Has the Investment Case for Energy Run Out of Steam?

Energy has been the worst performing sector in MSCI EAFE this year and the portfolio’s overweight exposure has been a material drag on investment performance. COVID-19 demand headwinds and the structural threat posed by the energy transition have dented investor confidence. So why do we believe there is long-term value in this sector?

Supply Discipline has Returned Despite Continued Demand Disruption

Lockdown measures in April saw an unprecedented oil demand decline of 25% compared with April 2019, on top of an unexpected increase in supply as the OPEC+ alliance briefly dissolved. These effects drove a rapid build-up in global oil inventory which threatened to breach storage capacity limits and sent benchmark oil prices tumbling. Since that trough period in April, we have seen a steady if unspectacular recovery in oil demand, the IEA now expects oil demand to fall around 8.5% in 2020. But crucially, supply discipline has returned in force. Once the extent of the pandemic became clear, OPEC+ re committed to production cuts approximately five times higher than the previous cuts – reducing global supply by around 10%. US shale output also fell materially, reducing global supply by a further couple of percentage points as producers responded to lower prices and scarcer capital. It is likely that OECD commercial inventories have been declining since July, and we would expect continued supply discipline to respond in the likely event of further COVID-19 related demand disruption. In other words, the oil market now seems well past the worst point of pandemic disruption.

Energy Transition Risks and Opportunities

Looking to the longer term, we accept and endorse the need for the world to decarbonize, but we are not convinced that it can happen overnight. The pathway and timeframe for decarbonization is hugely uncertain. Estimates of peak oil demand range from 2019 to the late-2030s. Timeframes for reaching net zero emissions on a global basis range from 2050 to beyond 2100. Regulatory regimes range from highly interventionist to laissez-faire. A wholesale, rapid energy transition, though desirable from an environmental standpoint, will take time to accomplish.

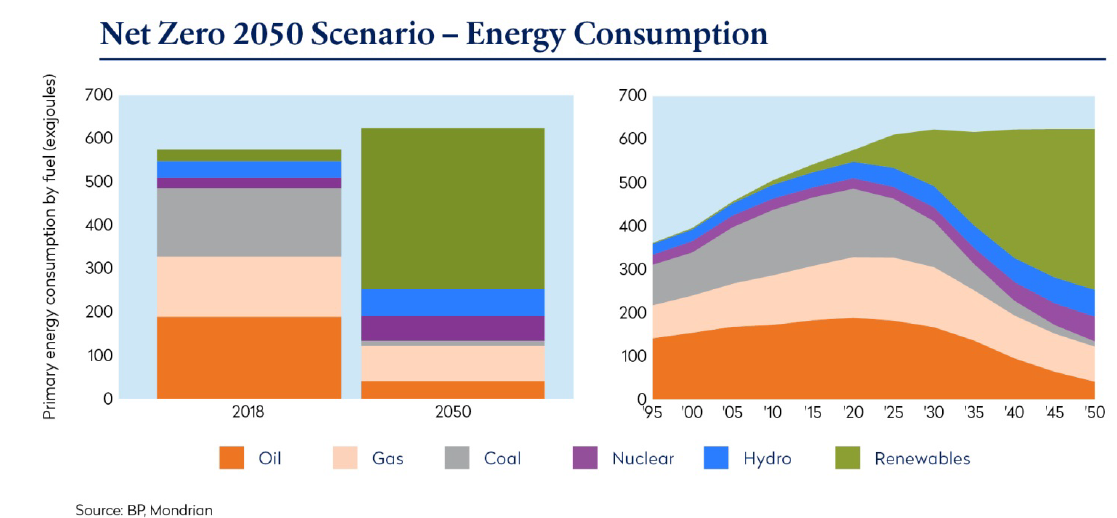

The scale of the global decarbonization challenge is vast. 80% of primary energy demand is currently met by fossil fuels. Renewable energy generation from solar, wind and biofuels accounts for less than 5%. To achieve net zero emissions by 2050, renewables would potentially have to grow to around 60% of the energy mix. Estimates suggest that annual spending on renewable energy generation would have to double or even triple from current levels. To incentivize this level of investment, global policy measures must regulate away high emissions; technological developments must reduce clean energy costs and resolve the problem of intermittency; and consumer behaviour must swing decisively behind clean energy. These requirements are all achievable, but in our view the weight of probability suggests it is currently unlikely to be achieved by 2050 on a global basis.

