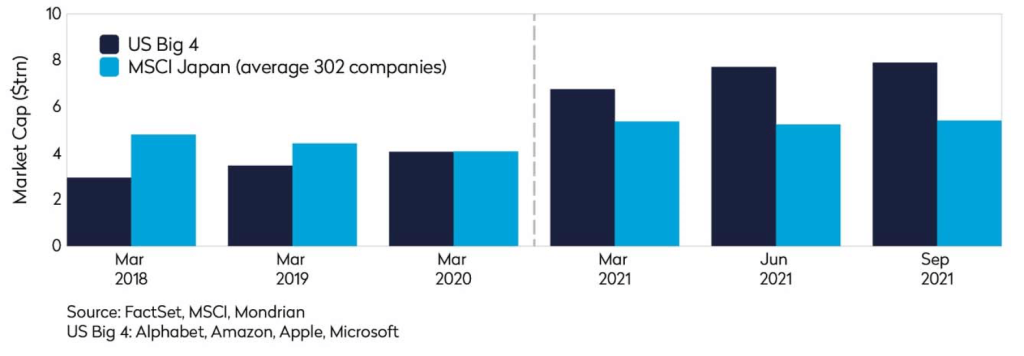

Having been a COVID-19 success story in the early months of the pandemic, the Japanese equity market has been a marked laggard in 2021. As a result, the aggregate market capitalization of just four US stocks (Apple, Amazon, Microsoft, and Alphabet) now exceeds the total capitalization of the Japanese equity market. While investor concerns have ostensibly centered around the slow start to the vaccine rollout, domestic politics and a pull-back from Bank of Japan ETF buying, Japanese corporate earnings, which are very much geared to global trade, have continued to recover strongly.

US Big 4 Larger than Japanese Market

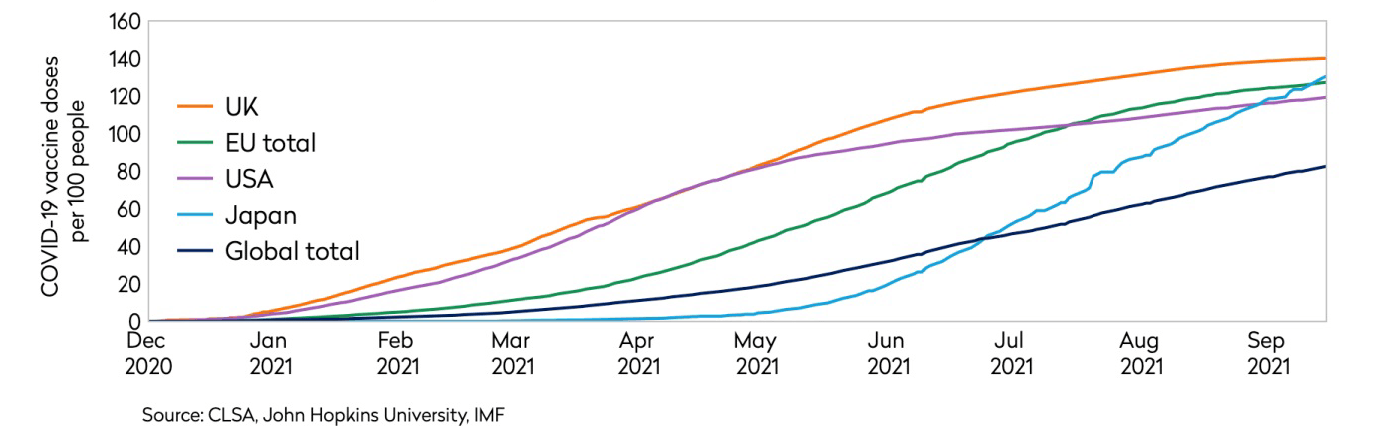

Under the radar, Japan’s vaccination program has accelerated in recent months, overtaking both the US and the EU. With COVID anxiety therefore abating, we believe the significant value inherent in the underlying earnings and dividend support should become more obvious. Despite its underlying earnings cyclicality, the Japanese market currently has an appealing combination of attractive valuations, a defensive dividend stream due to strong corporate balance sheets, and an improving corporate governance profile. This should create significant opportunities for long-term, valuation-focused investors like Mondrian.

