Summary

- Mondrian’s approach to credit is designed to identify and overweight the best value credits, consistent with Mondrian’s approach to bond market and currency selection

- Relative value is determined at the overall credit level, the sector level and the security level by our proprietary quantitative metrics, Relative Value Indicators (RVIs)

- Mondrian’s process is value orientated, quantitatively driven and follows a disciplined framework, which has been applied consistently over our long track record

- Mondrian’s credit process generates alpha opportunities across the overall allocation to credit, sector rotation and security selection, exploiting relative value regardless of the stage of the credit cycle

Overall Allocation to Credit

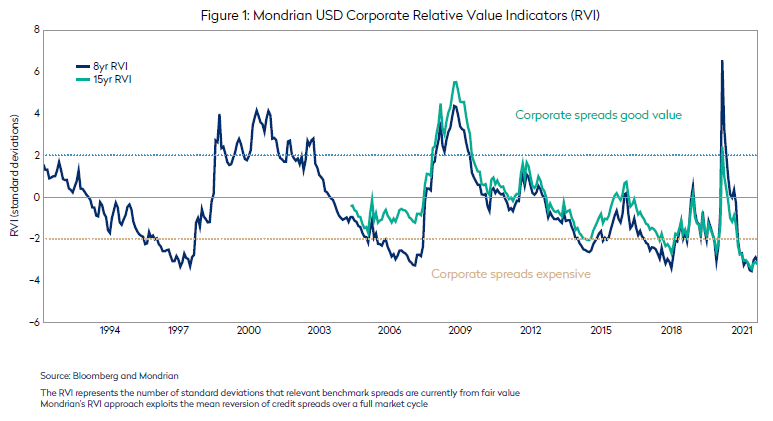

- Mondrian’s overall positioning towards credit is driven by our RVIs run at the total credit or total corporate level. Figure 1 below uses the example of the RVI for USD corporate bonds

- The measure is run on several time periods so value signals aren’t biased by any one significant event, for example the 2008 global financial crisis

- The 8-year and 15-year measures are shown here

- The approach looks for extremes in valuation to inform our overall allocation to credit risk

Sector Rotation

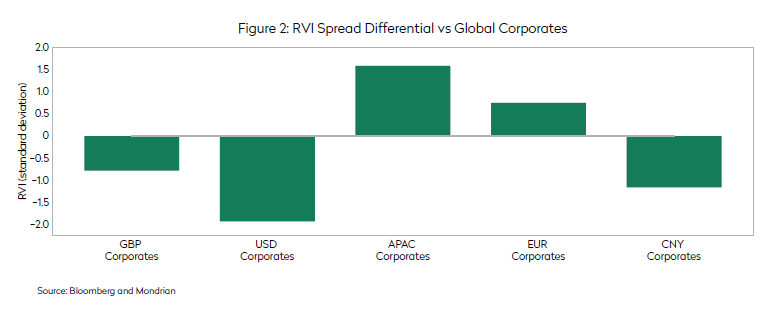

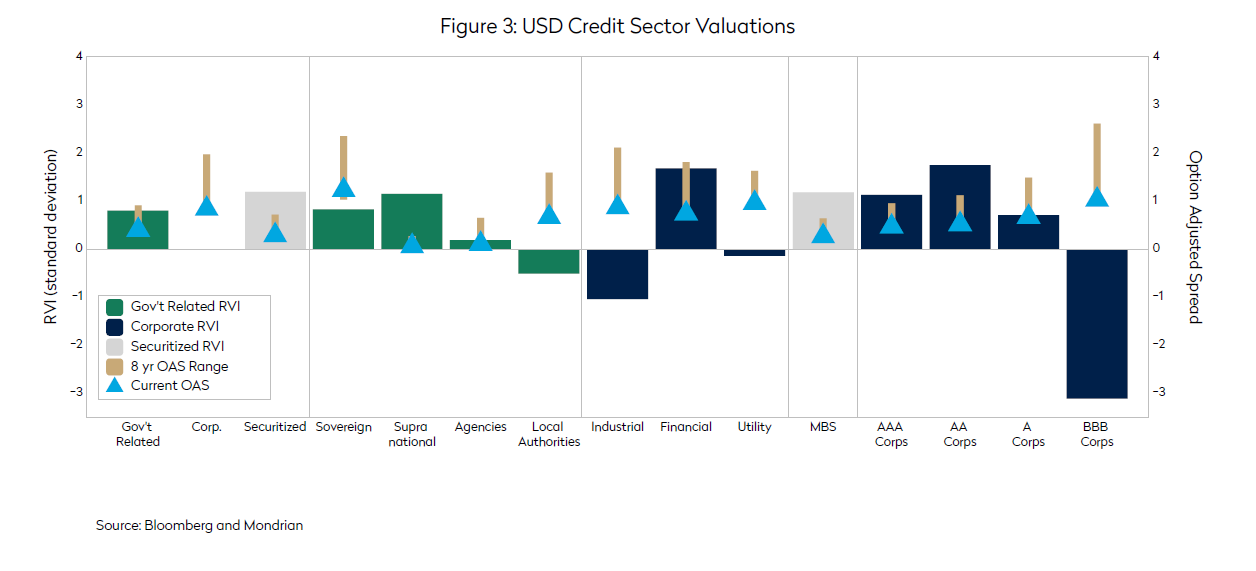

- Mondrian’s RVIs are subsequently run at increasingly more granular levels to identify those sectors, currencies, ratings and maturities that offer the best relative value in credit markets

- With spreads and valuations as tight as they are currently, the value gained from sector rotation and security selection becomes the dominant factor in the process

