Twelve months ago, most market observers assumed that further economic recovery and the threat of modestly higher inflation would prompt further tightening from central banks on a path to post-crisis monetary normalization. At the time, the US Federal Reserve was expected to raise interest rates possibly twice in 2019, and it was plausible that there would even be some token tightening from the European Central Bank and the Bank of Japan, if not in 2019, then not long after. The inversion of the US dollar yield curve, weaker global economic growth, and an uncertain geopolitical backdrop spooked central bankers into a U-turn, one which was enabled by the continued absence of serious inflationary pressures globally. It was this volte-face which defined the year and drove asset market returns.

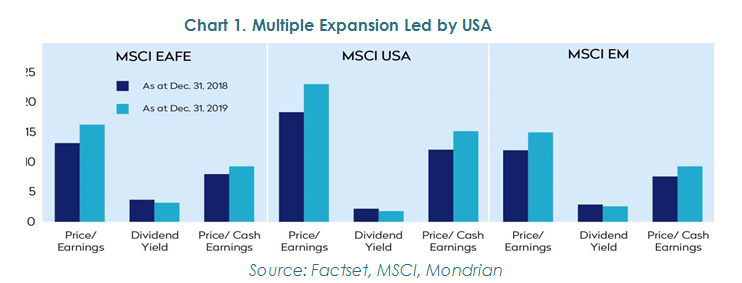

Equity markets responded quickly and dramatically to the fresh stimulus. Even as earnings expectations were repeatedly marked-down, the US equity market (MSCI USA Index) gained 31%, while the MSCI EAFE Index (“EAFE”) and the MSCI Emerging Market Equity Index also rose sharply, up 22% and 18% respectively. Not surprisingly given the looser monetary environment, within EAFE, value stocks lagged growth stocks by ~10% last year. Cumulatively, over the last decade, the EAFE Growth sub-index has returned 96% and the EAFE Value sub-index has returned 48%.

With market earnings expected to be roughly flat over 2020, investors appear to have priced-in either markedly higher economic and real earnings growth or a longer period of lower interest rates. While it is possible that some uncertainty may fade in 2020, not only as a consequence of the phase one trade deal but also as a consequence of other idiosyncratic factors affecting specific sectors (autos, IT) and specific countries (Brexit, Hong Kong), the broad geopolitical environment is likely to remain unstable. Even last year’s issues continue to percolate under the surface: the trade war is fundamentally unresolved, Brexit must now confront economic realities and the Middle East remains very unstable. The tensions between positive economic indicators – strong asset prices, low unemployment, and modest inflation – and geopolitical risks, technological disruption and moderate underlying GDP growth will continue to provide the backdrop to equity and fixed income markets in 2020.

Looking forward into the coming year, while interest rates are lower and the monetary environment potentially more supportive, our broad views on markets have not changed. With market returns outpacing earnings and economic growth last year, equity markets today, especially the US market, are even more expensive than they were a year ago. We believe earnings will need to grow strongly to support current valuation levels. The return, and crucially, the valuation gap between the value and growth sub-segments has widened. While we are somewhat chastened about anticipating early monetary policy normalization, with higher valuations, markets (or at least the growth segment thereof) are likely to be even more sensitive to any rise in the cost of money. In 2018 markets cracked every time US interest rates approached 3%. Given the underlying tensions within markets, it should not be surprising that much of the best potential value is in cyclical currencies, markets and companies.

2019 returns driven by multiple expansion; will earnings growth follow?

In 2019, global equity markets rose strongly, supported by lower interest rates and multiple expansion. The implication is that markets are either anticipating that earnings will recover strongly this year or

that interest rates, and therefore discount rates, will not rise any time soon. As the chart that follows illustrates, the US equity market and the broader growth sub-sector have been the greatest beneficiaries of multiple expansion.

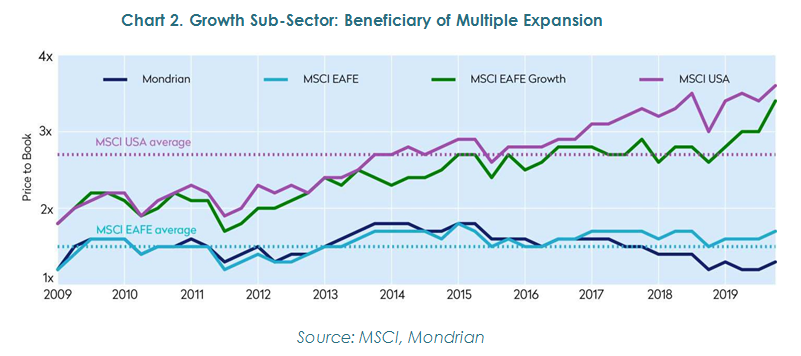

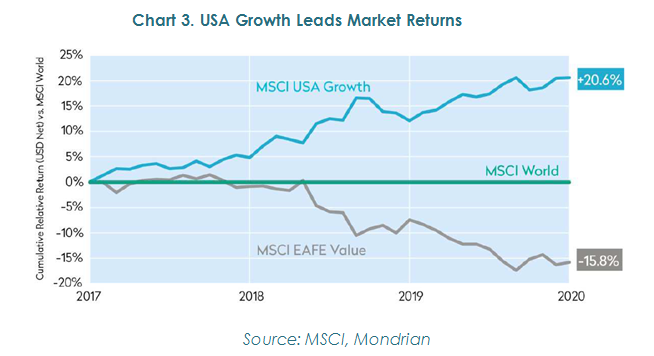

Will growth continue to be a “defensive” strategy?

