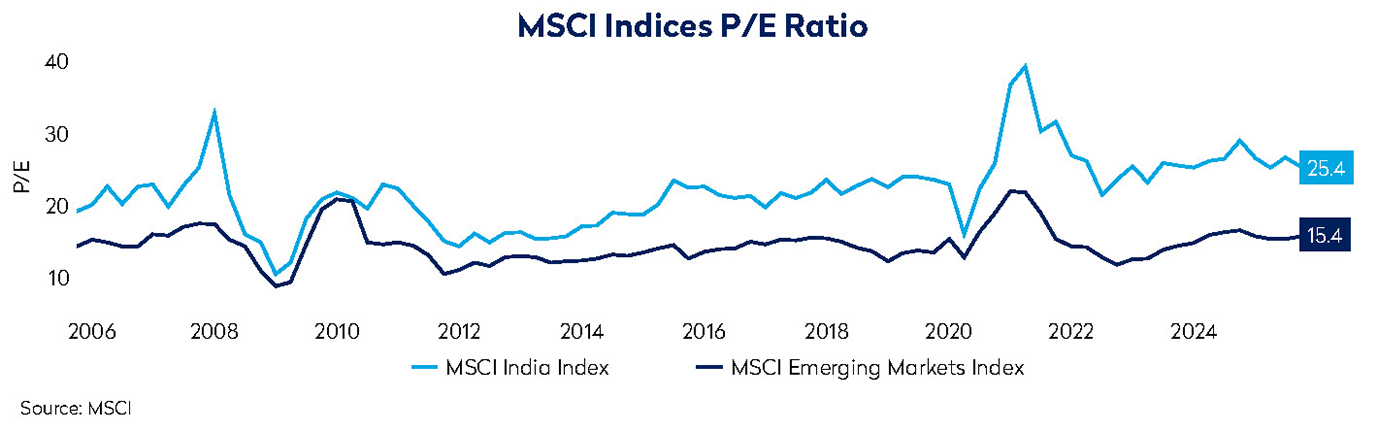

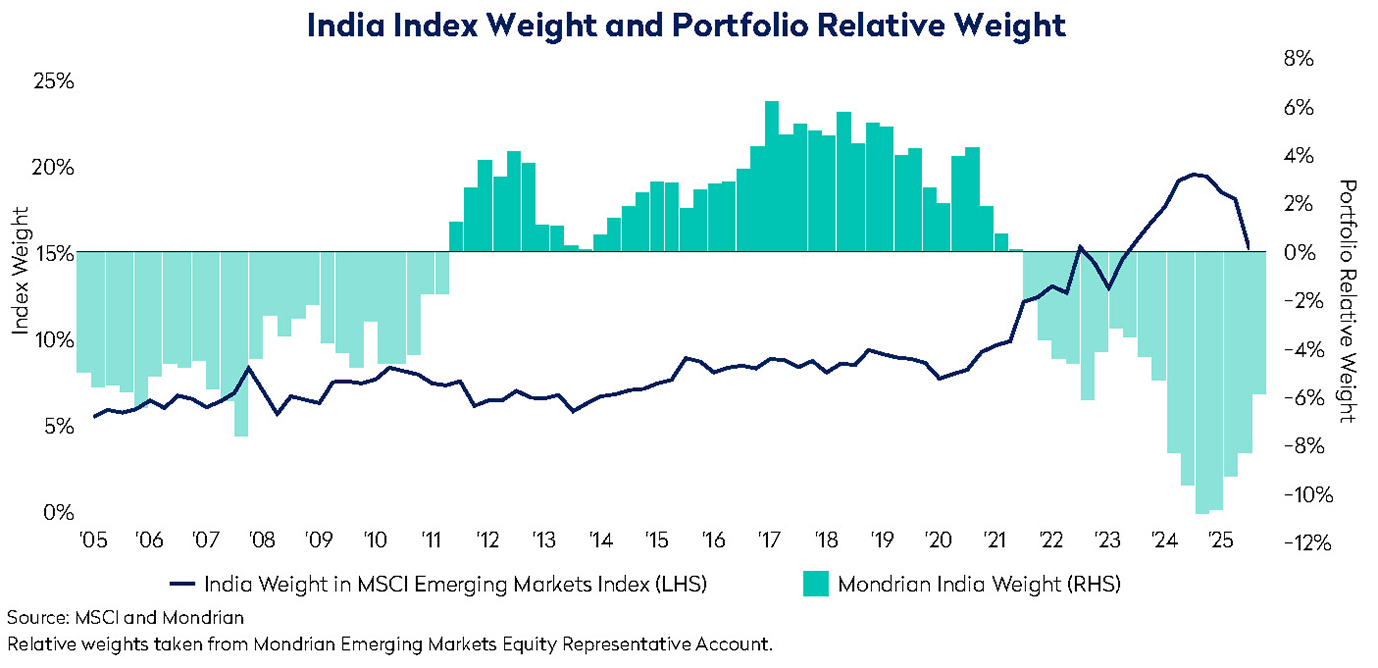

It has been three years since India last formed the theme of our quarterly outlook. At that time, the country had enjoyed a long stretch of strong equity market performance, comfortably outpacing most global indices and securing the second-largest weighting in the MSCI Emerging Markets (EM) index. This rally reflected India’s solid economic fundamentals and political stability, but it was also driven by an expansion in valuation multiples. India therefore represented a conundrum for us as value investors; while we recognized many positive features, concerns over stretched valuations led us to adopt a significant underweight position. Three years on, it felt an appropriate time to revisit India’s progress and our positioning.

