In the Bleak of Winter

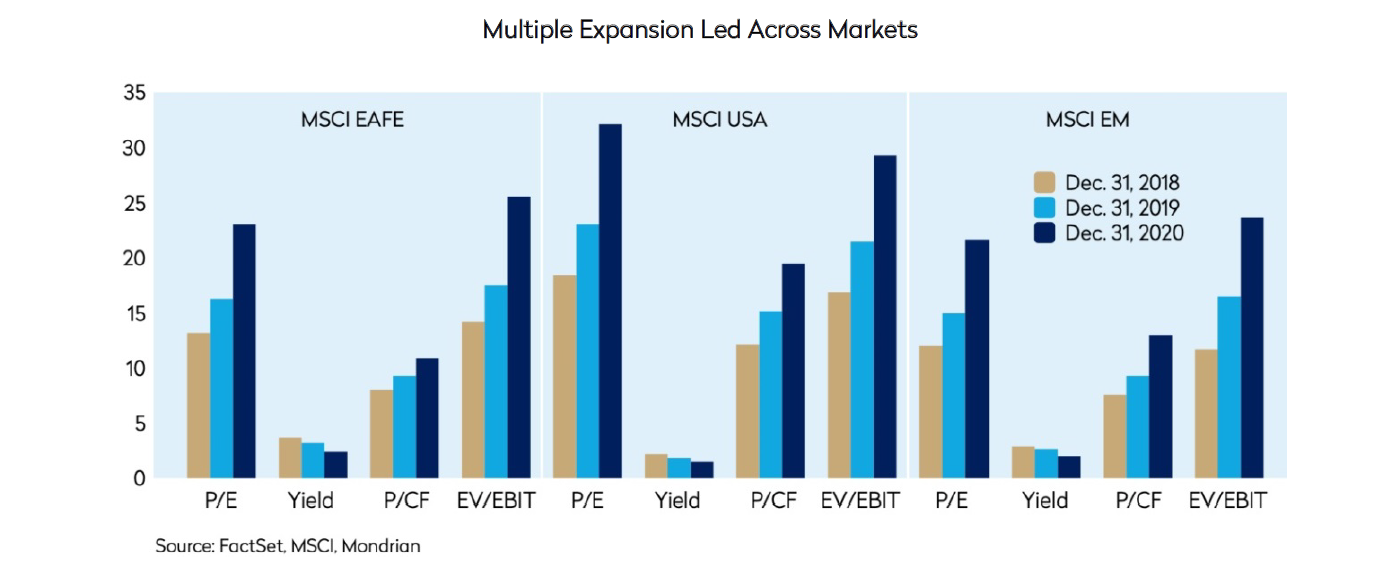

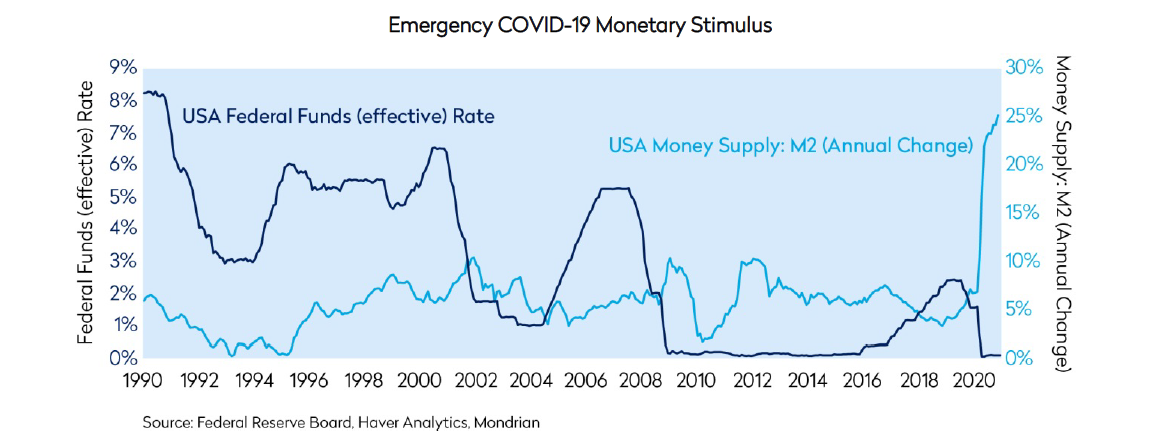

2020 has been a miserable year. In the UK, we are still largely confined to our homes, as a new super-contagious variant of the virus runs amok. And sadly, contemplating the past year in equity markets as a valuation-driven investment manager offers no respite! Markets have seemingly de-coupled further from earnings and fundamental value. Supported by the necessary COVID-19 emergency fiscal relief and the explosion of monetary stimulus, market multiples have expanded, underpinning returns despite weak earnings. We were slightly horrified to see TSLA enter the S&P at almost 7 times the price it started the year and over 3 times the price it was when we wrote on its overvaluation only a few months earlier.

In contrast, the returns for our valuation-based portfolio have struggled against relative multiple contraction. While the portfolio returns are generally consistent with our earlier forecasts of the likely COVID-19 impact on overall market valuations and returns, significant market multiple expansion means that the portfolio relative returns have been severely punished over the past year.

Despite the COVID-19 gloom, and well against most expectations earlier in the year, market-level investment returns in 2020 offered a positive alternative universe. At the end of February, given the uncertainty looming, most investors, if offered an 8% nominal return for the year would have taken it and spent the next twelve months on vacation. With hindsight, 8% looks pretty paltry and anyway there was nowhere to go on vacation. Instead, and despite the pandemic devastating economies around the world, major global indices have achieved double digit returns. China, which first experienced the pandemic, is up 30%, the MSCI World index is up over 12%, led by the 21% return from the US market. Even the laggard EAFE markets have returned that 8% in aggregate.

2021 Likely to See Further Fiscal Support, Vaccine-led Economic Recovery, Some Hard-earned Stability for Europe and the UK, and Continued Growing Prominence for China

After the challenges and contradictions of the past twelve months, writing an outlook for 2021 feels somewhat presumptuous. While this is written with trepidation, we do believe there are a few things that can be said with some confidence. The quarter ahead looks bleak, but it is likely that the global roll out of the vaccines, while slow and beset with some uncertainty, will result in a sharp and globally synchronized increase