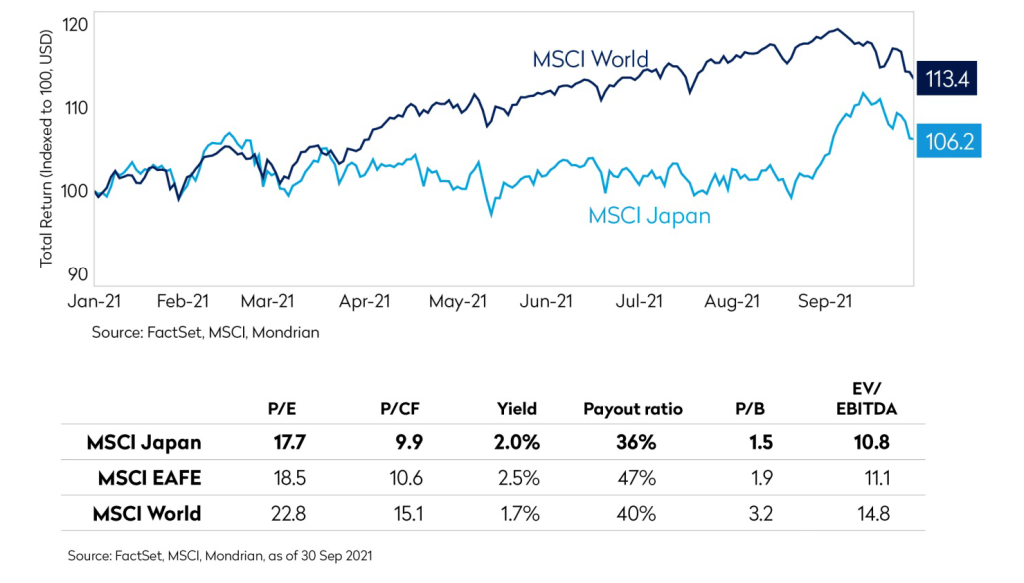

MSCI Japan has Significantly Lagged Year-to-Date

Corporate Japan continues to generate strong earnings and dividend growth, buoyed by the cyclical rebound in global trade

