In a strong year for equity markets, European stocks beat US stocks to the finish line

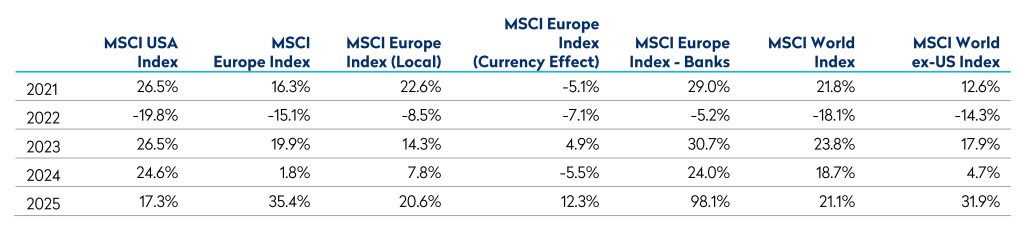

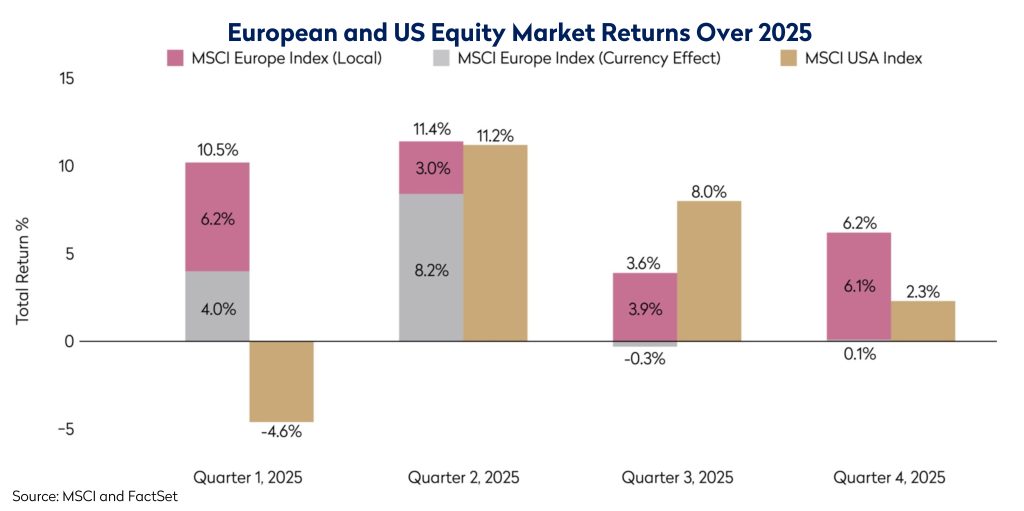

Global markets went on a rollercoaster ride in 2025. Equities that had gone up at the end of 2024, and continued rising early into the new year, lifted by expectations of tax cuts and looser regulation following President Trump’s election victory, came back down again as Liberation Day trade policies upended markets. April 2025 was a wild stretch for global equities, and witnessed some of the biggest one-day moves of the past decade: stocks quickly recouped their early-April losses as some of the initial tariff proposals were staggered or watered down. And markets marched steadily higher from there thanks, at least in part, to advances at the cutting edge of AI and increased expectations for new sources of AI demand. Still, investor bullishness in the rally cooled towards year’s end given nervousness about the magnitude and financing of the AI-related capex boom. MSCI Europe, up 20.6% in local terms in 2025, outperformed MSCI USA, up 17.3%, for only the fourth time since 2010. This outperformance occurred despite the AI boom – largely a US-centric theme – as markets increasingly focused on Europe’s more attractive valuations, alongside growing expectations of fiscal stimulus and structural reforms across the region.

