Post Financial Crisis economic concordia breaking down; exposing underlying financial market and economic fragility

After 15 years of post-crisis reconstruction – through low interest rates, debt socialization and the strengthening of capital buffers in the global banking system – high energy prices, high inflation, rising interest rates and war in Ukraine have pushed volatility higher and are once again exposing the fragile backdrop to the global financial system. The ongoing mini-crisis that erupted in the UK at the end of September, triggered by poorly thought out and poorly executed economic policy, underlines the broader systemic fragility, the challenges and risks of portfolio illiquidity and the very narrow execution space for policymakers. With the ongoing battle between higher interest rates and inflation unresolved, policy-makers will need to be wary of similar crises emerging elsewhere across financial markets.

While we have been concerned about ongoing financial system fragility for some time, what has been striking over the past six weeks, and indeed this year, is how few places there have been to hide.

Asset class returns for equities and bonds have been weak across the board this year. But after a strong market bounce in July, strong correlations within asset classes through the August and September weakness have made the recent quarter, after a relatively defensive start to the year, a challenging market for managers such as Mondrian who focus on downside protection.

Mondrian does not attempt to predict future short-term market directions. Instead we focus on estimates of probable underlying valuation as a basis to forecast future, expected long-term real returns. In the current volatile environment, with publicly traded assets bearing the pressures of illiquidity elsewhere in portfolios, we believe that significant long-term valuation anomalies against fundamentals are emerging, especially within international assets. We acknowledge that right now it is not hard to find reasons to be fearful of international investments. We believe that a defensive, cash flow oriented, shareholder return focused investment philosophy can be particularly attractive in a highly uncertain environment.

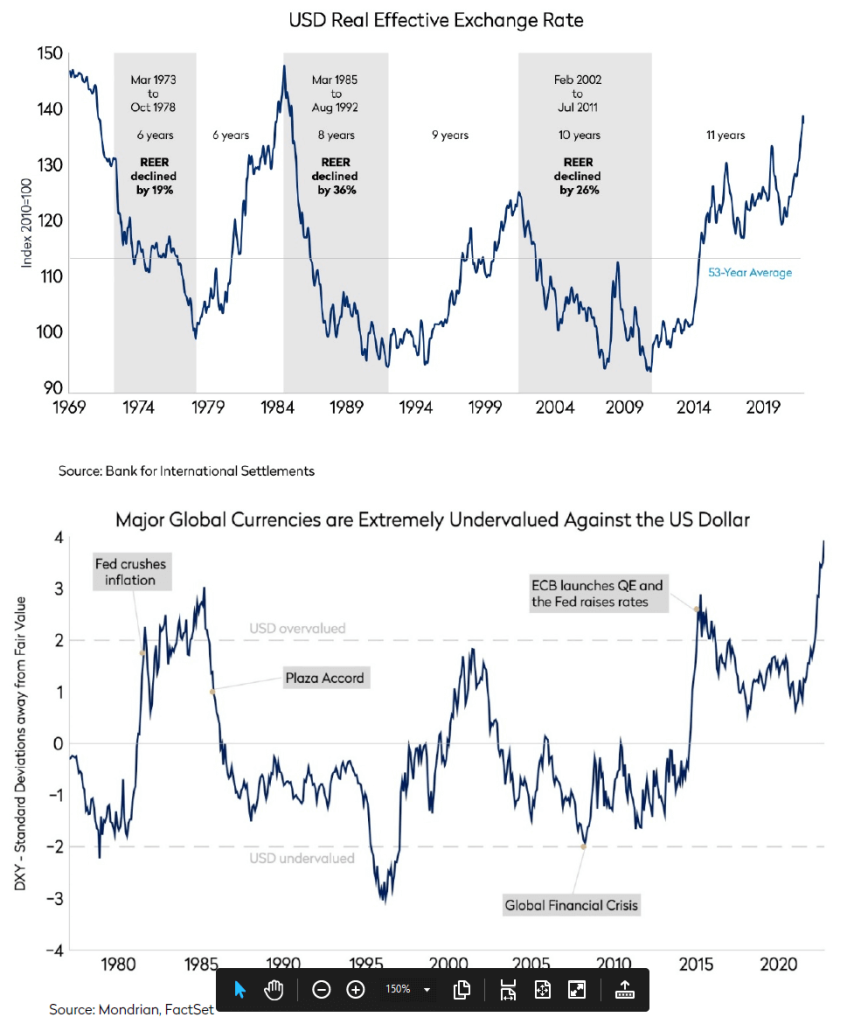

Extreme US dollar overvaluation manifestation of financial market fragility

Significant dislocations have arisen in foreign exchange markets. US dollar real exchange rates are approaching mid-1980s highs.

Using Mondrian’s purchasing power parity (PPP) methodology, the undervaluation of most currencies against the US dollar is now extreme. A lot of column inches have been written by commentators on the nuances of different valuation methodologies and comparisons with previous periods of extreme overvaluation. While the magnitude and historic positioning of the current overvaluation may be debated, the broad conclusion is no longer seriously contested. Our recent research trips to the US, Europe and Japan have reinforced the conclusions from the PPP analysis.

