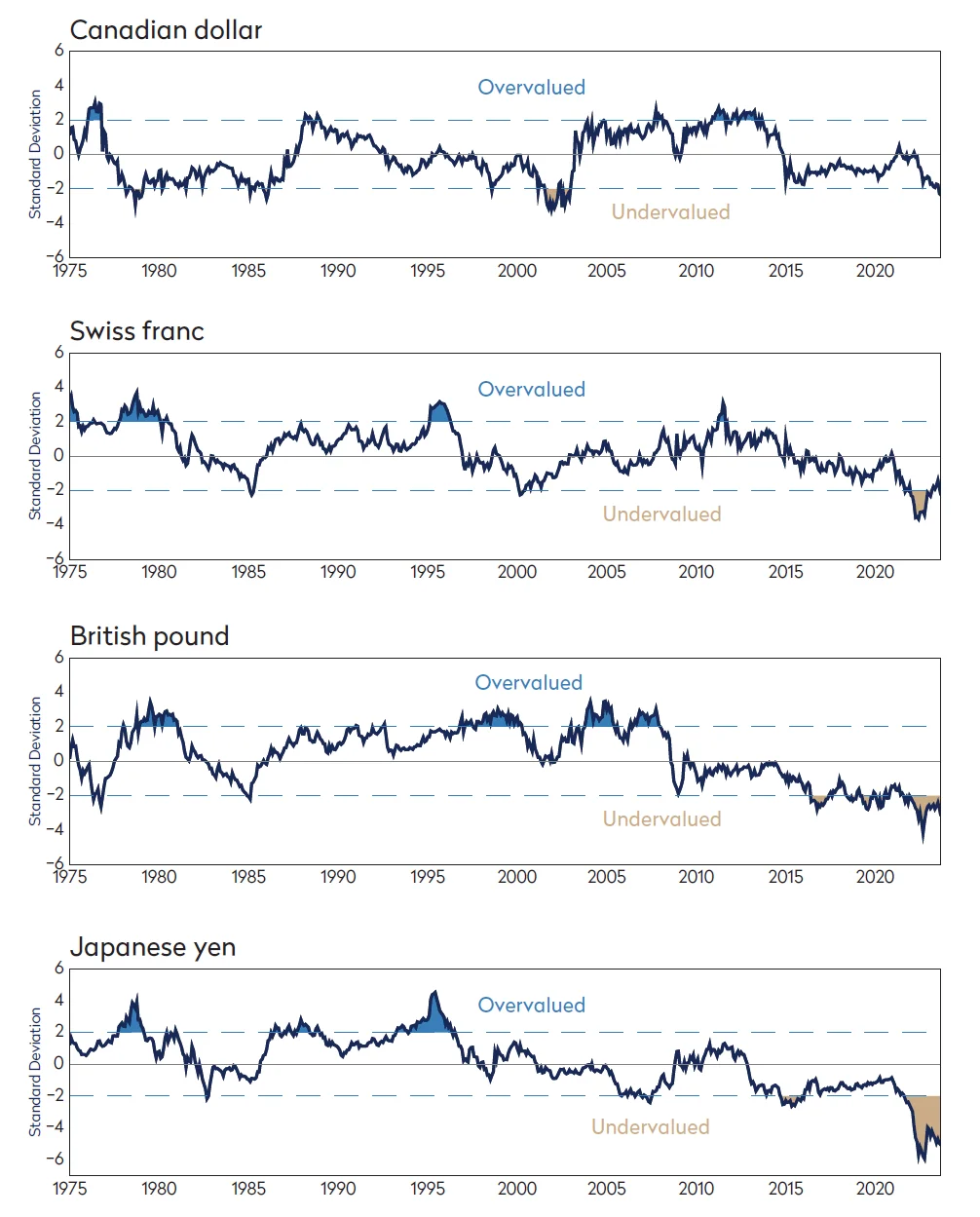

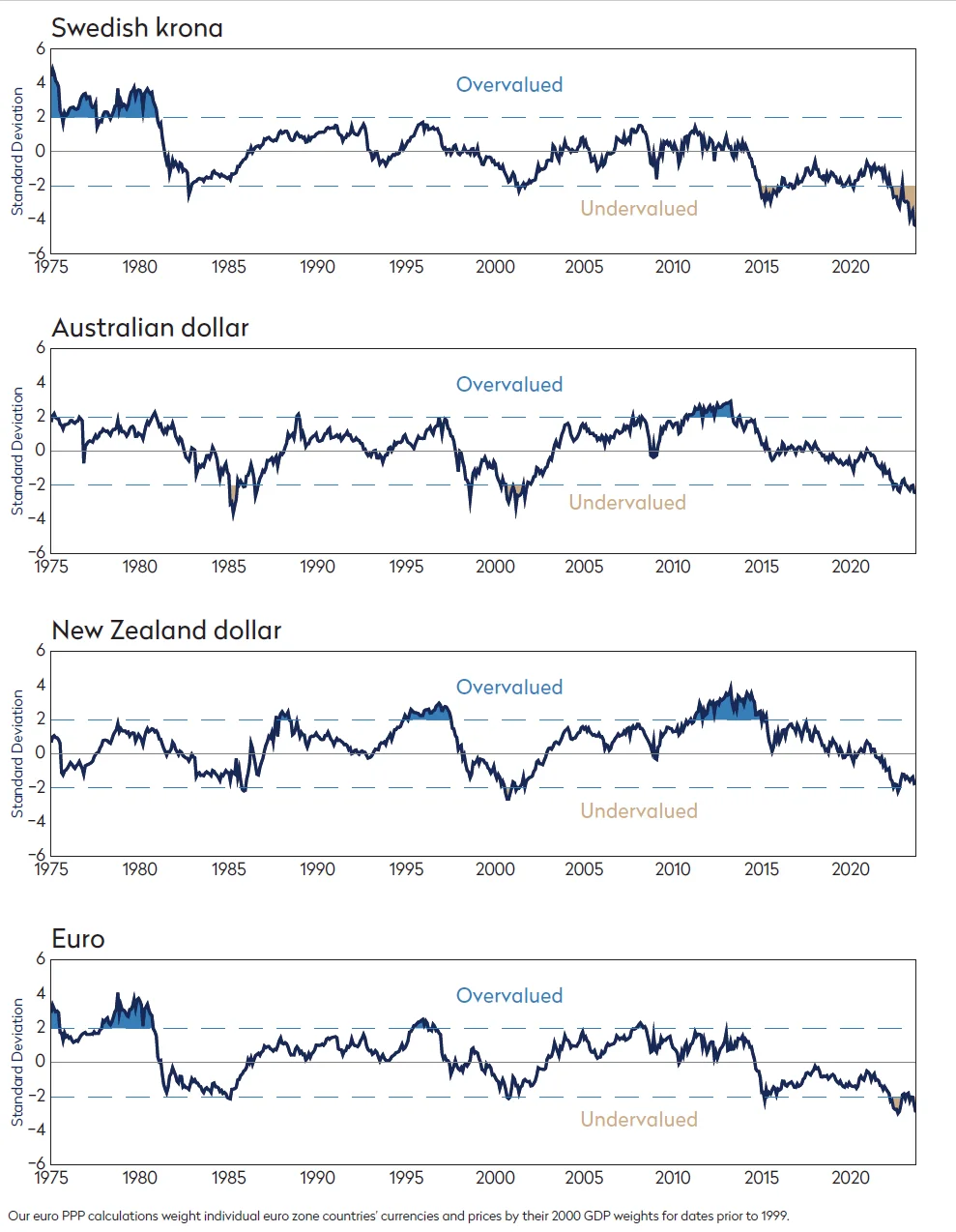

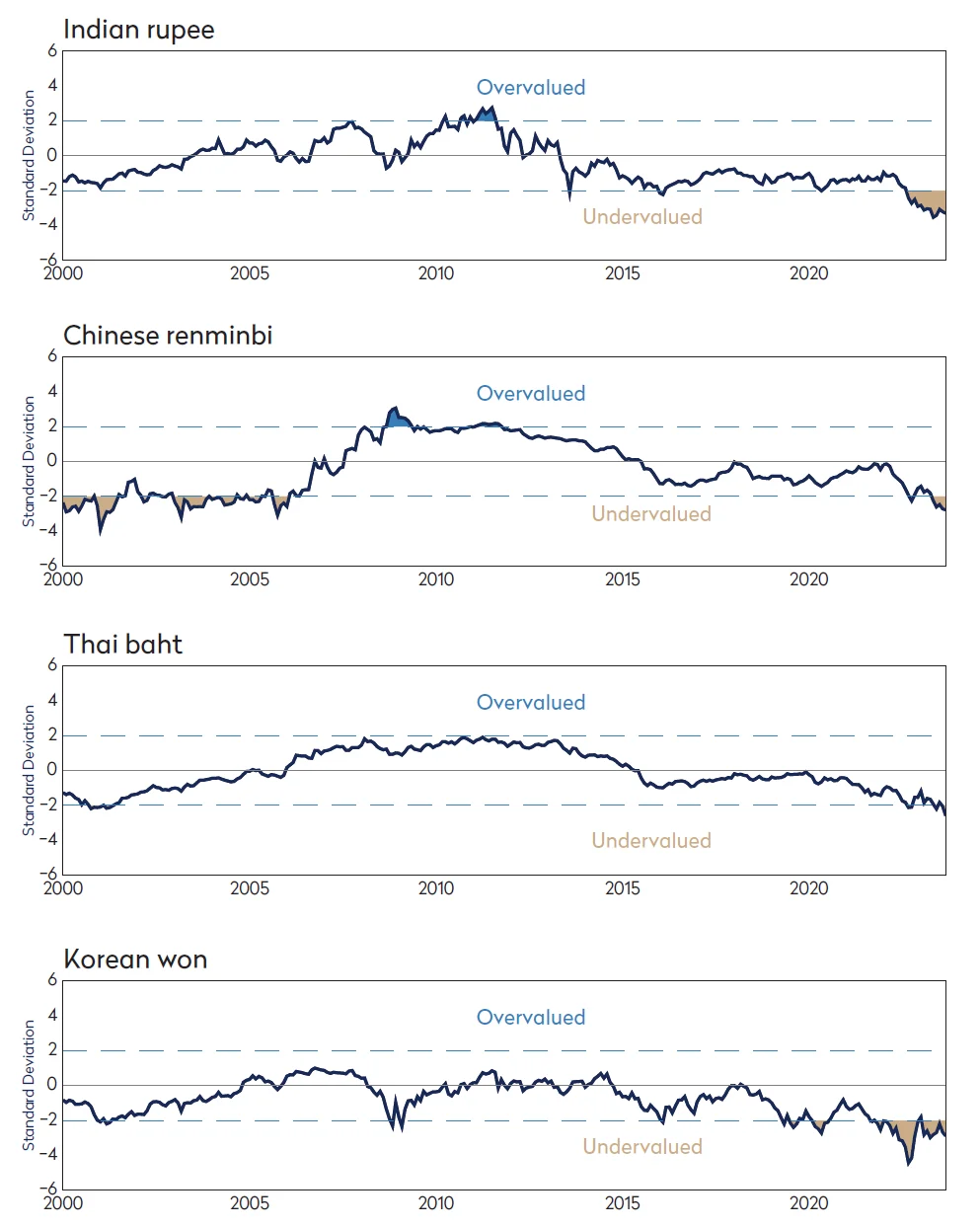

Mondrian’s Purchasing Power Parity method (PPP) provides a consistent measure of value across all currencies – a process we have employed since the founding of our firm in 1990. Our PPP fair value is the exchange rate at which a basket of goods and services costs the same in two different currencies and is supplemented by our sovereign credit analysis.

Below are Purchasing Power Parity valuations versus the US dollar for various developed and emerging markets.

Purchasing Power Parity Valuations versus US dollar

Developed Markets

Emerging Markets

As of September 30, 2023

This is for the intended Investment Professional only and may not be redistributed or reproduced, in whole or in part.

Past performance is not indicative of future results.

Views expressed were current as of the date indicated, are subject to change, and may not reflect current views. Views should not be considered a recommendation to buy, or hold or sell any security and should not be relied on as research or investment advice.

This introductory material is for informational purposes only and is not an offer or solicitation with respect to any securities. Any offer of securities can only be made by written offering materials, which are available solely upon request, on an exclusively private basis and only to qualified financially sophisticated investors.