Investment Case for International Energy Companies

We do not profess to have a superior ‘crystal ball’ with which to predict the precise timing of peak oil demand, and our investment thesis for the energy sector does not hinge on getting this point forecast right. Instead we use scenario analysis – completing base, best and worst case scenario models for oil demand, oil price, and international energy company (“IEC”) valuations. We then make investment decisions based on the range of outcomes and in particular, the skew of outcomes, which look increasingly attractive.

There are two key attributes we look for when gauging whether IECs can successfully navigate the uncertain outlook. Firstly, a flexible strategy that is returns-focused and can adapt appropriately to the speed of the energy transition; and secondly a capital framework that prioritizes a resilient balance sheet and sustainable cash generation to fund both the capital needs of the business and shareholder returns, whatever the backdrop. In our view, portfolio investments in the energy sector, namely Royal Dutch Shell, BP and ENI, are positioned to meet these requirements as we look forward.

Strategic Flexibility and Focus on Returns

Upstream strategy has been returns-focused for several years already, with the benefits somewhat obscured by the weak pricing environment. The shale revolution triggered this major strategic shift towards “value over volume”, with energy companies pivoting away from chasing expensive volumes towards value-driven investment. Standardization rather than gold-plating reduced engineering expense; digitalization reduced maintenance time and costs; development of oil fields near to existing infrastructure reduced operating and capital outlays, all driving up like-for-like returns. Capital expenditure of our IECs has fallen 50% since 2013 and 30% since 2015. Aggregate break-even levels continue to fall as this low-cost production comes online.

Concern around stranded assets has long been a key risk factor for the sector, and the lower oil price environment has seen non-cash impairments of between 3% and 8% of our IEC asset bases in recent months. This is certainly painful but does not in our view explain the halving of IEC market capitalizations. With lower capital investments, hydrocarbon reserve lives have been falling, reducing future stranded asset risks. The average reserve life of our IECs is now just over 10 years, theoretically implying that with no further investment in production growth, today’s proved reserves could be fully produced by 2030. This is extreme, for even in the “Net Zero 2050” scenario, new oil production would still be required to offset decline rates. So although capital deployment in oil will now be skewed towards maintenance capex, there is still scope for low-cost projects to generate attractive returns, whilst stranded asset risk can be mitigated by focusing on shorter payback periods. In our view, this low-cost, value focused, lower risk upstream strategy – managing oil exposure to maximize returns, allows a more nimble, opportunistic approach towards investment in oil, and will help to drive up returns and cash generation as the oil price recovers.

Gas commands a better long-term demand profile than oil, with gas demand expected to grow at 1% p.a. and LNG at 3-4% p.a. to 2040. As the cleanest hydrocarbon, gas is the ideal complement for the intermittency of renewable power, and with carbon capture, utilization and storage (CCUS), gas can be used to generate carbon neutral or “blue” hydrogen. With the development of the LNG market, gas is now a globally transportable commodity, helping to facilitate the replacement of coal-fired power generation in Asia. In almost all emission scenarios, demand for gas is expected to grow well into the medium-term, allowing our IECs more exposure to longer-dated, higher returning projects.