Risk aversion and higher interest rates have made the US dollar an attractive asset. This is now beginning to create economic strains across the world. The strong US dollar is exporting at least some US inflation to the rest of the world through commodity prices and the prices of other goods traded in dollars. Limited post-pandemic travel has meant that holders of US dollars are investing and spending less of their money abroad, reducing some natural economic equilibrium mechanisms. While in some emerging markets despite relative resilience so far, heightened inflation and US dollar denominated debt are beginning to exacerbate existing system stresses.

While a small number of countries made provisional forays into currency markets in September, there is not yet a global consensus to enable broader intervention in foreign exchange markets. While the 1980s Plaza Accord abruptly changed the trajectory of the US dollar valuation, the general policy of central banks in the intervening almost 40 years has been to intervene in the market as little as possible. This has been evident in the way the Bank of Japan has handled the recent weakness of the yen. Over the past year, numerous market commentators have declared “must-defend” levels, but as the yen has moved through each of those, the Bank of Japan has broadly declined to act. Towards the end of September, the Bank of Japan finally stepped into the market only to be overwhelmed the next day by the eruption of the UK mini-crisis. While the precise policy direction to manage the exchange rate polarity remains unclear, currency markets look to be approaching breaking points and US dollar overvaluation is likely high on most central bank agendas.

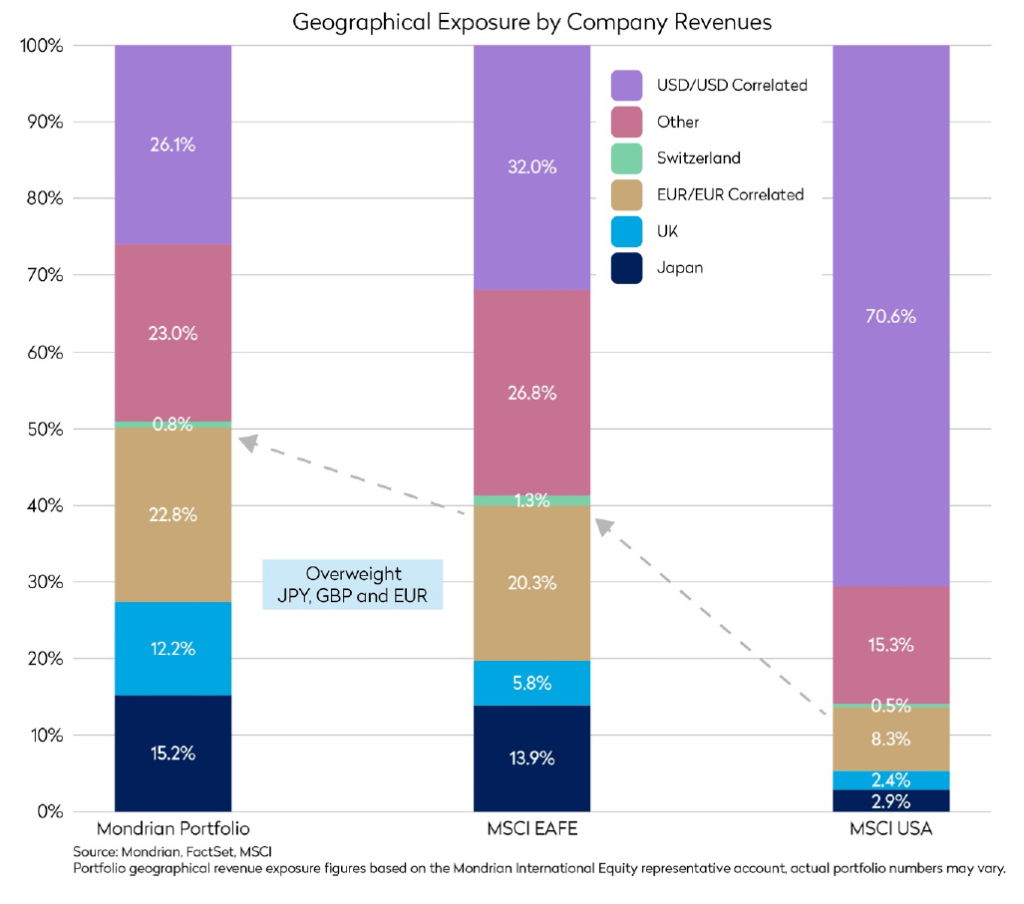

The Portfolio’s underlying currency exposure is now directed away from the US dollar

Economically, relative currency undervaluation should increasingly offer support to economies outside the US; it is a reasonable expectation that marginal investment will, over time, be attracted to those markets with lower asset prices and a lower cost base. This should particularly support relative economic activity across Europe and Japan where real currency movements have been the largest even if exchange rates move off their current polar extremes. While the near-term trajectory of economic growth remains uncertain, securities across the portfolio stand to benefit from any improvement in the global investment climate.

