For decades, U.S. Treasuries have been the cornerstone of fixed income portfolios, serving as the global benchmark for safety and liquidity. But today, rising U.S. fiscal burdens, political instability, and shifting global economic power mean the case for diversifying into global fixed income and emerging markets debt (EMD) has rarely been stronger. With volatility in the U.S. and opportunity abroad, investors are rethinking what it means to build resilient, income-generating portfolios.

U.S. Uncertainty Creates a Need for an Expansion of Investment Opportunities

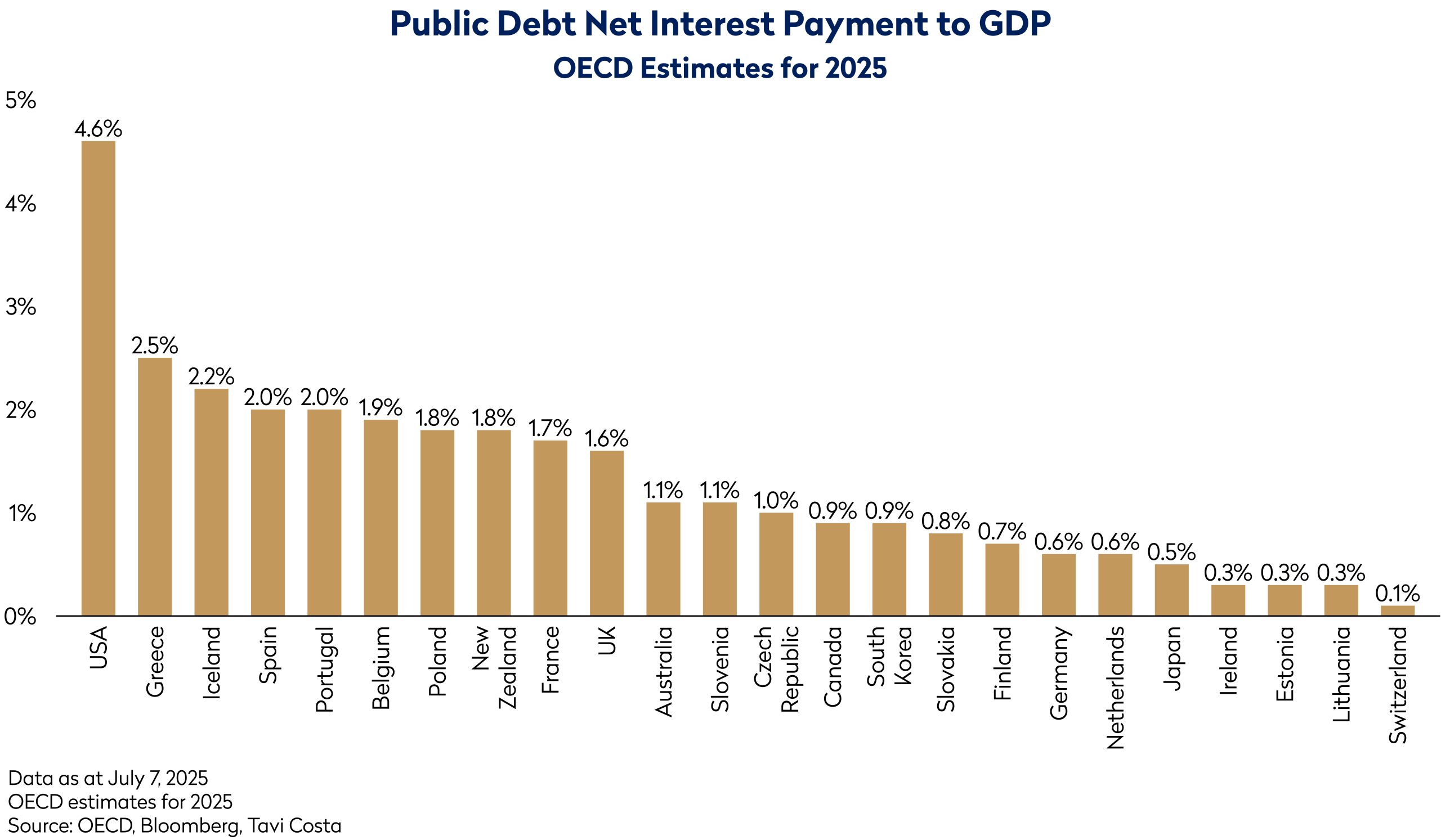

The U.S. faces growing challenges that undermine the reliability of Treasuries as the sole anchor of global portfolios. Net interest payments are projected to reach nearly 4.6% of GDP in 2025, the highest among developed peers, signaling an unprecedented fiscal strain on government finances.