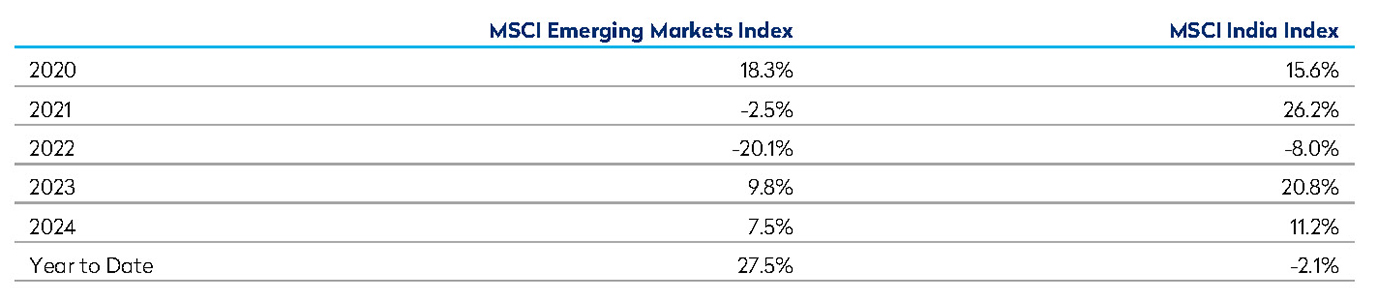

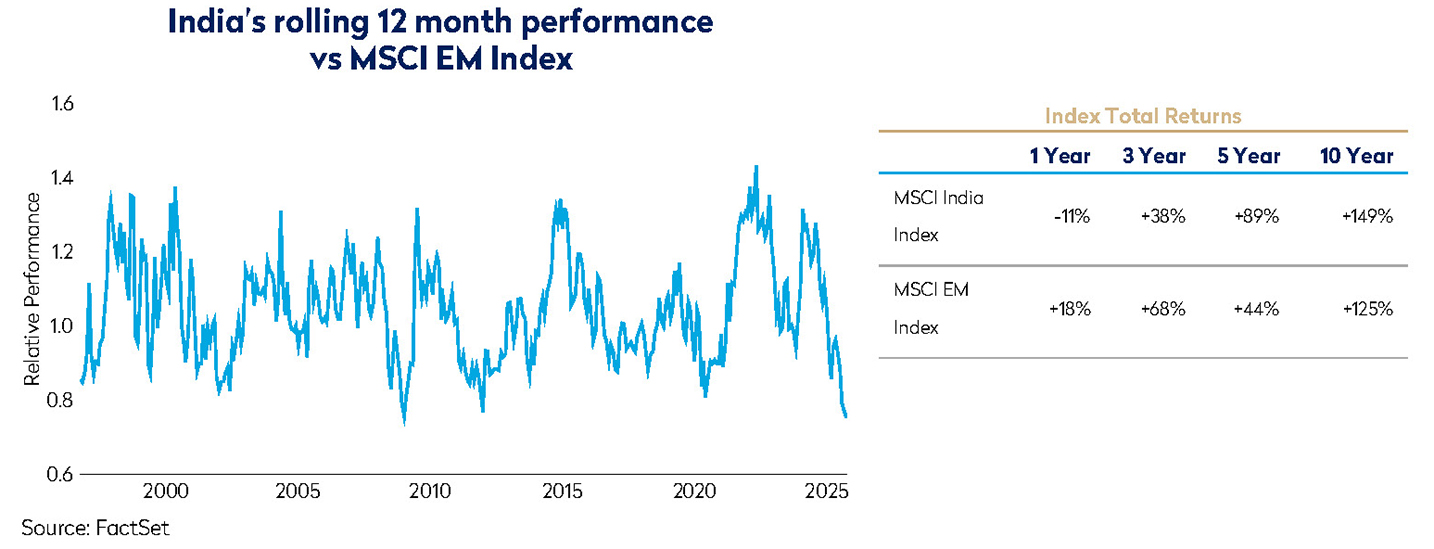

For much of the intervening period, investors retained a positive stance toward India. From October 2022 to September 2024, the equity market gained a further 56%, outperforming the MSCI EM Index by 10%. Our underweight stance was therefore a drag on relative performance through 2023 and much of 2024. Yet, since September 2024, India’s market has fallen by 11% in USD terms, while the EM Index rose 18%. This represented India’s worst year of underperformance since 1996 and means that, over three years, India has now underperformed EM by a not-insignificant 21%. Our underweight exposure thus evolved into a source of relative strength. The reasons for this shift cannot be traced to one event, but instead to a confluence of economic, structural, and valuation-related developments both within and outside India.

Economic performance has remained strong

From an economic perspective, India has continued to deliver robust performance. Prime Minister Modi secured a third term in the 2024 general election, extending a period of political and policy stability. On the back of this, real GDP growth was 7.6% in 2023 and 9.2% in 2024, putting India on track to become the world’s third-largest economy within a decade. Inflation has trended lower, while budget and current account deficits have remained contained. Institutions have generally managed risks effectively, though the central bank has faced criticism for excessive caution. High interest rates and tighter rules on unsecured lending were blamed for softer consumption and earnings growth in late 2024. Even so, India’s macroeconomic performance has remained impressive compared to global peers.