in economic activity over the year as economies accelerate to some new normal. They will likely be supported in the near-term, at least in the developed world, by further fiscal and, where possible, by monetary stimulus. The recent deal in the US to offer support to hard pressed families and businesses and the EU agreement to create an EU-wide recovery fund to be spent in 2021 both underline policy-makers’ ongoing commitment to fiscal support, even if it takes messy political wrangling to reach a conclusion. The UK, having reached a temporary stopping point in its post-Brexit referendum trauma, will hopefully be able to begin to focus on its real economic and social challenges. While the EU, having endured the dual traumas of Brexit and COVID-19, appears to have come out a stronger and more cohesive entity as it prepares to confront a post-Angela Merkel world. In Asia, China will be preparing for the 100th anniversary of the founding of the CCP later this year. It is likely to want to go into the anniversary with a strong economic and political backdrop.

Longer-term Challenges: Superpower Geopolitics, Stabilizing Economic, Fiscal and Political Systems, Inflation Risks and Opportunities, Deconstructing Monopolies, Confronting Climate Change

The extreme devastation that COVID-19 has wrought is likely to subside, but the political and economic uncertainty that preceded it will remain. The fight for global economic pre-eminence continues. The US relationship with China has only worsened through COVID-19. The relationship between the current and the emerging superpowers will remain subject to much speculation and uncertainty even with the change of administration in the US.

When COVID-19 first struck, we noted how important the quantity and quality of the fiscal and institutional response would be to the eventual resolution. The response in developed economies, while challenging, has so far demonstrated both monetary and fiscal commitment. Particular success has been evident in Asia which has had previous recent epidemic experience, while Germany has so far been able to use their deep financial resources to maintain substantial capacity in its health care system and to offer fiscal support to its population, and to some extent to Europe more= broadly. The strength and stability of financial and political systems will continue, for many years to come, to impact the ability of governments to accommodate and manage the long-term challenges resulting from the pandemic including the substantial fiscal debt accumulated around the world.