While it is reasonable to be cynical, BP, Shell and ENI have all published climate aims that are fully aligned with the Paris climate change goals, fundamentally shifting their strategies to become more flexible in the face of transition risks. BP and Shell aim to achieve net zero scope 1, 2 and 3 emissions by 2050 (covering emissions from their own operations, energy sources, and from produced hydrocarbons). ENI is aiming to achieve net zero scope 1 and 2 emissions from upstream operations by 2030, and for all group activities by 2040. Achievement of these goals will be driven by pivoting the hydrocarbon mix towards gas and ramping up scale in clean energy such as wind and solar, biofuels, hydrogen, and CCUS. It is worth stressing that these investments will only be made at scale if return hurdles are met; where return objectives clash with climate ambitions, returns will ultimately win.

Our IECs are not starting from scratch in clean energy – all have installed capacity in wind and solar; BP and Shell are world leaders in sugar cane biofuel; ENI converted two Italian refineries to biorefineries, which are supporting downstream profitability in the current environment; BP is the leading gas marketer in the US; Shell has been involved in hydrogen production for decades; and Shell has a stake in the Northern Lights carbon capture and storage project off the coast of Norway. On the face of it, returns are lower in clean energy than in oil and gas. Typical oil and gas projects have IRRs in excess of 15%, whereas IRRs from clean energy (solar / onshore wind) are 5-6% unlevered, or 8-10% with project financing and efficiencies. However, the risk profiles are very different: oil projects carry greater risks, and successful project IRRs must compensate for failures in exploration and production; whereas risks in clean energy projects are lower with power offtake agreements often running out 15 years, effectively locking in returns. Execution risks are also lower in clean energy. So on a risk adjusted basis, management teams see the return profiles of clean energy as much more comparable with oil than they might appear.

Capital Framework

In our view, a strong balance sheet is a pre-requisite to ensure stability through volatile times. With the disruption of the COVID-19 environment, energy sector balance sheets are too geared for the current low oil price environment. Our investments are not immune to this. We believe cash conservation to shore up balance sheets is the first priority, so where necessary, we have encouraged opex, capex and dividend cuts along with divestment of non-core assets to achieve deleveraging as a priority. Once balance sheet strength is restored, we would expect continued capital discipline and a commitment to growing shareholder returns as earnings and cash generation recover.

Valuations and Conclusion

There is currently a confluence of headwinds for the energy sector, with investors shunning the sector on COVID-19 impacts, transition threats and, increasingly, divesting for principles-based reasons. Given how much negativity is currently priced into energy stocks, our long-term view on valuations is more constructive based on the attractive skew of outcomes. The oil price is trading close to our worst case scenario price of USD 35 per barrel (based on analysis of the marginal cash cost of production). After at least halving their dividends, all three of our IECs are trading on floor dividend yields of between 5% and 7%. We also see opportunities for real dividend growth driven by growing gas, LNG, marketing, and clean energy businesses, funded by cash generative oil businesses. We expect the energy transition to happen, but it is likely to be uneven and slower than the market and the “Net Zero 2050” scenario suggests. A returns-focused, flexible approach to capital allocation combined with reduced duration risks means our energy investments are well placed to respond to transition uncertainties. The mispricing we see in the sector has created an attractive opportunity for value investors.

Views expressed were current as of the date indicated, are subject to change, and may not reflect current views. All information is subject to change without notice.

Views should not be considered a recommendation to buy, hold or sell any investment and should not be relied on as research or advice.

This document may include forward-looking statements. All statements other than statements of historical facts are forward- looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results to differ materially from those reflected in such forward-looking statements.

This material is for informational purposes only and is not an offer or solicitation with respect to any securities. Any offer of securities can only be made by written offering materials, which are available solely upon request, on an exclusively private basis and only to qualified financially sophisticated investors.

The information was obtained from sources we believe to be reliable, but its accuracy is not guaranteed and it may be incomplete or condensed.

It should not be assumed that investments made in the future will be profitable or will equal the performance of any security referenced in this paper. Past performance is not a guarantee of future results. An investment involves the risk of loss. The investment return and value of investments will fluctuate.