Domestic investment has been on the rise

India’s stock market has also evolved in notable ways. Long-term equity returns have drawn increasing domestic investor interest, a marked change from traditional preferences for real estate, gold, and deposits. Domestic institutional investment in equities nearly tripled from $22 billion in 2023 to $63 billion in 2024 and $64 billion in 2025 (Bloomberg data). Systematic Investment Products (SIPs), where investors make monthly contributions to mutual funds, have broadened participation further. This surge in domestic flows counterbalanced foreign outflows and absorbed high levels of new equity issuance, lifting market capitalization to $1.6 trillion in September 2024 and raising India’s MSCI EM index weight to 19.5%.

Yet not all changes were without friction. In mid-2024, the securities regulator SEBI flagged concerns about excessive flows into mutual funds, especially small-cap funds, and imposed curbs. As markets cooled from their peak, mutual fund inflows slowed, while corporate issuance remained heavy and foreign investors stayed cautious. This imbalance placed pressure on already-listed companies.

High valuations caused global investors to look elsewhere

The challenges posed by volatile flows have been compounded by elevated valuations. India has traditionally commanded high valuation ratios, especially relative to EM peers, but by September 2024, India’s Price/Earnings ratio had expanded to 29x, a post-COVID high. Such lofty levels made the market particularly vulnerable to negative shifts in sentiment. Even modest slowdowns in economic and earnings growth, combined with weaker inflows and abundant equity issuance, triggered a meaningful correction.