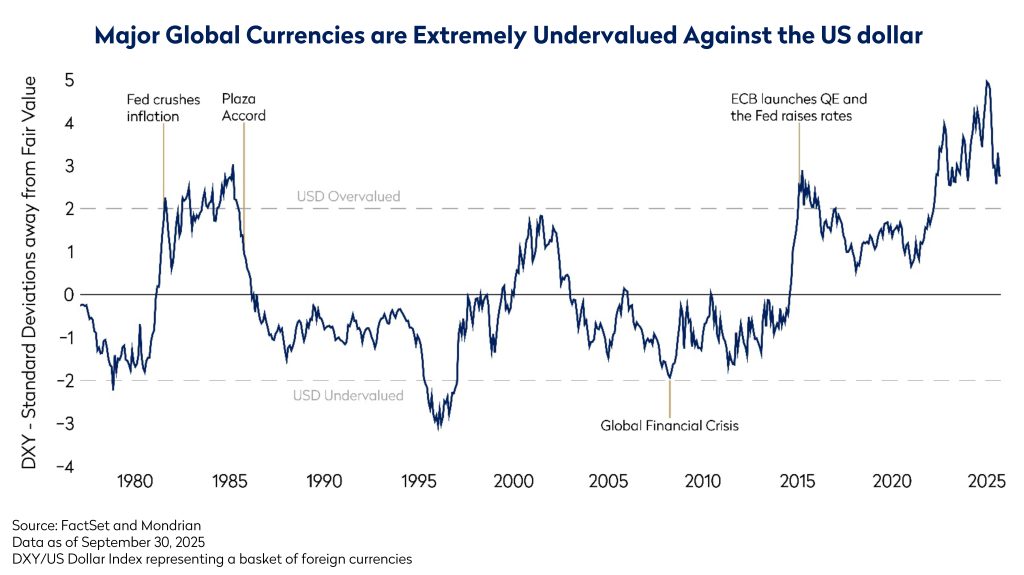

At the end of 2024 we wrote that currencies were trading at extremes against underlying economic realities, and that historic currency weakness relative to the US dollar presented a compelling opportunity for global investors. This began to play out over the course of 2025, with the US dollar coming under material pressure when faced with stop-start tariff wars, the vast borrowing needs of the US and worries about the independence of the US Federal Reserve. In 2025, currency represented a significant additional source of return for investments in non-US markets. Based on our long-run Purchasing Power Parity (PPP) approach, international currencies still appear very attractively valued against the US dollar, despite recent appreciation. We expect currency appreciation to further support long-term international returns, with investments in non-US markets more attractively valued than US equities in local-currency terms.

Cyclical sectors have led the charge higher in markets

Alongside breakneck spending in the AI sector, it has been the strength in cyclical sectors such as financials and industrials that has led the market’s recovery from post-Liberation Day lows, reflecting both solid earnings delivery in these areas of the market as well as renewed investor confidence in the outlook for global growth. The financials sector in particular has been a primary driver of the rally in global equities. The sector has been an exceptionally strong performer over the last twelve months and, indeed, over the last five years. The portfolio has a significant underweight position, which has been a headwind for relative returns which has had to be offset elsewhere. The challenge has been more severe when returns are compared to the MSCI EAFE Value sub-index, which carries an exceptionally high concentration to financials, at c.39%.

