Investors have long known that adding international equity exposure to their portfolios will add diversification benefits that may improve returns and dampen portfolio volatility. However, particularly since the US stock market has outperformed international equities for nearly a decade, some may falsely believe that owning non-US stocks no longer offers the performance-enhancing advantage it once did. We would argue that this perspective ignores a real and significant resurgence in international equities, fueled by solid corporate earnings and global economic growth.On a trailing one year basis through June 30, 2017, the S&P 500 rose 17.9%, the MSCI EAFE (net) gained 20.3%, and the MSCI Emerging Markets (net) advanced 23.8%.1After years of unusually wide performance dispersions of international versus US indices, US investors with international equity positions should be pleased.While recent market performance has been quite positive, we believe that active strategies that seek to limit downside risk while participating during market advances are the best way to protect and grow client capital. As a value-oriented, defensive manager, Mondrian Investment Partners has a strong bias toward preserving client capital during protracted market declines.Our rationale for including non-US value-oriented equities in a diversified international investment portfolio can be briefly summarized as follows:

1. Active Defensive Strategies May Help Insulate Portfolios from Volatile Global Markets

The last several years have been relatively benign in the world’s equity markets. Investors have largely focused on buoyant economic fundamentals and ignored the chaos of American politics. However, there is a growing recognition that headline risks — whether a potentially serious threat of nuclear confrontation with North Korea, a possible US trade war with China, or unspecified terrorist attacks — could lead to greater equity-market volatility worldwide.Conditioned to expect good earnings news, investors may be ironically more sensitive to headline events, and react to them – often poorly. Our belief is that a value-oriented investment strategy that utilizes extensive fundamental research and assesses value across country boarders to emphasize earnings quality over speculative growth is more likely to preserve investor capital in times of market stress.

2. Macro Risks Could Lead to a Rotation into Value

Interventionist central bank actions in Europe and the US have largely helped growth investors who have benefited from globally low interest rates and loose monetary policy.A return to a more ‘normal’ monetary environment with relatively more restrictive interest rates and policies would generally be more favorable to value stock investors. International value equity investors, who focus on the quality and sustainability of future cash flows and successfully apply a long-term, real, equity risk premium will be better able to defend their portfolio from these macro shifts.

3. An Expanded Opportunity Set

At the end of 2016, the US accounted for 53.2% of the world stock markets.2 However, while the market capitalization of the largest US companies has grown markedly over the past several decades, the composition of the US market itself has changed significantly relative to the rest of the world.In 1998, there were 7,500 US publicly listed companies tracked by the Wilshire 5000, an index used as a proxy for equities with available pricing data. In early 2017, that number was down to 3,600 US stocks3 likely reflecting the fallout from increased regulations making it more difficult to take companies public, fewer IPOs, and increased M&A activity.At the same time, the number of companies listed on global exchanges has expanded rapidly, from about 23,000 in 1995 to 33,000 by the end of 2016.

4. Clear Diversification Benefits Over Time

US stocks respond in some measure to US economic and market forces, while stocks domiciled outside the US offer exposure to a broader array of economic forces. Even as evidence points to increasing globalized correlations between US and foreign markets, structural differences in interest rates, currency values and inflation often cause international markets to produce very different performance characteristics from US equities.5. Better Value Than US Shares