The sharp rise in government debt is only the most obvious manifestation of the economic crisis created by the pandemic. Economies and individuals are likely to struggle with significant scarring that may undermine future productivity and long-term economic growth. Higher and extended unemployment, lack of training and education for workforces, corporate zombification from debt overload, ongoing de-globalization, additional workplace safety measures, and significant structural changes in some sectors have the potential to damage individual companies and overall economic productivity. The damage will not be uniform and some companies and countries will emerge far less scarred.

The accumulation of fiscal debt coupled with substantial monetary stimulus has also caused commentators to begin to countenance the prospect of inflation. While recent money supply indicators might cause investors to anticipate an inflationary boom, more likely in the near-term, the large output gap created by the pandemic in most economies will make anything other than temporary supply-side driven inflation still a remote possibility. The economic history of Japan in the last twenty years illustrates how challenging it can be to try to create inflation. However, the sharp rise in M2 in the US, the change in the Fed’s mission and, in certain circles, the enthusiasm for Modern Monetary Theory are changing the dialogue. Can/will inflation help us “build back better” out of the devastation of the pandemic? Will we face a depressed environment with ‘lowflation’ or a reprise of the Roaring Twenties one hundred years on?

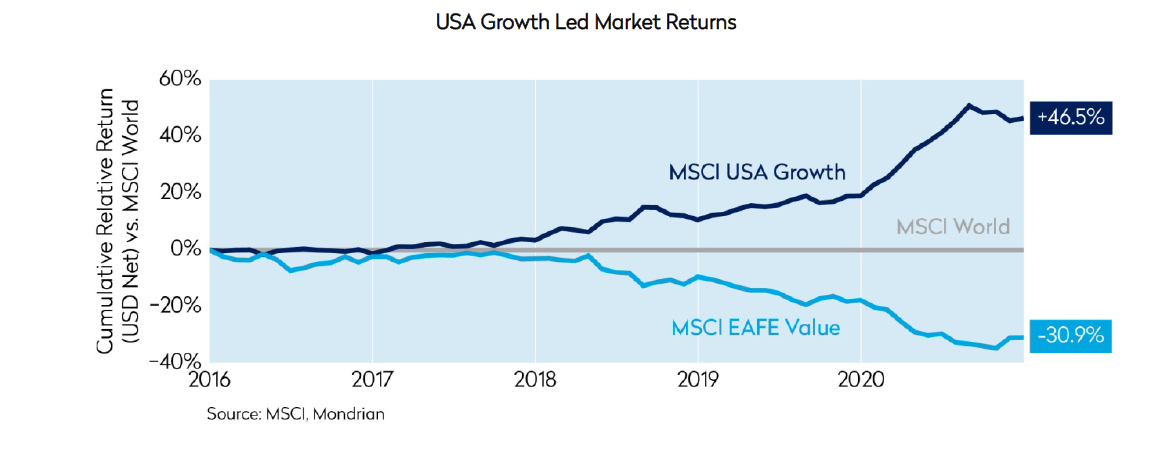

Alongside most investors, we have explained the strong returns from growth stocks as the result of sharply lower interest rates across the yield curve, a hugely uncertain economic environment, and an uncertain outlook for corporate profits undermined by a radical upheaval in traditional working and leisure practices because of the pandemic that has led to an almost total reliance on technology. While these factors are important, another force – monopolistic or oligopolistic positioning and power – have also been highly rewarded. Most competition authorities now judge potential competition challenges based on their impact on pricing to the consumer. As technology has generally resulted in lower prices and innovation has appeared strong, regulators, until recently, have not been worried about certain accumulation of oligopolistic power and instead focused their efforts on ensuring adequate competition remained in more traditional areas of the broader economy. Whether it is because of political challenge (Alibaba, Facebook), potential for super-normal profits (Google), or structural challenges to existing economic or fiscal structures (Amazon), policy makers from China to the US to Europe are making tentative steps to challenge the growing power of the potential monopolists. How that clash of power develops and its implications remains to be seen. While the motives of policy-makers around the world may differ, they will likely take support from each other if they can reach a common purpose.