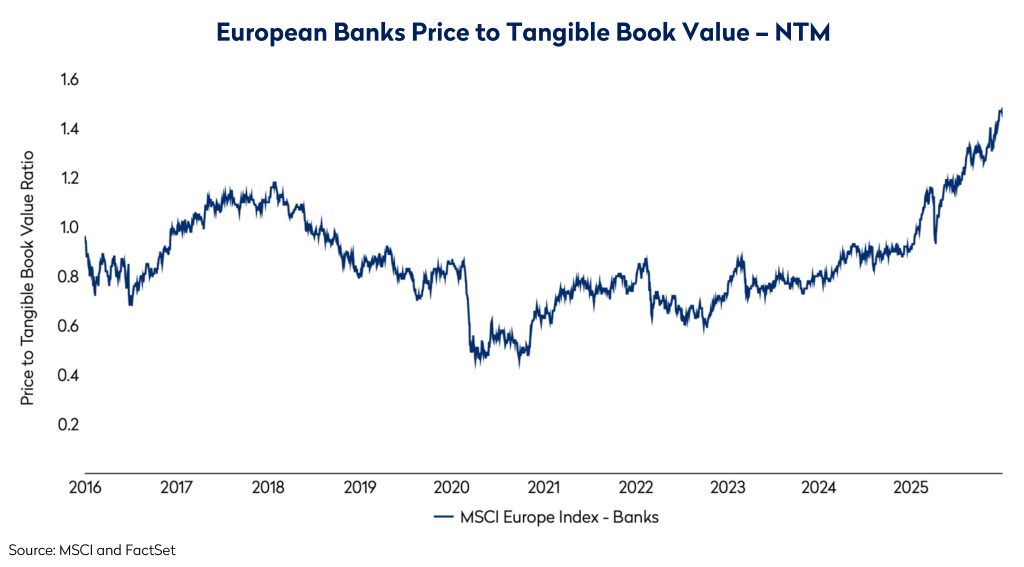

Within the sector, European banks have been the strongest pocket, with returns of c.77% in 2025 (in local currency). Having been in purgatory since the Global Financial Crisis, this segment of the market has been rehabilitated in the eyes of investors. During the prolonged period of zero or negative interest rates, return on equity was compressed (at around 8-9%) and banks were still in a phase of capital-build. While returns have since normalized – ROTE has improved to above 12% following the exit from ultra-low rates – this improvement has coincided with a period in which capital and regulatory headwinds appear to be easing.

Importantly, the sector has demonstrated greater resilience than expected as capital positions were rebuilt. Lockdowns, the abrupt rise in interest rates, and a two-year cost-of-living squeeze have all failed to trigger an increase in bad-debt charges, one of our primary concerns – alongside historically weak capital positions.

Looking forward, the argument in favor of European bank stocks looks increasingly nuanced. On the positive side, central banks appear to have engineered a soft landing: the gradual return of inflation to target has allowed for rate cuts and some erosion of debt burdens in real terms, while credit growth and economic activity have stabilized, without a marked pick-up in unemployment. Moreover, the revenue headwinds associated with falling interest rates are now fading. These supportive factors, however, are already well appreciated by financial markets – as reflected in the sector’s significant valuation re-rating. Some caution is warranted, as the current environment of low unemployment and very tight credit spreads has limited scope for further improvement and may deteriorate from here. At this stage, we believe an underweight position in banks and in the broader financials sector is appropriate, while continuing to evaluate selective, stock-specific opportunities within the sector.

The range of outcomes for AI remains very wide

Shifting away from financials, another key driver of recent equity market performance has been the rapid acceleration of investment in artificial intelligence. Nevertheless, the second half of 2025 may come to be seen as having marked a turning point for AI investing. A surge of headline partnership agreements signaled a shift in how leading model developers finance their growth; for these developers, rather than raising equity themselves, many recent deals now resemble vendor-financing arrangements. This shift is rooted in a simple dynamic: scaling laws continue to hold, and maintaining frontier performance now requires capital on a scale the tech industry has never seen. Monetization is growing rapidly by historical standards, yet still falls far short of funding the investment needed to stay competitive. The result is a widening gap between commercial revenue and the capital intensity of cutting-edge model development, prompting companies to seek new financing structures through strategic partnerships that are increasingly debt-funded.