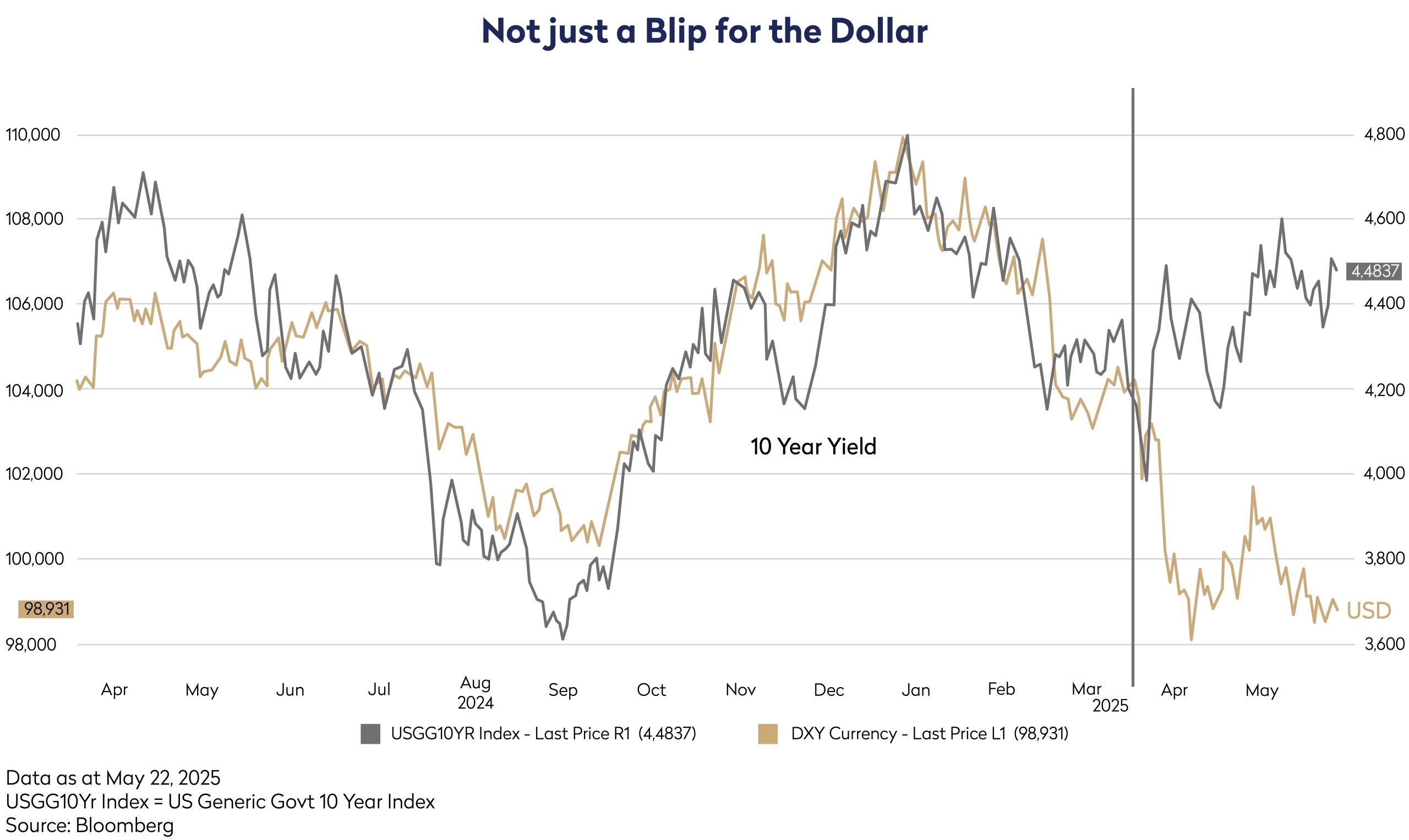

At the same time, the dollar, once the unrivaled reserve currency, has shown meaningful weakness against global peers, just as long-term yields have risen sharply. The combination of currency depreciation and higher financing cost has begun to erode the traditional “safe-haven” status of Treasuries.

Overlay the volatile political environment—election cycles marked by deep division and the potential for policy dislocation—and investors have reason to look beyond U.S. borders for stability and opportunity. In short, the U.S. may no longer provide the ballast portfolios once relied upon.

