Strong start to the year for equity markets

Amidst increasing concern over deteriorating economic growth, geo-political uncertainty and the prospects of tightening monetary policy, global equity and credit markets threw a temper tantrum towards the end of 2018. Reacting swiftly to the near-term data points, the Fed took the lead signaling a pause in monetary tightening, and markets responded very positively in the first quarter. The MSCI EAFE index rose 10.0% while US markets were even stronger: the MSCI USA index rose 13.7%.

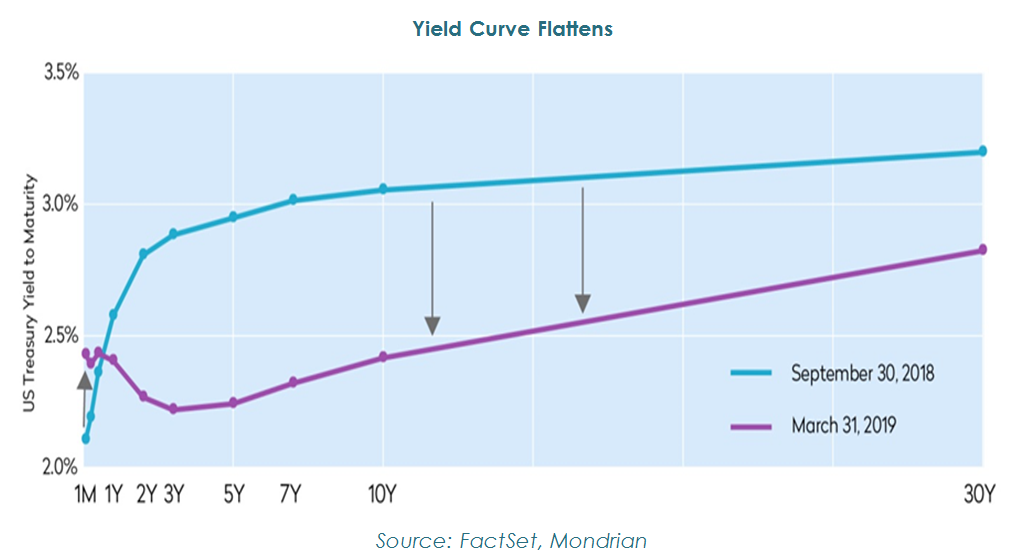

With December’s increase, the US has now experienced nine interest rate rises over the past four years as well as the start of quantitative tightening. While the Fed’s official assessment of monetary conditions is still supportive, the interest rate curve has moved from steeply sloping upwards six months ago to flattish today, reflecting the maturity of the economic cycle.

Meanwhile, valuations which had begun to look more attractive towards the end of last year are slightly less compelling today and heavily dependent on earnings growth materializing in an extended cycle. This is especially true of the US market, where Mondrian’s forecast expected real return (ERRPA) lags other developed markets, partly held back by an expensive currency.