Two distinct groups define the AI landscape today. Hyperscalers are funding the build-out from free cash flow, which gives them the ability to scale models, infrastructure and distribution without balance sheet strain. By contrast, AI startups have been striking deals of extraordinary scale and uncertainty with some of the largest IT companies in the industry in order to meet the coming infrastructure demands. It has been reported that OpenAI, for example, currently loss-making, has agreed to pay $300bn in a five-year contract to buy data center capacity from Oracle, with little certainty the deal will ever be fully consummated. If demand for its services falls short, OpenAI may simply be unable to pay, or the two sides could choose to negotiate. In the meantime, the real cash burden of capacity expansion is pushed onto downstream partners, such as Oracle, that must borrow to keep pace. This shift toward debt funded build-out adds systemwide fragility given the economics of AI are still unproven, future demand is uncertain, and capital intensity is increasing.

There is ongoing debate about the sustainability of current AI-related valuations. While we do not dismiss the transformative potential of the technology, there remains considerable uncertainty around the ultimate returns on the very large amounts of capital being deployed. At the same time, valuations have risen across much of the AI ecosystem, with the most pronounced stretch evident among privately held and early-stage companies. In these cases, firms such as OpenAI, Anthropic, and Perplexity are structurally incentivized to drive valuations higher because their equity serves as a key currency for both funding and talent acquisition. Mondrian’s disciplined, bottom-up valuation framework allows for selective exposure to AI-related opportunities while we maintain a focus on companies trading at compelling valuations, with limited balance sheet risk, such as Capgemini and Fujitsu.

Conclusion

Developed market equities have delivered strong returns over the past three years – approximately 21% p.a. globally and 18% p.a. outside the US (in USD)1. Performance has been driven primarily by a narrow set of stocks, most notably AI-related investments and financials, which have accounted for a disproportionate share of recent market gains.

Despite the relative outperformance of non-US markets compared to the US market in 2025, we continue to see differentiated and compelling opportunities outside of the US, where valuations began, three years ago, at meaningfully lower levels. In an interconnected world, investors can often access similar end markets or geographical exposures irrespective of where companies are listed. Accordingly, we focus on evaluating end market and geographic exposure on a company-by-company basis, rather than relying on a corporate’s country of listing. Non-US equity markets remain particularly attractive from a stock-picking perspective, offering less concentration risk, lower correlation to AI-driven themes and a broader opportunity set for valuation-driven investors. We believe the consistent application of our disciplined, value-oriented investment approach across this diverse universe can identify a sub-set of materially mis-priced securities with superior risk-adjusted return profiles.

Disclosures

¹ Referring to the MSCI World Index and MSCI World ex-US Index respectively

Views expressed were current as of the date indicated, are subject to change, and may not reflect current views. All information is subject to change without notice. Views should not be considered a recommendation to buy, hold or sell any investment and should not be relied on as research or advice.

This document may include forward-looking statements. All statements other than statements of historical facts are forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results to differ materially from those reflected in such forward-looking statements.

Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing, or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent.

This material is for informational purposes only and is not an offer or solicitation with respect to any securities. Any offer of securities can only be made by written offering materials. The information set forth herein is a summary only and does not set forth all of the risks associated with the investment strategy described herein.

The information was obtained from sources we believe to be reliable, but its accuracy is not guaranteed, and it may be incomplete or condensed.

It should not be assumed that investments made in the future will be profitable or will equal the performance of any security referenced in this document. Examples of securities will represent only a small part of the overall portfolio and are used to illustrate our investment approach. Any holdings are subject to change and may not feature in any future portfolio. More information on holdings is available on request.

Unless otherwise stated, all returns are in USD.

All references to index returns assume the reinvestment of dividends after the deduction of withholding tax and approximate the minimum possible re-investment, unless the index is specifically described as a “Gross” index

Past performance is not a guarantee of future results. An investment involves the risk of loss. The investment return and value of investments will fluctuate.

Mondrian Investment Partners Limited is authorized and regulated by the Financial Conduct Authority (Firm Reference Number: 149507). Mondrian Investment Partners Limited is also registered as an Investment Adviser with the Securities and Exchange Commission (registration does not imply any level of skills or training).