By Sarah Mitchell and Kevin Fenwick

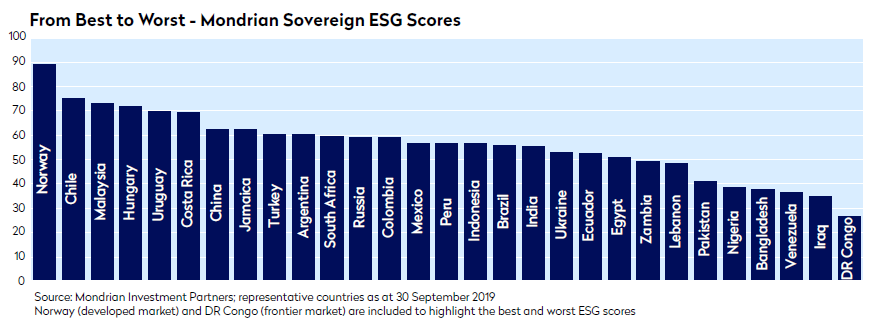

The applicability of Environmental, Social and Governance (ESG) factors to Emerging Markets (EM) investing is often questioned. After all, those countries that score better on ESG metrics tend to be richer, more developed ones and by overweighting such countries, poorer, less developed countries can be deprived of development capital that they urgently need. However, if an investor truly wants to make a positive impact on the world then they should reward and deploy capital to those markets that are striving to improve in terms of ESG criteria rather than just those that already score highly.

Rather than use ESG in isolation as a screening tool, Mondrian believes it is better used as a risk factor which can be priced along with other credit risk factors and demand a higher return on capital to compensate us for additional ESG risk. In this way, the improvement of environmental, social and governance standards provides a tangible benefit to the issuer in question.

The case for Emerging Markets Debt (EMD) is well-founded. Compared to developed markets fixed income, it offers higher yields whilst at the same time providing the benefit of additional diversification. Investors can choose to allocate to external debt, issued in a hard currency such as the US dollar or euro, or local currency debt issued in the issuer’s own currency; they can also choose to allocate to sovereign or corporate issuers. Higher yields along with improving fundamentals and, in the case of local currency debt, the potential for FX appreciation make a compelling case for the EMD asset class.

Broadly speaking, there are two sources to the higher real yields on offer in EMD. Firstly, in emerging economies the return on capital should be higher than in advanced economies. Emerging markets have the potential to grow faster than developed ones since they have more scope for productivity enhancement through investment in both physical and human capital. In order to attract the capital necessary to finance this growth, yields tend to be higher. Secondly, yields can be higher since there is typically a premium built into each market’s yield that compensates for the increased risk involved when investing in an emerging market.

Why ESG is a Critical Component of EMD Valuations

When it comes to investment in emerging economies, it has always been vital to recognise the importance of factors that now fall under the umbrella of ESG. In order for EM countries to catch up and improve the living standards of their citizens, the structure of the economy must incentivise and reward productive behaviour. It has long been recognised that unambiguous property rights, the rule of law and effective institutions are all fundamental pre-requisites for economic development. Such attributes are all what might be thought of as governance factors. But we must also recognise that poor environmental and social traits have the ability to impair a country’s ability to service its debt.

For instance, protection and maintenance of the environment for the wellbeing of future generations is essential for the sustainability of economic activity that supports the creditworthiness of sovereigns. In the shorter term, undiversified economies based on commodities, agriculture or tourism are prone to climate change related shocks, such as flooding and storm damage that can place additional burdens on the sovereign. Similarly, social stability provides the most fertile setting for investment and long term sustainable growth. Health, education, the development of human capital and protection from civil disorder and social unrest all affect the productivity of the workforce. In addition, adverse demographic trends can put strains on public finances and corruption inhibits the productive allocation of resources, depletes social capital (‘trust’) and exacerbates inequality.

All of these ESG risk factors therefore form a critical and distinct facet of both sovereign and corporate credit risk analysis that are incorporated into Mondrian’s overall assessment of creditworthiness. When it comes to sovereign credit analysis we consider ESG risks alongside a country’s fiscal profile, the strength of its domestic economy and the health of its external balance sheet.

Emerging Markets Corporates and ESG

ESG factors are becoming increasingly material to emerging markets corporate issuers as the investor base broadens to include a greater proportion of non-domestic holders of debt, and at the same time greater emphasis is being put on ESG factors by domestic institutions. A recent example being Operation Carwash in Brazil, a broad ranging anti-corruption project launched following the initial Petrobras bribery scandal. Increasingly ESG-based risks are not only reputational in nature but also have a direct monetary cost.

ESG issues in emerging markets have historically been harder to analyse given a lack of disclosure and data on the scale as that available for developed market corporates. Whilst disclosure is improving, analysis still necessitates engagement to understand the credit risks. There is a long held belief that engagement is the domain and responsibility of equity holders. However, Mondrian has always believed that engagement is also integral to the fixed income investment process. Whilst bondholders do not have the voting rights afforded to equity holders, the majority of bond issuers will have a refinancing need and therefore will have to be cognisant of their credit rating and the resultant cost of issuing debt. We believe that if bondholders and rating agencies are raising key issues and questions that are material to credit quality, issuers will need to respond with an eye on their standing in the debt markets.

The Bottom Line

We believe that ESG analysis can and does make a difference. By integrating it directly into credit analysis – of both sovereigns and corporates – we, as an industry, can promote and encourage the adoption of best practices in the areas of environmental protection, social justice and good governance.

Disclaimer:Mondrian Investment Partners Limited is authorised and regulated by the Financial Conduct Authority

-

- Views expressed were current as of the date indicated, are subject to change, and may not reflect current views.

- Views should not be considered a recommendation to buy, hold or sell any security and should not be relied on as research or investment advice.

- This document may include forward-looking statements. All statements other than statements of historical facts are forward- looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results or performance to differ materially from those reflected in such forward-looking statements.

- Mondrian Investment Partners Limited provides investment management and advisory services to institutional clients only, not for retail or onward distribution.

- Past performance is not a guarantee of future results. An investment involves the risk of loss. There can be no assurance that the investment objectives of the strategy will be achieved.