The growth sub-sector has led the market since the financial crisis, supported by the ongoing loosening of monetary policy. This return and valuation gap between value and growth sub-segments of world markets has become particularly acute in the past three years. Over this time, US growth stocks have outperformed the MSCI World index by 21%. During that same period, the EAFE Value sub-index has lagged the US growth sub-index by 43%. This is a period during which central bankers have tried, and so far struggled, to make any significant and lasting inroads towards normalizing monetary policy on a sustainable basis. Also notable about this period is that while US market started on a premium rating, subsequent earnings growth has so far not justified that rating. In fact, earnings growth in EAFE over the past three years has actually exceeded that of the US, resulting in a further relative de-rating.

Cumulatively, over the last decade, the EAFE Growth sub-index returned 96% while the EAFE Value sub- index returned 48% (USA Growth stocks returned 296%!). Despite the stronger returns from growth stocks, within EAFE, over the decade earnings growth has been comparable between the value and growth sub- indices; we have effectively absorbed a very painful de-rating for value stocks.

Market is vulnerable to change of expectations

Although the Value style was left in the dust in 2019, the acute sensitivity of equity markets to changes in interest rates was again in evidence. To be sure, it is not our view that inflation will suddenly manifest itself and force the US 10-year Treasury rate back to 3.5% (in fact, subdued economic growth in 2019, and most likely in 2020, specifically argues against it), merely that interest rates are on balance unlikely to remain this low for a sustained period (today, buying a German 10-year government bond locks-in a negative nominal yield of 20bps). The level of bond yields suggests that investors have entirely written off the threat of inflation and possibly even economic growth, even as unemployment is hitting multi- decade lows in several major economies, driving some (so far modest) upward pressure on wages. Given the level of bond yields, and how heavily positioned investors appear to be in the opposite direction, it would not take much of a surprise to force investors to re-evaluate.

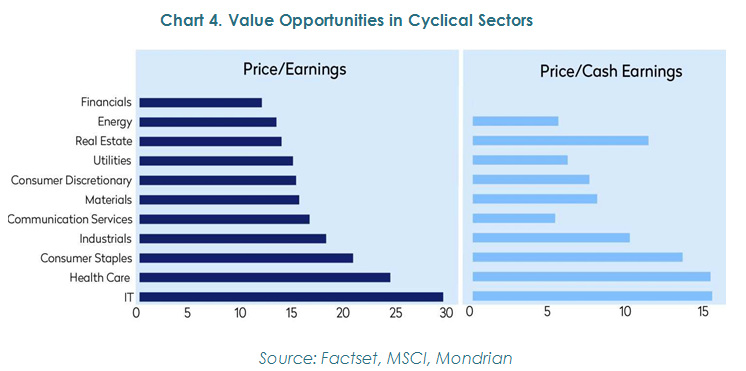

Best defense can be offense: We believe cyclicals are offering greater value

Ever lower discount rates combined with the perceived threats from technological disruption, changing patterns of consumption and investment prompted by ESG factors and concerns over economic growth have contributed to investors bidding up the valuations of more stable companies to ever higher levels. This has created a dilemma for defensive value managers like Mondrian. Valuations now strongly support more cyclical areas of the market.

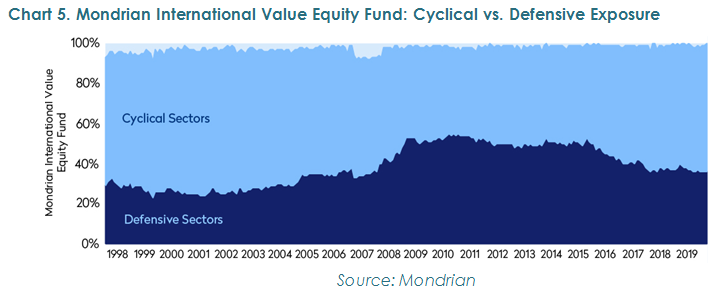

As the next chart illustrates, as value has emerged in cyclical areas of the market, Mondrian has moved the Fund to benefit from that greater expected long term upside in more cyclical sectors just as we did during the tech bubble in the late 1990s. For portfolio construction, this creates near term challenges as the portfolio becomes potentially more vulnerable to an economic setback. To offset this risk, we are focusing our analysis on worst case expected outcomes and looking closely at the trade-off between

expected central case return and potential downside. We believe the downside risk can often be mitigated by a preference towards companies with strong balance sheets and lower financial leverage as in Japan, particularly low valuations as is the case in many UK companies or in the auto sector, and through a focus on diversification across risk exposures. While higher exposure to cyclicals can make for the occasional sleepless night, it is an environment that we are familiar navigating. Moreover, experience has taught us that when markets are ultimately weaker, valuation is the best defense against falling share prices.