- Figures 2 and 3 below illustrate RVIs across currencies and sectors as at November 2021. Even at a time of overall credit overvaluation, relative value opportunities are evident

Security Selection

- Mondrian’s RVIs are also run at the single name level to identify the best value issuers

- Fundamental analysis is then undertaken on issuers identified as offering good value, to assign an internal credit rating

- Analysis is driven by quantitative models to form an initial base credit rating, which is then adjusted up or down by the more qualitative factors which models cannot capture

- At Mondrian we take an integrated approach to ESG risks, therefore ESG factors are inputs into our final internal credit rating

- Close Close collaboration with Mondrian’s team of over 40 equity analysts informs credit analysis and provides excellent access to company management enabling a comprehensive program of issuer engagement

- Those best value credits, which stand up to the scrutiny of the analysis, will be added to the portfolio in line with internal ratings based diversification limits

- Mondrian’s global approach to credit enables us to identify the best value credits regardless of country of domicile. For example, Yankee bonds (USD bonds from non-US issuers) can often offer better relative value than USD bonds from US issuers of similar credit quality and duration

How Mondrian’s Credit Approach has Worked in Practice

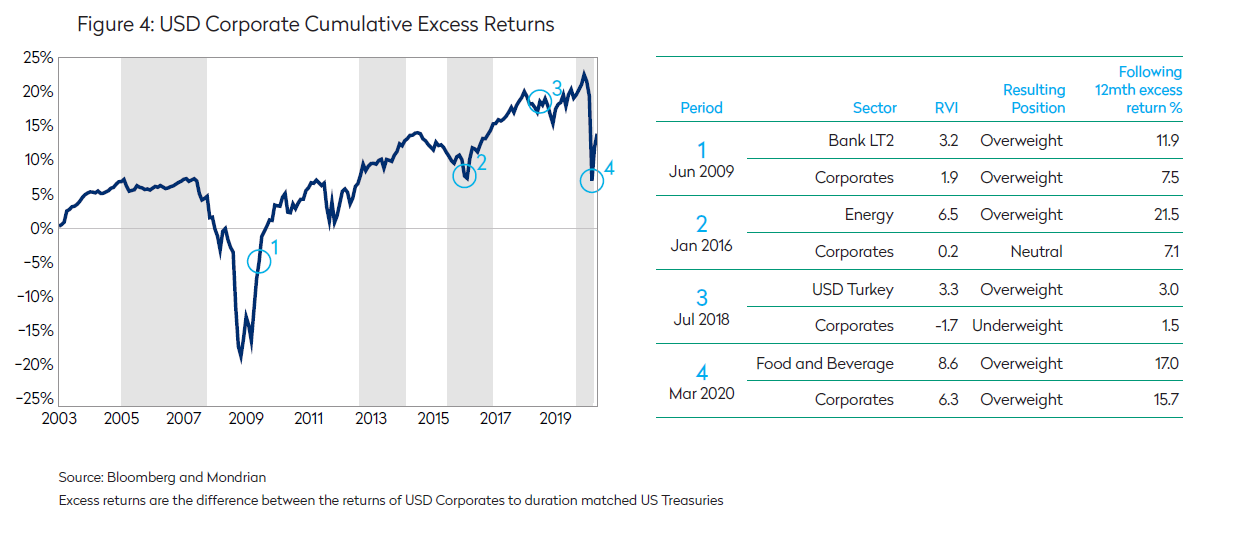

- Figure 4 below illustrates how Mondrian’s measure of credit valuation has historically mapped to USD corporate cumulative excess returns. Shaded areas show periods of time when USD Corporates were over two standard deviations overvalued according to the Mondrian RVI measure

- Mondrian will take both overweight and underweight positions to credit. However, the design of our process ensures that we only take these overweights or underweights to risk following a suitably strong valuation signal from our underlying models

- For example, during the onset of the global pandemic in Q1 2020, the RVI metrics at the overall credit level directed us to underweight credit risk in the first half of Q1 2020, and then overweight credit risk later in Q1 2020 as markets sold off. This alone was beneficial to performance, however, additional alpha was generated by our sector level RVIs directing the allocation into areas such as Food and Beverage and more generally into BBB rated USD industrial corporate bonds which were identified as particularly good value

- Figure 4 below highlights this along with other examples of sector positioning, mapping this to excess returns, illustrating how important sector rotation has been for alpha historically

- Mondrian’s disciplined approach avoids running a structural overweight to credit, with alpha also being generated from sector rotation and security selection. An overweight to credit risk is not a core feature of our strategy, different to many other managers in the current reach-for-yield environment, and a factor behind the consistency of our Global Aggregate track record

Disclosures

Views expressed were current as of the date indicated, are subject to change, and may not reflect current views. Views should not be considered a recommendation to buy, hold or sell any security and should not be relied on as research or investment advice.

The information was obtained from sources we believe to be reliable, but its accuracy is not guaranteed and it may be incomplete or condensed. All information is subject to change without notice.

This document may include forward-looking statements. All statements other than statements of historical facts are forward- looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results or performance to differ materially from those reflected in such forward-looking statements.

The material is for informational purposes only and is not an offer or solicitation with respect to any securities. Any offer of securities can only be made by written offering materials, which are available solely upon request, on an exclusively private basis and only to qualified financially sophisticated investors.

Past performance is not a guarantee of future results. An investment involves the risk of loss. This document is confidential and only for the use of the party named on its cover and their advisers. It may not be redistributed or reproduced, in whole or in part.

Mondrian Investment Partners Limited is authorized and regulated by the Financial Conduct Authority.