Diversifying an institutional portfolio with international equities is an accepted way to pursue asset accumulation and preserve value over time.

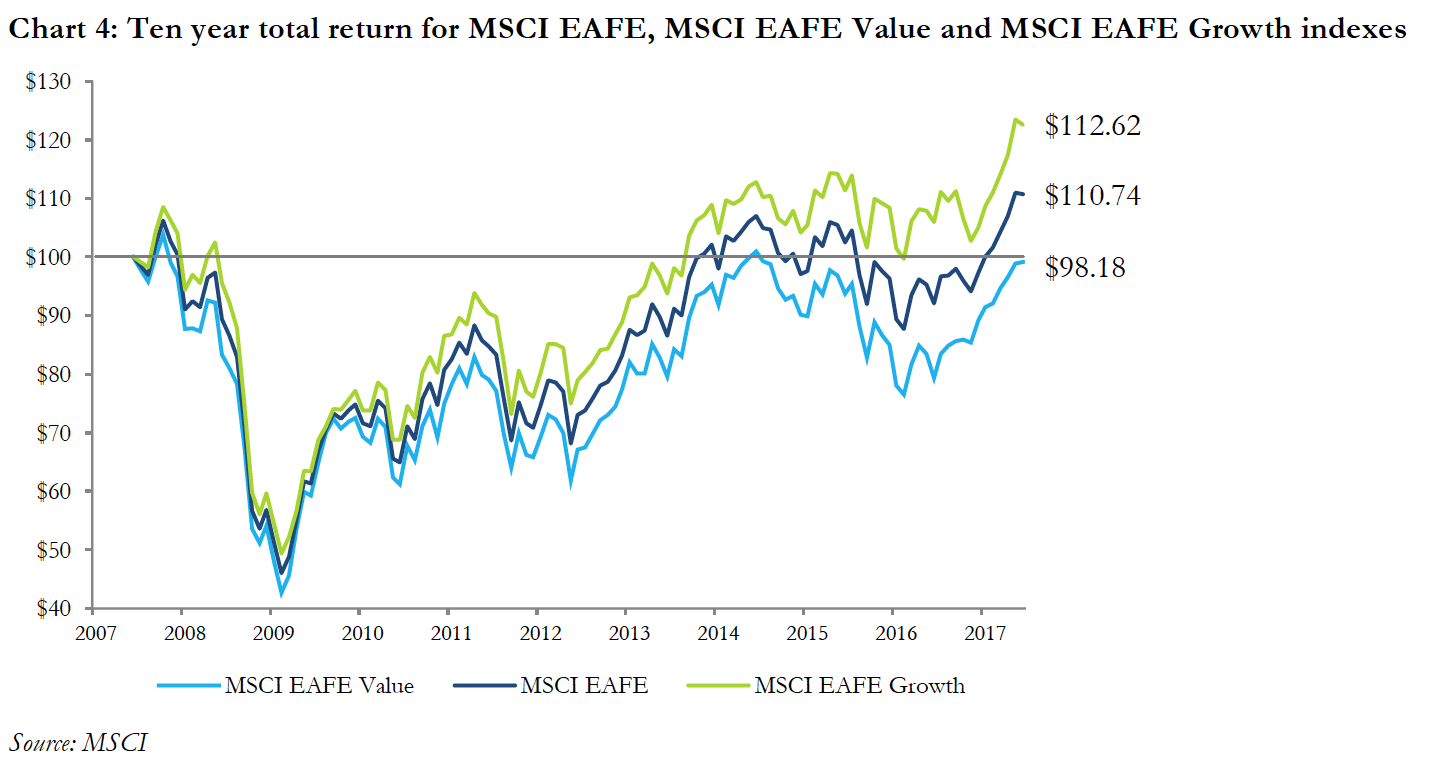

For the first six months of 2017 it was also a rewarding strategy as the MCSI EAFE (Europe, Australasia, and Far East) Index returned 13.8%. For the same period, the EAFE Value Index was up 11.1%, while the EAFE Growth Index returned 16.7%. Asset classes and investment strategies can go in and out of fashion. With value investing being out of favor since the 2007-08 global financial crisis, investors may begin to question the wisdom of allocating institutional capital to a value-oriented, defensive strategy (see chart below).