Near-term underlying economic growth probably bottomed in the first quarter

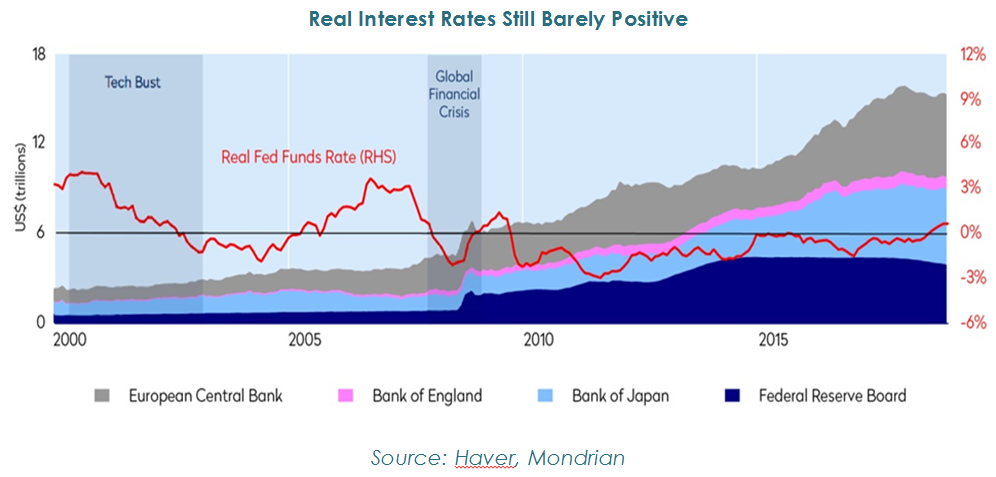

While market commentators are justifiably worrying about the inverted yield curve and the contractionary pressures it creates, it is our expectation that, in the near term, global economic growth should most likely continue on a positive trajectory this year. Real interest rates remain low and inflationary pressures remain generally subdued. Moreover, central banks have reacted extremely swiftly to weak data by delaying balance sheet reduction. Following the Fed’s action, China also abandoned its de-leveraging policy to support growth, and the European Central Bank (ECB) pushed out its forward guidance for interest rate normalization, announcing new liquidity measures to support the financial sector. As the chart below illustrates, the real monetary environment remains broadly supportive.

Some economic data points, especially in Europe, continue to be soft, but it is still likely that supply side factors such as China trade negotiations, concerns over Brexit, and the transition to the new emissions testing regime in Europe have exerted an outsized temporary negative impact on recent economic data which should begin to roll off.

After a pause, discount rates likely to continue pushing upwards

We have written before about our expectations for equity investors’ long-term discount rates to continue to normalize, albeit slowly. We believe this will be the natural result of a slow normalization of real interest rates from very low current levels interacting with heightened political risk, concerns on the slow progress of addressing global leverage risks, as well as the challenges of a drawn out economic cycle and greater market volatility.

With regard to political risk, we have also previously written on the UK and Brexit. We have now passed the original exit deadline, with the Conservative Government unable to find a solution that maintains party and Government unity and garners sufficient support in parliament. With the latest EU-imposed deadline of April 11 looming, most outcomes remain on the table; it is likely that the exit process will drag on for many months to come, weighing on the UK economy. However we believe that the political-driven risk premium built into UK stock prices is much higher than in most other markets, making selected companies, particularly domestically-exposed companies, attractively priced.

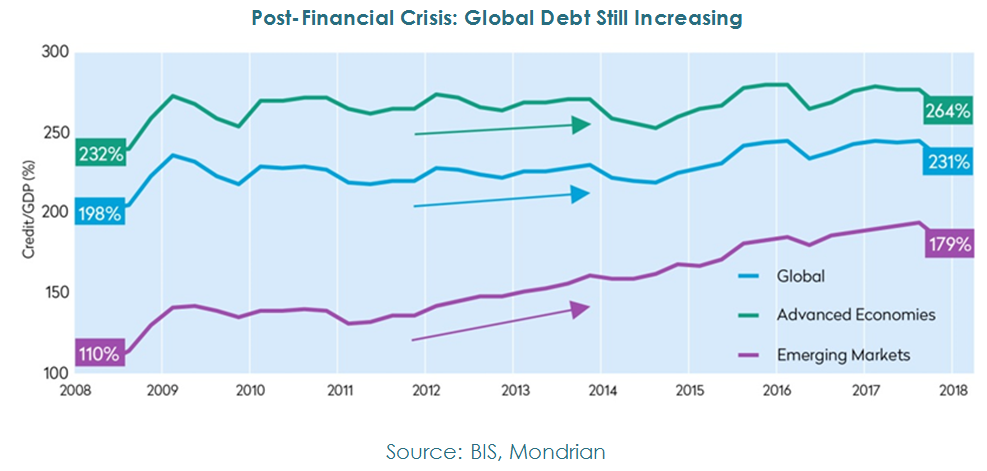

Of even greater concern for the global economy is the continuous rise in the stock of debt in relation to GDP since the financial crisis. While ultra-loose monetary policy and low interest rates have been an important tool in combatting the challenging post-crisis economic environment, they have led investors to seek to compensate for weaker growth through leverage. In advanced economies, aggregate debt-to-GDP has increased from 232% to 264% in the last decade. In emerging markets, the growth has been more spectacular, rising from 110% to 179%, and this has not been limited to China. While this increase in leverage may not necessarily be the trigger for the next economic downturn, it will nevertheless act as an amplifying mechanism in any crisis.