Scarred by the effects of the pandemic, a nervous population, while desperate for a return to normality, is likely to be risk averse especially as regards large structural risks like climate change. The current trend towards ESG, particularly environmental awareness and transparency, is likely to continue. Politicians who make sweeping promises to meet significant targets well out into the future may increasingly be held to account for progress in reaching those targets. Listed companies in particular will be forced to disclose and document their progress towards meeting these objectives. These added costs and bureaucracy could potentially act as a drag on their long-term returns, but it will also most likely make them more robust to meet future risks, and consequently less risky, at least on a relative basis, as investments.

Market Outlook: Valuation Gap Continued to Widen in 2020 as Multiple Expansion led Earnings Outlook

After the broad extent of the pandemic was apparent, our forecasts as calculated in March 2020 anticipated that, with a scenario broadly as has manifested, across the market a COVID-19 loss to underlying value was likely to be the present value of (on average) two years of earnings and dividends which we calculated to be approximately 5% off the previous valuation. While market participants initially feared much worse, actual return outcomes for 2020 illustrate that our forecasts were not unrealistically optimistic. While we acknowledge that a dividend-driven present value calculation could, in the COVID-19 scenario, disproportionately impact higher yielding companies, based on our initial analysis of the pandemic’s impacts, and supported by lower portfolio valuations, we did not see the forecast returns for companies in our portfolio being any more impacted than the overall market in terms of underlying valuation-driven expected return. This view was supported by the portfolio’s lack of exposure to some of the worst hit sectors including hospitality, aviation, general retail, and tourism. With hindsight, and supported by substantial fiscal and monetary stimulus that cushioned the impact on the worst affected sectors, the market came to realize that one to two years earnings is not hugely material and that stocks traded at real bargains in mid-March. However, as the performance of the value sub-sector illustrates, investors also concluded that stocks already unloved, especially those with cyclical risk, were still best avoided. As a result, the return and valuation gap between value and growth sub-sectors continued to widen as the charts below illustrate. Despite some improvement in returns from the value sub-sector recently, this gap has only closed very slightly in the 4th quarter.

Bifurcation of Value and Growth Underpins Portfolio Expected Returns Despite COVID-19 Trauma

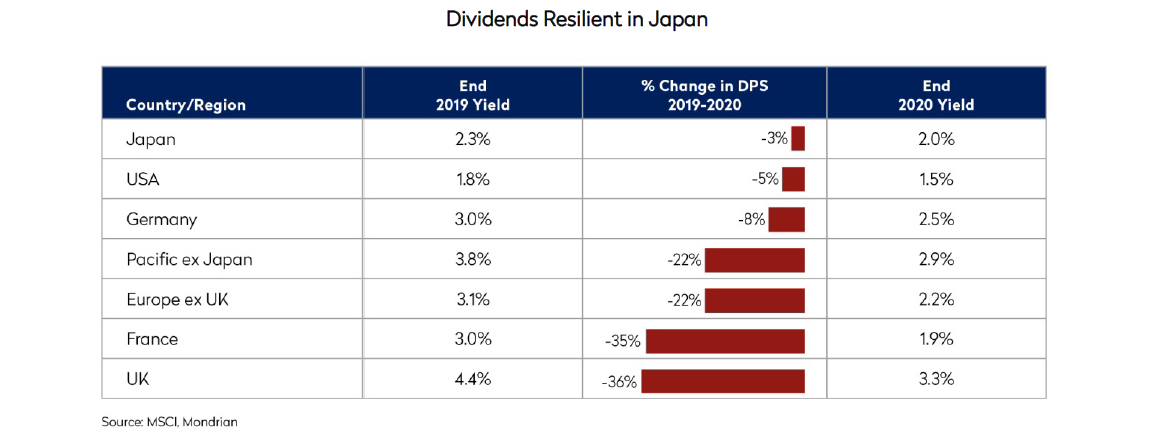

Current aggregate market valuations look challenged, but a significant bifurcation between the valuations of stocks classified as value and as growth has opened up. We accept that a low valuation does not necessarily imply a mis-valued stock. So after the challenging relative return of the portfolio in 2020, and especially its performance in March, we reviewed and reran our valuation models to stress test the underlying ability of the companies to generate the earnings and dividends anticipated by those models. That analysis indicated a short-term sensitivity to dividend cuts (though not one disproportionate to the overall market), but it did not show any structural disproportionate and unanticipated destruction of underlying value across the portfolio.