India’s underperformance also reflected global comparative dynamics. For years, India’s steady growth contrasted sharply with China’s struggles, making it a unique bright spot in EM equities. Investors were willing to overlook high valuations in that context. However, recent developments in other EMs—such as Korea’s “value-up” program, Taiwan’s AI-driven investment cycle, and Chinese stimulus measures—have drawn capital elsewhere. As new opportunities emerged across the region, investors became more demanding about India’s risk/reward trade-off and rotated into other markets. As a result, foreign investors have withdrawn a net $17b from India so far in 2025, matching the record annual outflow seen in 2022.

Geopolitical risks come back into focus

Entering 2025, with valuations somewhat reduced and macro fundamentals intact, the outlook initially looked more constructive. Optimism was bolstered by the apparent personal rapport between PM Modi and President Trump, which seemed to shield India from punitive tariff measures affecting other Asian economies. However, the US stance cooled in response to India’s continued purchases of Russian crude oil. New tariffs on Indian exports, tighter H1B visa rules, and higher duties on pharmaceuticals have since weighed on key sectors. Even so, India’s economy remains largely domestic in orientation. Recent interest rate cuts and tax reforms should provide stimulus, offsetting external pressures and supporting a recovery in corporate earnings, aided by the low base of 2024.

Valuations remain the key challenge

Valuations remain the most problematic element of the investment case. While the market has pulled back from extremes, the correction has been modest given weak earnings growth. The India index continues to trade above 25x trailing P/E, a level high both historically and relative to other EMs. The hoped-for de-rating has yet to materialize, leaving valuations the central barrier to building a stronger position on Mondrian’s portfolio.

High valuations have also done little to slow the pace of equity issuance, with the IPO pipeline remaining full. Coming at a time where foreign investment activity remains low and domestic inflows are running below their peak levels, this could over-saturate the market, creating a further headwind for stock returns.

India continues to represent a conundrum for value investors

In summary, India continues to present a conundrum for value investors, just as it did in 2022. India retains an attractive long-term outlook, with a growing economy, deeper markets, and improving breadth of participation. The country should offer substantial investment opportunities over time, but valuations remain a persistent obstacle. For this reason, we remain cautious at the aggregate market level and maintain an underweight stance. Still, we have selectively added exposure where attractive entry points emerged, including new positions in Hero Motocorp and Infosys. This has nudged our total exposure higher to above 9%, narrowing our underweight to approximately 6% compared with 11% a year earlier. This level of positioning is consistent with where we stood three years ago when the benchmark weight and valuation ratios were almost identical to today’s.

For now, we continue to be disciplined and patient in approaching India. While we recognize its long-term potential, stubbornly high valuations limit the case for more aggressive positioning. We continue to monitor for opportunities in companies aligned with India’s structural growth story, but for now remain cautious, waiting for more compelling entry points.

Disclosures

Views expressed were current as of the date indicated, are subject to change, and may not reflect current views. All information is subject to change without notice. Views should not be considered a recommendation to buy, hold or sell any investment and should not be relied on as research or advice.

This document may include forward-looking statements. All statements other than statements of historical facts are forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results to differ materially from those reflected in such forward-looking statements.

Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing, or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent.

This material is for informational purposes only and is not an offer or solicitation with respect to any securities. Any offer of securities can only be made by written offering materials. The information set forth herein is a summary only and does not set forth all of the risks associated with the investment strategy described herein.

The information was obtained from sources we believe to be reliable, but its accuracy is not guaranteed, and it may be incomplete or condensed. It should not be assumed that investments made in the future will be profitable or will equal the performance of any security referenced in this document. Examples of securities will represent only a small part of the overall portfolio and are used to illustrate our investment approach. Any holdings are subject to change and may not feature in any future portfolio. More information on holdings is available on request.

Unless otherwise stated, all returns are in USD.

All references to index returns assume the reinvestment of dividends after the deduction of withholding tax and approximate the minimum possible re-investment, unless the index is specifically described as a “Gross” index

Past performance is not a guarantee of future results. An investment involves the risk of loss. The investment return and value of investments will fluctuate.

Mondrian Investment Partners Limited is authorized and regulated by the Financial Conduct Authority (Firm Reference Number: 149507). Mondrian Investment Partners Limited is also registered as an Investment Adviser with the Securities and Exchange Commission (registration does not imply any level of skills or training).