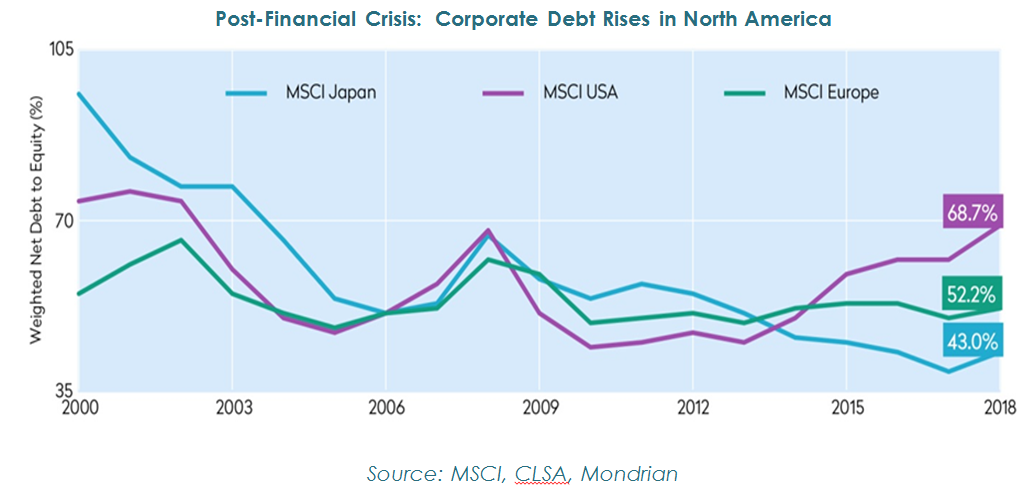

At a corporate level, while leverage has an important role in corporate structures, rising leverage can indicate that companies are overpaying shareholders at the price of future pay-outs. As the chart below illustrates, Japanese corporates have steadily de-levered post their early 90s crisis. Balance sheets now look among the strongest in developed markets. Elsewhere, especially in North America, post-crisis low interest rates and lower taxes have encouraged management teams to take on more debt, mostly to fund share buy-backs.

Sustainably-generated shareholder returns are fundamental to Mondrian’s valuation model. The structure of a company’s balance sheet not only has implications for sustainable returns, but it can also alter the skew of risks around that business. In 2019, company accounts and debt levels may come under greater scrutiny from investors as the implementation of IFRS 16, a new accounting standard, will bring operating lease obligations onto corporate balance sheets in most of the world outside the US. In theory, this accounting change should not change the value of the company as it will not impact equity, cash flow or the underlying long-term obligations of companies, but the IASB expects that the assets and their corresponding liabilities now coming in to view on balance sheets will be approximately $2.8 trillion. This will highlight to investors the greater underlying asset intensity of the businesses in which they are investing and those corresponding financial obligations.

Implications for investment risk and return: Brave New World or Back to the Future?

The ten years from the end of the financial crisis has been a challenging but overall good period for equity investors. Monetary policy has been very supportive, growth has slowly returned, and equities and bonds have both offered investors strong returns with declining volatility. Despite the euro zone crisis and the collapse of oil prices, international equity markets have offered around 9% annualized returns over these ten years1. While long-term returns do not normally get much better than that, for growth-focused investors, close to an additional 100 basis points annualized (source: MSCI) surely makes this period feel like a brave new world: growth companies are achieving supernormal returns.