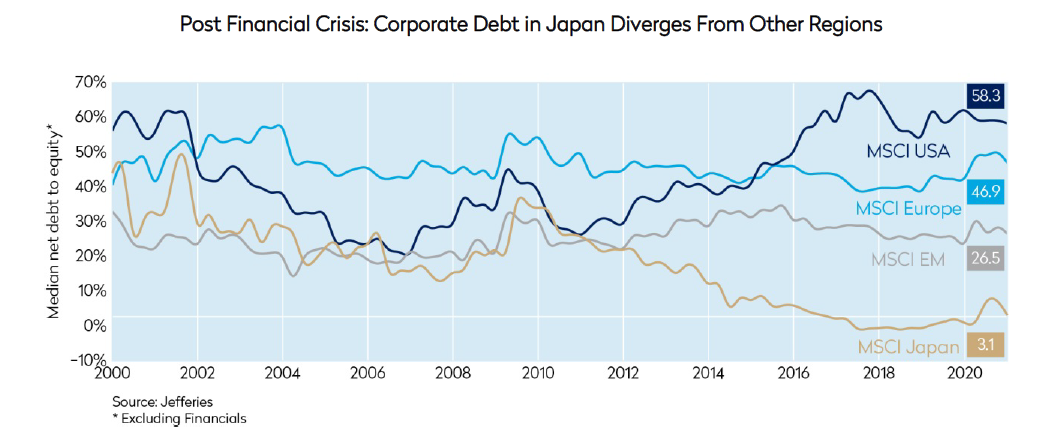

To support this analysis, we then built an Enterprise Value model to test that we had fully captured within our valuations any excess accumulation of debt in portfolio companies, especially as compared to the market. We wanted to ensure that we were identifying and avoiding so-called zombie companies that were accumulating unsustainable amounts of debt in the face of the difficult economic operating conditions. The conclusion of this analysis was that while the portfolio’s EBIT (Earnings Before Interest and Taxes) had fallen, the companies generally had had sufficient internal cash resources to manage through the crisis. They were not required to take on significant additional debt and therefore should be well positioned as economies normalize and EBIT recovers.

This analysis also confirmed that despite the contraction of EBIT, the portfolio’s EV multiple rose less than that of the index in the depths of the crisis, resulting in a de-rating of the portfolio relative to the index. With aggregate portfolio debt relatively unchanged over the period, it is reasonable to conclude that the equity value of the portfolio has become even more attractively valued over the period. The portfolio today, despite the recent appreciation, continues to trade at a significant discount to the overall market.

As the Range of Outcomes has Widened Across the Market, Japan is Increasingly Attractive on a Risk-Adjusted Basis

Underpinned by relatively stable dividends, and strong balance sheets, the Japanese equity market stands out as attractive on a risk-adjusted basis. The portfolio remains overweight to the Japanese market, benefitting from positions in leading companies with strong balance sheets supporting the skew of outcomes such as Fujifilm, Honda, Kyocera, Mitsubishi Electric, NTT, Tokio Marine and more recently purchased Sony.