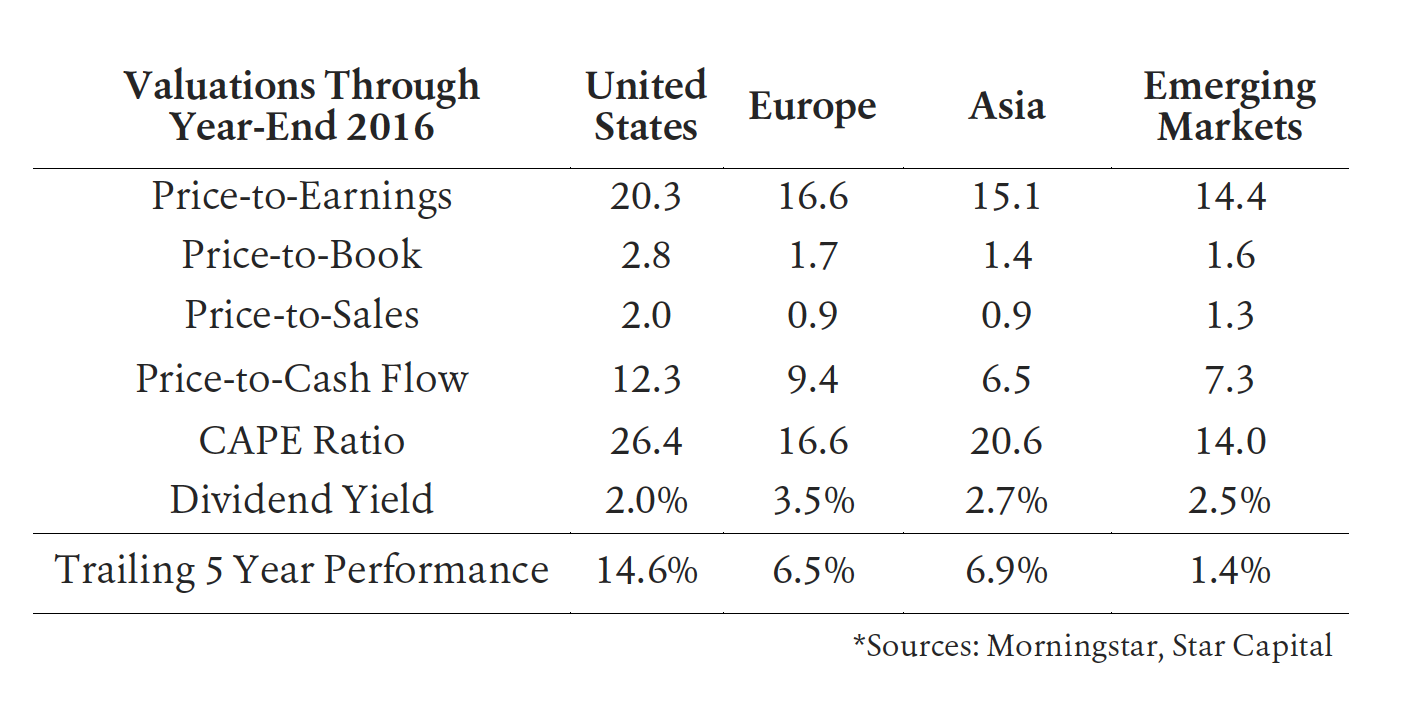

At the end of 2016 the US was the most expensive market across every major valuation metric, which makes sense given the US market’s outperformance over the recent years, as the following table shows.

A Strategic Allocation

Notwithstanding the unusually long period of outperformance of US equities relative to international equities, we believe investors are well served by maintaining a strategic allocation to more defensive international value stocks.In our view, owning long-term positions with well-diversified exposure across individual companies, countries, industries, and underlying currencies can provide access to far more opportunities than are presently available in US markets, greater protection from headline and macro risks, and greater portfolio diversification benefits than is available from an all-US equities portfolio.Mondrian Investment Partners Limited www.mondrian.com is an independent, employee-owned, international value-oriented investment manager with offices in London and Philadelphia.Mondrian, founded in 1990, managed more than $60 billion (US) in assets, including over $16 billion in international equity assets as of June 30, 2017. We have a diverse, global client base, investing for corporations, public and private pension plans, endowments, foundations, and individual investors in a broad range of strategies and vehicles.[1] Source: MSCI – Past performance is no indication of future performance.[2] FTSE Analytics, FTSE All-World Index Series, December 2016.[3] Dimensional Fund Advisors, quoted in Bloomberg.com, March 17, 2017.

James Brecker – (215) 825-4542 / jim.brecker@www.mondrian.com