While we have held this view on relative US dollar valuation and its economic implications for a while now, over that time, the polarity has only become more extreme. It is likely that the extent of the underlying divergence has been somewhat obscured by the pandemic, a sharp focus on US dollar interest rates and investor risk aversion related to the Ukraine war and the energy crisis. While it is hard to know precisely what will change investors’ attitudes towards the US dollar, Mondrian’s investment strategy is continuing to identify attractive companies with revenue streams generated outside the US dollar. To illustrate this point, the chart below highlights the geographical distribution of revenues earned by the companies Mondrian’s portfolios against the broader market.

The underlying earnings and cashflows in Mondrian’s portfolios are now weighted away from the US dollar towards developed market currencies with a high degree of undervaluation.

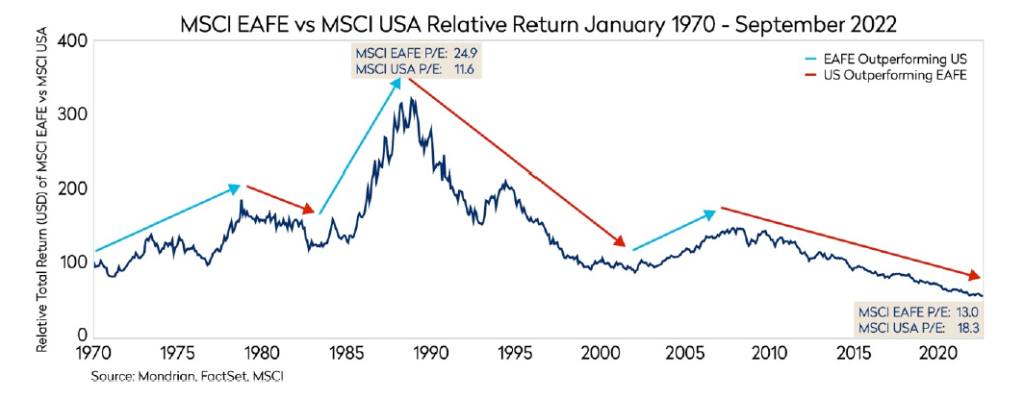

Could a reversal in currency valuations herald a structural change in investment returns?

For anyone old enough and with a long-term memory, the late 1980s through the 1990s was the peak for US investors moving investments outside the US. With hindsight, timing may not have been optimal. Many of these decisions were driven by the supposed superior returns and risk reduction benefits offered by international markets based on high expectations for Japan and historic return streams.

Today we still believe that there are many, maybe even more, very good economic and valuation arguments for investing outside the United States, but they are not driven by looking at historical returns and historical correlation coefficients on efficient frontiers. In terms of money earned, the US today is a smaller share of global GDP, representing less than 16% of the global economy compared to 20% in 1990. The global investable universe has continued to grow with leading companies such as TSMC, Samsung Electronics, L’Oréal, Sony, Toyota Motor, Diageo, Shell, BMW, Saint Gobain, ASML, Enel, Unilever, Allianz, National Grid and Novartis to name a handful of larger household names. But the biggest reason is valuation.

Since the inception of the MSCI index series at the end of 1969, both the US and EAFE markets have achieved attractive annualized long-term returns with the US market after its recent run slightly outpacing international markets: +9% per annum to +8%. This long-term return has been achieved despite international markets having spent more recent years struggling through crises: both imported (tech bubble, GFC and now Ukraine) and of their own making (Japan bubble and Eurozone crisis). If the system isn’t entirely broken (and while it might be damaged, we don’t think it is completely broken), relative to US equities, today’s valuations reflect a sober reality at undervalued exchange rates. And within global equity markets, we believe a defensive investment approach focused on cashflow generation can build relative stability and upside optionality in an uncertain world.

Disclosures

Past performance is not a guarantee of future results. An investment involves the risk of loss. The investment return and value of investments will fluctuate.

For investment professionals only.

Purchasing Power Parity Valuations are calculated using proprietary Mondrian models. Further information on these models can be provided on request. Information and data is correct as at 30 September 2022. Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent.

Mondrian Investment Partners Limited is authorized and regulated by the Financial Conduct Authority. Registered in England No.2533342. Mondrian Investment Partners Limited is registered as an Investment Adviser with the SEC (registration does not imply any level of skills or training).

Views expressed were current as of the date indicated, are subject to change, and may not reflect current views.

All information is subject to change without notice. Views should not be considered a recommendation to buy, hold or sell any investment and should not be relied on as research or advice.

This document may include forward-looking statements. All statements other than statements of historical facts are forward looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results to differ materially from those reflected in such forward-looking statements.

This material is for informational purposes only and is not an offer or solicitation with respect to any securities. Any offer of securities can only be made by written offering materials, which are available solely upon request, on an exclusively private basis and only to qualified financially sophisticated investors.

The information was obtained from sources we believe to be reliable, but its accuracy is not guaranteed and it may be incomplete or condensed. It should not be assumed that investments made in the future will be profitable or will equal the performance of any security referenced in this paper.