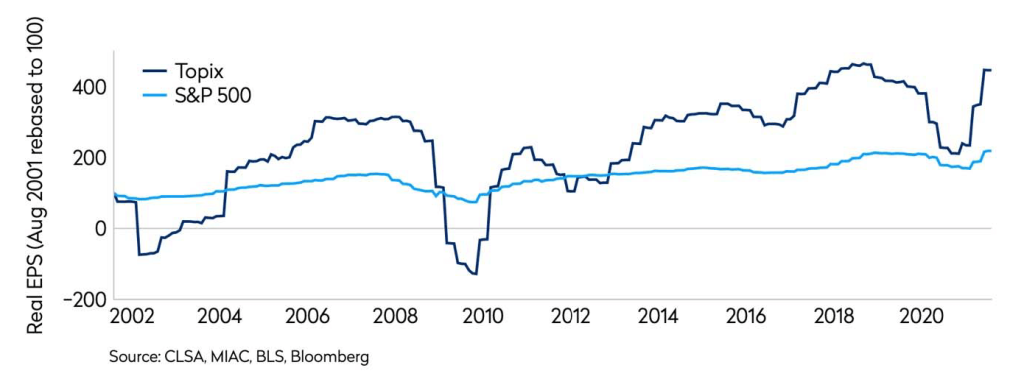

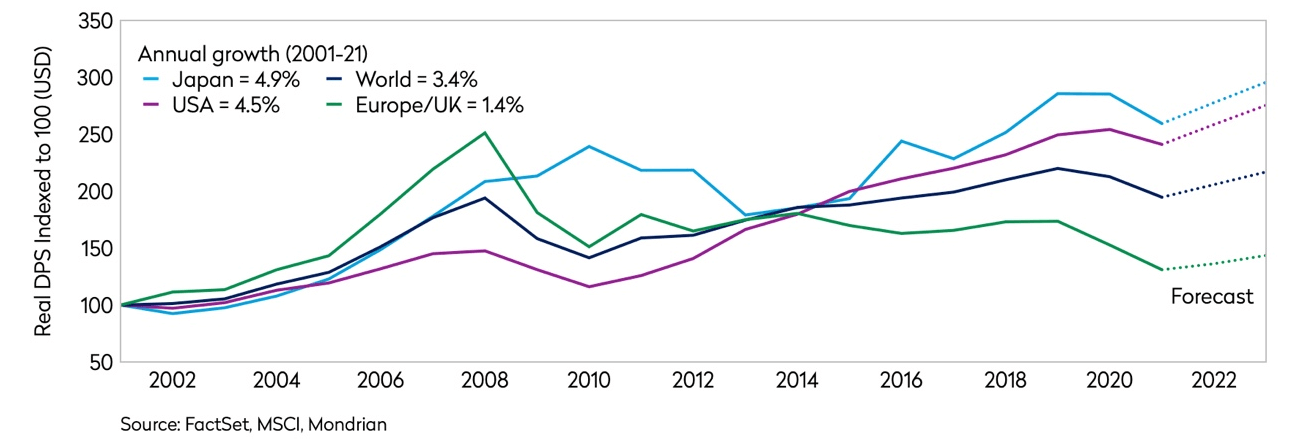

Japanese corporate earnings and dividend growth have been strong in the post-GFC world, and post-pandemic are likely to further benefit from any global economic recovery. Crucially, it surprises many to note that EPS and DPS growth in the Japanese market has actually exceeded that of the US market over 20 years (see charts below), albeit with a more cyclical profile. Although you might not guess it from recent market returns, Japanese corporate profits are approaching record highs.

Japanese Corporate Earnings have Outgrown US Earnings

MSCI Japan Exhibits Strongest Dividend Growth Since 2001

Strong corporate balance sheets support a positive skew of outcomes

We have written in the past about how historically many investors have placed little value on overcapitalized balance sheets of Japanese companies due to the traditional reluctance to return this excess cash to shareholders. In our analysis, we are cautious and do not assume that Japanese corporates will successfully “unlock all of the balance sheet value” in our base case scenario but the capital strength does create potential upside and provides a cushion against the worst case outcomes in our bottom-up valuation analysis. Moreover, improving corporate governance and a growing focus on capital allocation continues to increase the probability of positive outcomes, potentially enhanced by significant upside given still much lower average payout ratios in Japan. Encouragingly, Japanese corporate share buyback announcements so far in 2021 are at a record high level despite ongoing COVID-related uncertainty.

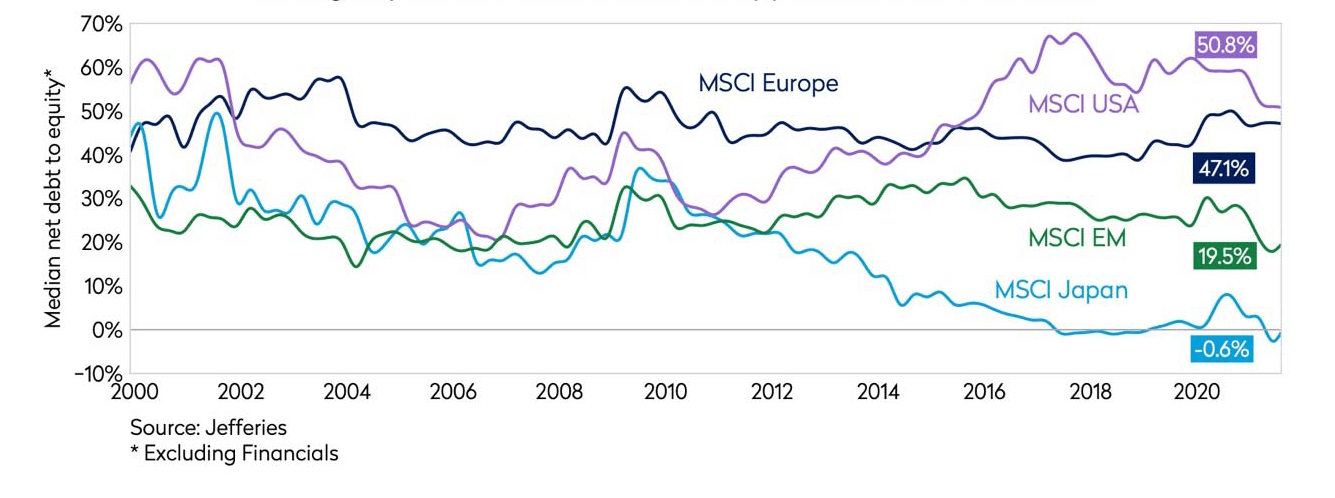

Strong Japanese Balance Sheets Support Skew of Outcomes

While the US equity market has been boosted by a significant rise in share buybacks since the global financial crisis, funded in part by adding leverage, corporate Japan could be at the beginning of this journey from a highly overcapitalised starting point.