Ten-year Total US$ Return for International Equity Indices

When Should Investors Consider Value?

As a value-oriented international equity manager, Mondrian has found the current environment to be a challenge, to be sure. At the same time, we caution investors who may be relaxing their valuation discipline to chase the performance of the growth stocks. In international markets characterized by low interest rates and loose monetary policy, many investors have lowered the discount rates they apply to anticipated future growth, which in general is fueling what we believe to be speculation in some growth stocks. Equity markets are not static, and when the cycle eventually turns, we believe Mondrian’s time-tested value investment approach will be able to preserve capital and mitigate global market volatility. In challenging markets, there are certain advantages to following a defensive value-oriented approach. Here are several to consider:

1. A Buffer to Downside Market Volatility

Value investing provides a buffer to downside market volatility. Mondrian’s value-oriented, defensive investment approach is centered on identifying companies whose strong future cash flows, derived from dividends and changes in the capital structure, has proven to provide a stable long-term return for shareholders.

2. A Margin of Safety

An additional element to this approach is focusing on the risk of a company failing to provide those cash flows. Mondrian explicitly models those risks using scenario analysis. This value discipline creates a margin of safety that may help avoid some of the most risky, volatile investments — even when business performance falls short of base-case expectations. Despite inevitable periods when growth outperforms value, investing across a range of lower-risk stocks can deliver attractive returns with less volatility and potentially smaller drawdowns.[1]

3. A Strategy to Mitigate Currency Movements

Thoughtful country selection and allocation decisions based on real returns can help mitigate host-country pricing pressures. Foreign currency movements can have an outsized effect on stock values in the investor’s home country, and make it difficult to compare valuations of securities in different domiciles. In addition, currency effects can distort margins of safety that help protect value in challenging markets. Currency movements are nearly impossible to forecast with much consistency, so at Mondrian we apply a proprietary long-term purchasing power parity (PPP) currency analysis to assist our security and country selection process and, at extreme levels of overvaluation, inform any hedging decisions. These steps are essential to defending a portfolio when currency values are at extremes.

4. A Way to Isolate the Value of Cash Flows

Active, fundamental securities analysis isolates value from index-based pricing dispersions. Passive equity approaches have become popular, and outsized inflows into capitalization-weighted indexes have had distorting effects on individual company values, especially among a handful of tech names.

Active defensive approaches, on the other hand, are geared to measuring the quality and sustainability of future cash flows. When these cash flows are appropriately discounted to reflect the equity risk premium and expected inflation, investors are better protected from downside losses and better positioned to participate when markets return to health.

A Defensive Value-Oriented Philosophy

As noted earlier, investors tend to overpay for growth when interest rates are held artificially low and monetary policy floods the markets with liquidity. Even with the value strategy being currently out of favor, we believe that an allocation to a defensive, value-oriented equity strategy — one that incorporates detailed security research as well as top-down country allocation and currency analysis — may be an effective way to preserve capital during international equity market declines.

Mondrian Investment Partners Limited www.mondrian.com is an independent, employee-owned, international value-oriented investment manager with offices in London and Philadelphia.

Mondrian, founded in 1990, managed more than $60 billion (US) in assets, including over $16 billion in international equity assets as of June 30, 2017. We have a diverse, global client base, investing for corporations, public and private pension plans, endowments, foundations, and individual investors in a broad range of strategies and vehicles.

[1] Black, F. (1972), “Capital Market Equilibrium with Restricted Borrowing,” The Journal of Business, Vol. 45, No. 3, pp. 444-455.