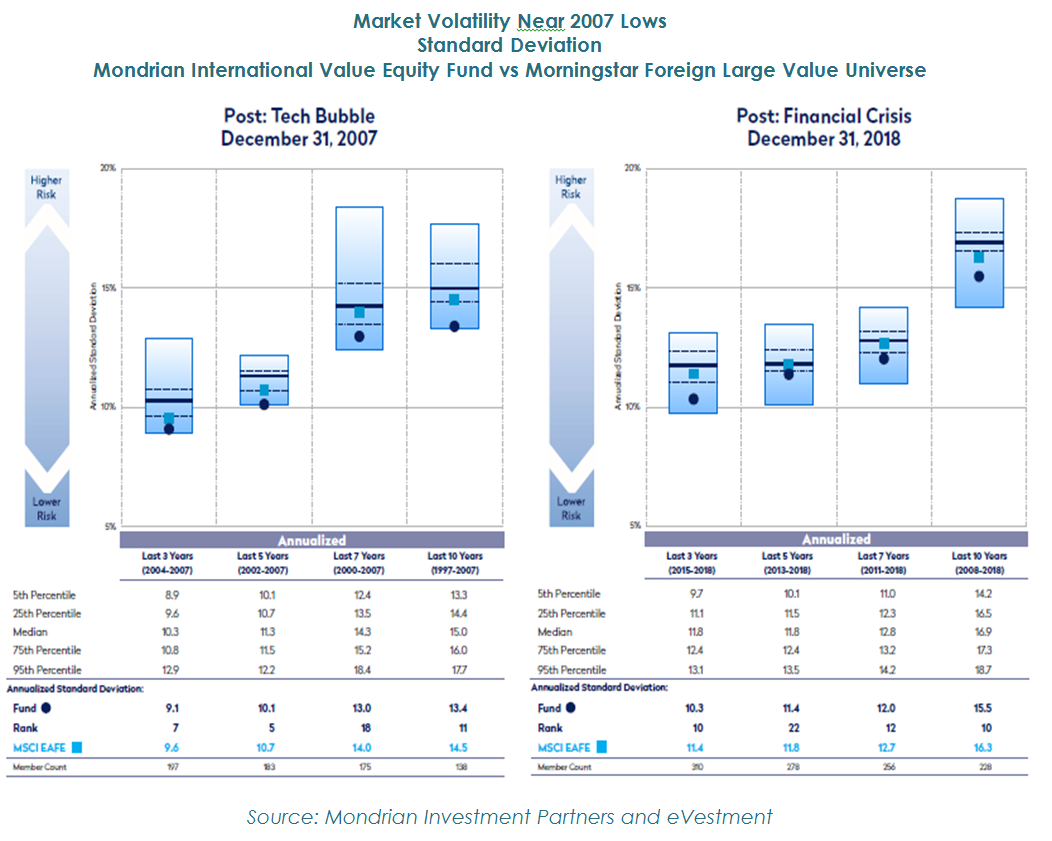

To try to gain a better understanding of the current environment, we searched back in history for periods with similar risk and return characteristics to today. The most straightforward parallel turned out to be 2007. Annualized returns for the previous ten years were a similar 8.7%2, while the rolling risk characteristics for the market and our portfolio look remarkably similar: compressed low risk in the more recent periods ballooning out to a much wider portfolio risk range to incorporate an earlier crisis.

©2019 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Please note that the number of portfolios for eVestment may differ from Morningstar due to additional managers reporting if run at a later date.

Looking at these two charts juxtaposed is a salutary reminder that recent low volatility is not unique; market volatility in the period leading up to the financial crisis (blue squares) was even lower than today as the market had responded positively to the post-technology bubble, supportive monetary environment. The trajectory of the two charts is not a forecast, and it does not evidence similar causation or indicate any imminent crisis, but it does provide a warning that a tectonic shift can and often will occur suddenly in markets after a prolonged period of stability. In today’s data-driven world, it is also important to note that any disruptive shift will fundamentally distort the information content in underlying data. To be able to build forward-looking lower risk equity portfolios in a changing environment requires, we believe, integrating an understanding of likely future risk from the bottom–up.

1 MSCI EAFE Total Return (Net): 31 Mar 2009 – 31 Mar 2019

2 MSCI EAFE Total Return (Net): 31 Dec 1997 – 31 Dec 2007

This information should not be relied upon as research or investment advice regarding any particular security. This is intended to provide insight into the manager’s investment process and strategy. Forward looking analytics are not a forecast of the Fund’s future performance.

To determine if the Fund is an appropriate investment for you, carefully consider the fund’s investment objectives, risk, and charges and expenses. This and other information can be found in the funds full and summary prospectus which can be obtained by calling 888-832-4386 or by visiting www.mondrian.com/mutualfunds. Please read the prospectus carefully before investing.

Investing involves risk, including the possible loss of principal. International investments entail risks not ordinarily associated with U.S. investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors, as well as increased volatility and lower trading volume. The Fund may invest in derivatives, which are often more volatile than other investments and may magnify the Fund’s gains or losses.

The Mondrian Investment Partners Limited Funds are distributed by SEI Investment Distribution Co. (SIDCO). SIDCO is not affiliated with the advisor, Mondrian Investment Partners Limited. Mondrian Investment Partners Limited. Mondrian Investment Partners Limited is Authorised and Regulated by the Financial Conduct Authority.