Corporate governance and capital allocation continue to improve, increasing the probability of realizing value for shareholders

Corporate governance is understandably often cited as a key concern when investing in Japan. While we acknowledge that Japan still lags other developed markets in this area, the direction of travel is clearly positive. This, in turn, increases the probability of improved capital allocation and shareholder returns. There remains significant value in Japanese equities that can be unlocked with improving capital or operational efficiency. Positive corporate governance changes are only beginning to see increased realization of this value. Mondrian’s integrated and forward looking ESG analysis enables us to recognize the potential opportunities in this improving trajectory alongside considering possible risks.

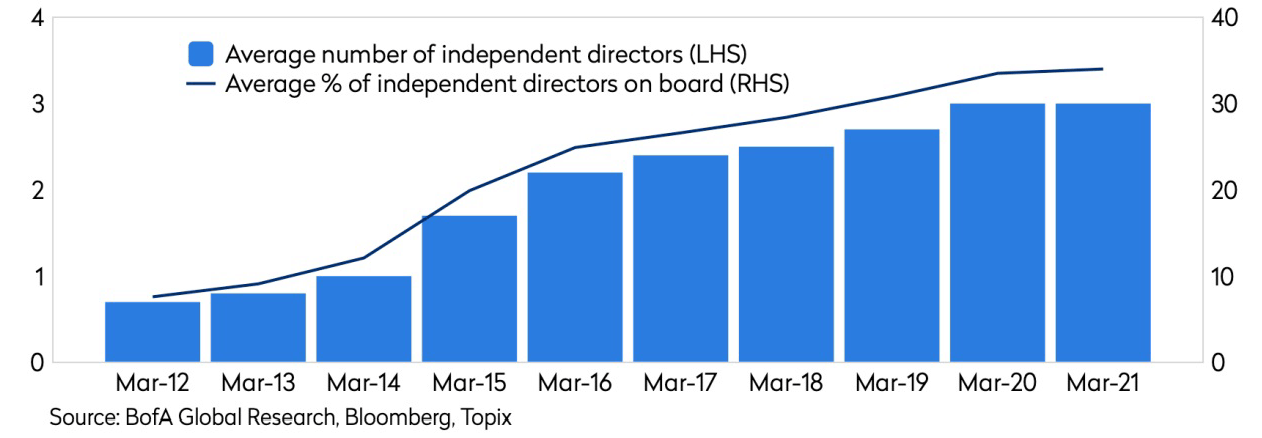

The positive corporate governance changes initiated by former Prime Minster Abe continue to gather momentum; the revised Corporate Governance Code released in May this year has increased the focus on board independence in particular (see chart below). Activist pressure and private equity interest in the country are also notably on the rise, putting increased pressure on companies with poor capital or operating efficiency. The past year has seen the first successful hostile acquisition as well as the largest ever share buyback in Japanese corporate history. From next year, proxy advisors ISS and Glass Lewis will recommend voting against re-election of management where cross-shareholdings make up more than 20% or 10% of assets respectively, adding further pressure on inefficient capital allocators.

Improving Board Independence

In our meetings with Japanese companies we continue to notice a discernible, positive shift in attitudes towards shareholders. A good example in the portfolio where corporate governance improvements have led to increased shareholder returns is MatsukiyoCocokara. The drugstore operator has steadily increased its dividend in recent years; more recently, the company used excess cash on its balance sheet in its acquisition of a smaller competitor in the Japanese drugstore space, increasing its share in a consolidating industry, in a move which led to subsequent share price outperformance. We have seen similar gradual corporate governance improvements in other companies in the portfolio: Mitsubishi Electric has just initiated a stock buyback while Hitachi has moved to a diverse and majority independent board, coinciding with a significant sharpening of focus in its portfolio of businesses supporting strong free cash flow. We believe the company is now poised to move to the next phase of its journey by increasing shareholder returns more meaningfully.