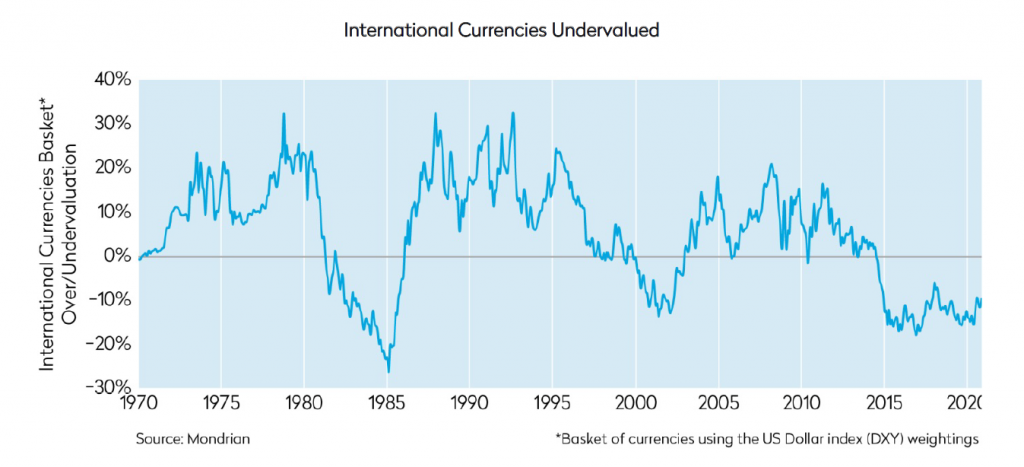

Despite Recent Appreciation, Non-US Currencies Remain Undervalued

Over the last few years, our proprietary purchasing power parity (PPP) analysis has indicated that the US dollar is overvalued. Despite last year’s appreciation which has taken most currencies back to the exchange rates of early 2018, non-US currencies are currently, in aggregate, still about 10% undervalued against the US dollar. This undervaluation is likely to be supportive of long term EAFE returns. However at current exchange rates, the level of undervaluation does not reach two standard deviations of statistical deviation from fair value, the level required to forecast with confidence near-term currency movements. While most commentators are now expecting US dollar weakness this year, from our models, it is challenging to predict a clear direction. To maximize the portfolio’s exposure to potential currency return, we are reducing exposure to stocks denominated in currencies that are close to or above fair value such as the Australian dollar and the Swiss franc and focusing the portfolio in stocks in more undervalued currencies where returns would potentially benefit directly from currency appreciation or indirectly from the implicit economic stimulus of an undervalued currency.

Valuation Provides Stability to Future Long-term Returns in an Uncertain World

2020 should make us all humble about the challenges of making near-term market forecasts. However, looking forward over the medium to long-term, we know that valuations matter, as does the direction of interest rates. It is reasonable to assume that any sustained reappraisal of those inputs will, as happened in the 4th quarter, likely have an outsized impact on market and portfolio returns. Global equity markets have delivered strong returns in 2020 against the backdrop of the pandemic, and on the back of a better-than 20% return in 2019 (which itself was well in advance of earnings growth). The basic conditions which today seem likely to define the next year – vaccine deployment, a more complete economic recovery, and hyperstimulative policy – may support equity market valuations in the near-term and may indeed drive them still-higher. However, a legacy of the health crisis is likely to be generally-subdued long-term economic growth. Our analysis suggests that aggregate market-level valuations look increasingly full. Any sustained market strength from here would effectively be a

pulling-forward of future returns.

The outlook for value-oriented strategies seems brighter. For a start, they have significantly lagged broader market returns and those of growth-oriented strategies (the deepest and most extended period of value underperformance in history). The valuation dispersions are extreme, and vaccine deployment and a return to more normal conditions would appear likely to benefit so-called value stocks disproportionately. In addition, the monetary policy backdrop seems unlikely to pose a fresh challenge from here. While long-term interest rates in the US have nudged fractionally higher in recent weeks, they remain at exceptionally low levels, and near-zero outside the US. 2020 was a miserable year, and an extremely challenging one for portfolio relative returns, but our bottom-up stock analysis suggests that our portfolios should deliver attractive long-term absolute and relative returns in a central case, with a favorable skew of outcomes. We therefore remain faithful as ever to our investment process and consistent in our application of the long-term dividend discount methodology. In an environment where the range of long-term outlooks is wide, we believe our focus on underlying valuation supports the portfolio.

Views expressed were current as of the date indicated, are subject to change, and may not reflect current views. All information is subject to change without notice. Views should not be considered a recommendation to buy, hold or sell any investment and should not be relied on as research or advice.

This document may include forward-looking statements. All statements other than statements of historical facts are forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results to differ materially from those reflected in such forward-looking statements.

This material is for informational purposes only and is not an offer or solicitation with respect to any securities. Any offer of securities can only be made by written offering materials, which are available solely upon request, on an exclusively private basis and only to qualified financially sophisticated investors.

The information was obtained from sources we believe to be reliable, but its accuracy is not guaranteed and it may be incomplete or condensed. It should not be assumed that investments made in the future will be profitable or will equal the performance of any security referenced in this paper. Past performance is not a guarantee of future results. An investment involves the risk of loss. The investment return and value of investments will fluctuate.