Global Bonds: Attractive Yields and Defensive Role

The strategic case for global fixed income rests on diversification. With the global bond asset class encompassing a wide range of countries, it provides opportunities for diversification versus domestic bond portfolios, and the characteristics of global bonds can also provide excellent diversification against riskier asset classes such as equities and high yield credit.

In the short term, global bonds have usually outperformed during periods of market turmoil. As a result, they can help stabilize portfolios during times of crises. By their very nature, market crises are unpredictable and will always occur. Global bonds have the ability to act like an insurance policy – there when you need them most.

This strategic rationale for global bonds is bolstered by a strong tactical case for diversification out of domestic bonds for a U.S. based-investor. Despite weakness this year, the U.S. dollar is significantly overvalued against virtually all other global currencies. This provides a significant source of potential return for U.S. dollar-based investors. Rather than be biased to any particular market that can be subject to its own idiosyncratic shocks, we believe it makes more sense to hold a diversified basket of high-yielding high-quality instruments.

Global GDP dynamics underscore this point: while Germany’s economy was four times the size of China’s in 1990, by 2025 China’s GDP is four times Germany’s. The world is not static, and fixed income allocations should evolve to reflect these economic shifts.

Emerging Markets Debt: Yield, Growth, and Diversification

Emerging markets debt continues to provide opportunities for higher yields and portfolio diversification, supported by generally improving economic fundamentals in several regions. EM economies continue to grow faster than developed peers, and many have made significant progress in building deeper, more liquid local bond markets. The expansion of these markets—particularly in Mexico, India, Brazil, and China—has created opportunities for investors to access both income and structural growth.

Credit spreads in EM debt typically provide a meaningful income premium over developed market bonds, compensating for perceived risks. When combined with stronger fiscal positions in certain EM countries and higher growth rates, this income stream looks increasingly attractive.

Importantly, EM debt often exhibits moderate correlation with U.S. Treasuries and developed market bonds. This diversification benefit can help reduce overall portfolio volatility, especially during periods of U.S. political or fiscal stress. Recent investor flows into EM local-currency bonds underscore the growing recognition of their value.

Why Now?

Beyond cyclical considerations, the current environment is one of secular change. Demographics, productivity patterns, and government debt loads are shifting the global balance of power. For decades, investors benefited from U.S. exceptionalism in liquidity, innovation, and political stability. But with debt burdens rising, political risks intensifying, and real returns diminishing, relying solely on Treasuries and U.S. denominated debt is increasingly risky.

Meanwhile, global bonds and EM debt markets have matured. Local issuance has expanded, transparency has improved, and investor access is far greater than in previous cycles. These dynamics make global fixed income a timely and attractive allocation for investors seeking both yield and diversification.

The era of unquestioned U.S. exceptionalism in bonds is fading. Rising debt costs, political volatility, and negative real returns have weakened Treasuries’ role as the sole foundation of portfolios. Global fixed income and emerging markets debt offer investors a broader, stronger toolkit – one that has the ability to deliver income, diversification and balance.

For those seeking resilience in an uncertain world, the time to expand beyond U.S. borders is now.

Disclosures

Views expressed were current as of the date indicated, are subject to change, and may not reflect current views. All information is subject to change without notice. Views should not be considered a recommendation to buy, hold or sell any investment and should not be relied on as research or advice.

This document may include forward-looking statements. All statements other than statements of historical facts are forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results to differ materially from those reflected in such forward-looking statements.

This material is for informational purposes only and is not an offer or solicitation with respect to any securities. Any offer of securities can only be made by written offering materials. The information set forth herein is a summary only and does not set forth all of the risks associated with the investment strategy described herein.

The information was obtained from sources we believe to be reliable, but its accuracy is not guaranteed, and it may be incomplete or condensed.

Unless otherwise stated, all returns are in USD.

Past performance is not a guarantee of future results. An investment involves the risk of loss. The investment return and value of investments will fluctuate. Investing in emerging markets involves a greater risk of loss due to greater political, tax, economic, foreign exchange, liquidity and regulatory risks. Prospective Real Yield and other similar characteristics are not guaranteed and is subject to change.

Mondrian Investment Partners Limited is authorized and regulated by the Financial Conduct Authority (Firm Reference Number: 149507). Mondrian Investment Partners Limited is also registered as an Investment Adviser with the Securities and Exchange Commission (registration does not imply any level of skills or training).

It should not be assumed that investments made in the future will be profitable or will equal the performance of any holdings referenced in this document. Examples of holdings will represent only a small part of the overall portfolio and are used to illustrate our investment approach. Any holdings are subject to change and may not feature in any future portfolio.

Preceding 5 Calendar Year Returns