Key longer-term risks include high government debt, cyclicality, geopolitics, yen appreciation

As with any investment, investing in Japan has its risks. But while media attention has continued to focus on the slow start to the vaccine rollout, rising COVID cases around the Tokyo Olympic & Paralympic Games, and domestic political squabbles, our risk analysis focuses more on the longer-term risks.

Japanese Vaccine Rollout has Accelerated

Vaccination rates in Japan have already overtaken the US and the EU, and the government lifted the state of emergency restrictions at the end of September which should support a rebound in economic activity. The dominant Liberal Democratic Party (LDP) are still very likely to win the upcoming Lower House elections and a shift from Suga to Kishida as Prime Minister will likely have little long-term impact on the Japanese equity market.

The Bank of Japan buying of equity ETFs in recent years is a commonly cited reason for global investors to be cautious about investing in Japan. Like QE and tapering, some investors perceive the risk to be too much purchasing while others worry that the marginal buyer is tapering. While the BOJ’s involvement in the market is an important consideration, the evidence in relation to the central bank’s influence on price setting and index levels is ambiguous and sometimes contradictory, with the market derating since the BOJ began to purchase equities and ETFs.

For Mondrian, the key longer-term risks to investing in Japan are around high government debt levels, the cyclicality of corporate earnings, geopolitics, and the potential for yen appreciation to harm the operating margins of exporters. High government debt is the mirror image of strong corporate balance sheets. It is mostly held domestically which helps to mitigate the risk, but we continue to monitor this closely and remain aware of the longer-term challenges exacerbated by challenging demographics. We are very aware of the cyclicality of Japanese corporate earnings and the sensitivity to global trade, itself vulnerable to supply chain disruption. However, strong corporate balance sheets help to ensure that corporates continue to invest in their businesses and that dividends are much more resilient even when profits see a cyclical decline. For example, since the onset of the COVID pandemic, dividends in Japan have held up much better than those in most other global markets.

Geopolitics remains an issue for many markets globally and Japan is not alone in walking a fine line between its two largest export markets in the US and China. On the positive side, Japanese corporates do benefit from significant exposure to other Southeast Asian countries which can benefit from any potential movement of supply chains out of China. Our forward-looking currency analysis explicitly forecasts yen appreciation. We consequently include a margin impact in our bottom-up, forward-looking financial statement models. This currency analysis is also encouraging us to look again at more defensive, domestic-oriented investments, including names such as Sundrug, where the portfolio return would also benefit from any yen appreciation.

Japan continues to offer attractive opportunities for bottom-up stock selection

Despite political and COVID uncertainty, Japan is an attractively valued market which offers strong corporate earnings growth, a defensive dividend stream, and continued corporate governance improvements helping to unlock further value. In this broad and deep market – Japan, which makes up only 7% of MSCI World by market capitalization, accounts for more than 17% of the index’s constituents – we continue to find strong, bottom-up value opportunities, especially in those companies with overcapitalized balance sheets. This approach has worked well for Mondrian over time, with Japan stock selection a positive contributor to returns over the long-term. We see attractive opportunities in Japan today and aim to continue to identify mis-priced securities, in what we believe is probably the least well-covered developed equity market, using our fundamental, forward-looking, bottom-up, and value-focused approach.

Views expressed were current as of the date indicated, are subject to change, and may not reflect current views. All information is subject to change without notice. Views should not be considered a recommendation to buy, hold or sell any investment and should not be relied on as research or advice.

This document may include forward-looking statements. All statements other than statements of historical facts are forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results to differ materially from those reflected in such forward-looking statements.

This material is for informational purposes only and is not an offer or solicitation with respect to any securities. Any offer of securities can only be made by written offering materials, which are available solely upon request, on an exclusively private basis and only to qualified financially sophisticated investors.

The information was obtained from sources we believe to be reliable, but its accuracy is not guaranteed and it may be incomplete or condensed. It should not be assumed that investments made in the future will be profitable or will equal the performance of any security referenced in this paper. Past performance is not a guarantee of future results. An investment involves the risk of loss. The investment return and value of investments will fluctuate.