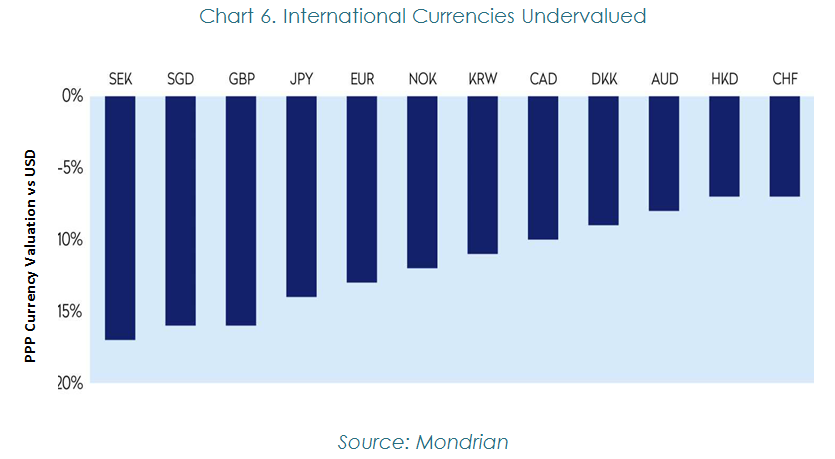

Global currencies are still undervalued against the dollar

Sterling rebounded against the US dollar and the euro at the end of 2019 on the back of the vote in favor of an EU withdrawal treaty in parliament, and then further on the Conservative victory in the UK general election. Despite the bounce, it and most other global currencies still remain undervalued against the US dollar. Our team believes currency appreciation will add value to long term international returns over the next 5-10 years. The only caveat we would note is that most of the undervaluations are within two standard deviations of fair value. In the currency world, at this level PPP (Purchasing Power Parity) is less good as a predictor of short term direction. With geopolitical risks, trade issues, and the US election, we could still see some volatility within a longer term trend to a weaker US dollar.

We believe market behaviors can create attractive opportunities for long-term value-focused investors

Having looked at the data and thought about the implications, we do not believe that the relative de-rating of “value” stocks is fully justified based on the future earnings outlook. The performance differential and relative valuation metrics between the growth and value sub-indices are at historical extremes. Investors are paying increasingly large premiums for companies with certain attributes that appear to make them “safe bets”: decent revenue growth, high and relatively stable profitability, or good visibility. Our analysis, based on the consistent application of our dividend discount methodology suggests that, in some cases, investors are at risk of confusing support from falling interest rates (a lower discount rate) with underlying fundamental attractiveness.

While markets may continue to be jostled by short term interest rate changes, we feel strongly that over the long term, and especially at current valuation levels, markets will ultimately be driven by underlying economic growth and the corporate earnings created. We feel the best value today is in international currencies and the value sub-sector of international and emerging markets. Ten years post-crisis and looking forward to a new decade, the world remains a very uncertain place and forecasting market cycles is a mug’s game. Our value-oriented, disciplined, cash-flow-and-dividend-driven valuation methodology focuses on reducing the uncertainty where possible and therefore raising the probability of achieving attractive long- term absolute real returns.

This information should not be relied upon as research or investment advice regarding any particular security. This is intended to provide insight into the manager’s investment process and strategy. Forward looking analytics are not a forecast of the Fund’s future performance.

To determine if the Fund is an appropriate investment for you, carefully consider the fund’s investment objectives, risk, and charges and expenses. This and other information can be found in the funds full and summary prospectus which can be obtained by calling 888-832-4386 or by visiting www.mondrian.com/mutualfunds. Please read the prospectus carefully before investing.

Investing involves risk, including the possible loss of principal. International investments entail risks not ordinarily associated with U.S. investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors, as well as increased volatility and lower trading volume. The Fund may invest in derivatives, which are often more volatile than other investments and may magnify the Fund’s gains or losses.

Indices are unmanaged and do not include the effect of fees. One cannot invest directly in an index.

The Mondrian Investment Partners Limited Funds are distributed by SEI Investment Distribution Co. (SIDCO). SIDCO is not affiliated with the advisor, Mondrian Investment Partners Limited. Mondrian Investment Partners Limited. Mondrian Investment Partners Limited is Authorised and Regulated by the Financial Conduct Authority.