The past decade has been a challenging period for value investors: record low interest rates and structural changes in the economy have caused investors to shun value stocks in favor of growth stocks. COVID-19 widened the performance gap further as investors apply the best case and a low discount rate for one subset of growth stocks and the worst case for another. This caused a substantial valuation gap between value and growth stocks and significant concentration in the US market, where six stocks make up over 20% of the MSCI USA index.

While growth is a desirable feature of stocks, future returns will depend as much on that growth as on the price that investors have to pay to get exposure to it. While it is difficult to envisage bond yields rising in the current environment, the deflationary skew in yields and the lofty expectations in growth names make markets very vulnerable to any increase in inflation or other unforeseen events. The world is changing rapidly and the current uncertain environment and the presence of tail risks present significant opportunities for a defensive value manager like Mondrian. The typically defensive characteristics of Mondrian portfolios arise from the combination of the focus on dividends and the structured and detailed scenario analysis helping us to avoid some of the riskiest, volatile investments. We believe that the skew is in our favor to produce strong risk-adjusted relative returns over the long-term.

Extreme Divergence between Value and Growth

Investors are well aware that since the financial crisis, growth investments in equity markets have significantly outperformed value. We believe that this can be understood in a Discounted Cash Flow (DCF) or Dividend Discount Model (DDM) framework as exceptionally loose monetary policy is suppressing investors’ discount rates. As discount rates are dragged lower, investors are much more willing to trade off cash flows today against cash flows far into the future. At the same time, technology and other forces have caused significant structural changes in our economy and in certain cases, disrupted businesses. These companies are, in most cases, in the value sub-index: in retail, the rise of e-commerce penetration has caused severe damage to bricks and mortar; in autos and energy, ESG concerns and the potential growth in electric vehicle penetration has resulted in significant disruption for traditional automakers and raised the likelihood of a reduction in oil demand over the long-term. The confluence of these factors has caused a significant divergence between value and growth returns over the past decade, a bifurcation that in most cases, is far greater than fundamentals would warrant.

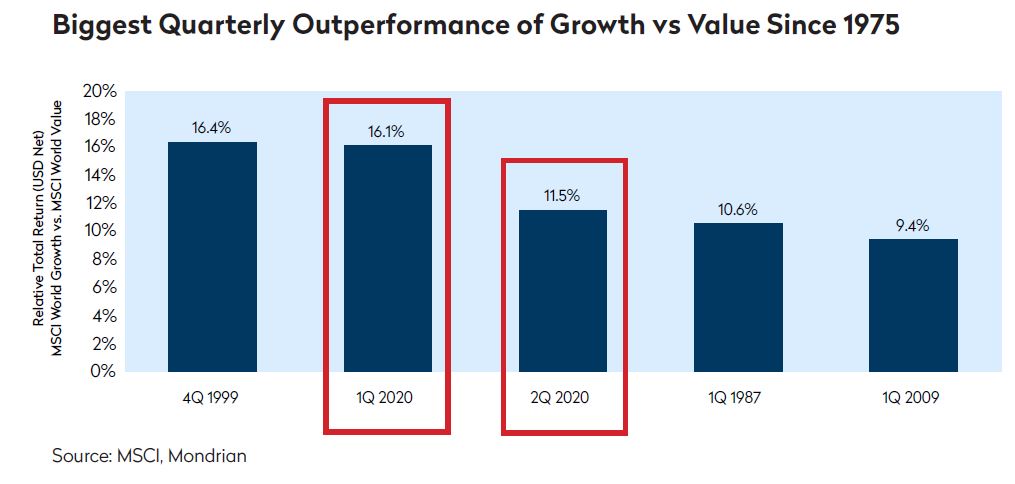

After years of quantitative easing, the Federal Reserve started to raise interest rates in 2018 and value outperformed strongly in the 4th quarter of that year. The market took a dramatic turn in 2020 as COVID-19 caused central banks once again to intervene in the market, this time by cutting interest rates aggressively. With one exception (4Q 1999), Q1 and Q2 2020 witnessed the most significant divergence in returns between value and growth since the inception of the MSCI sub-indices in 1975. The compounding impact of returns helped growth to outperform value by an astounding 29.5% in the first half of 2020. It is worth noting that post the strength of growth over value at the end of the 90s, value subsequently significantly outperformed until the global financial crisis.

Japan in the 90s

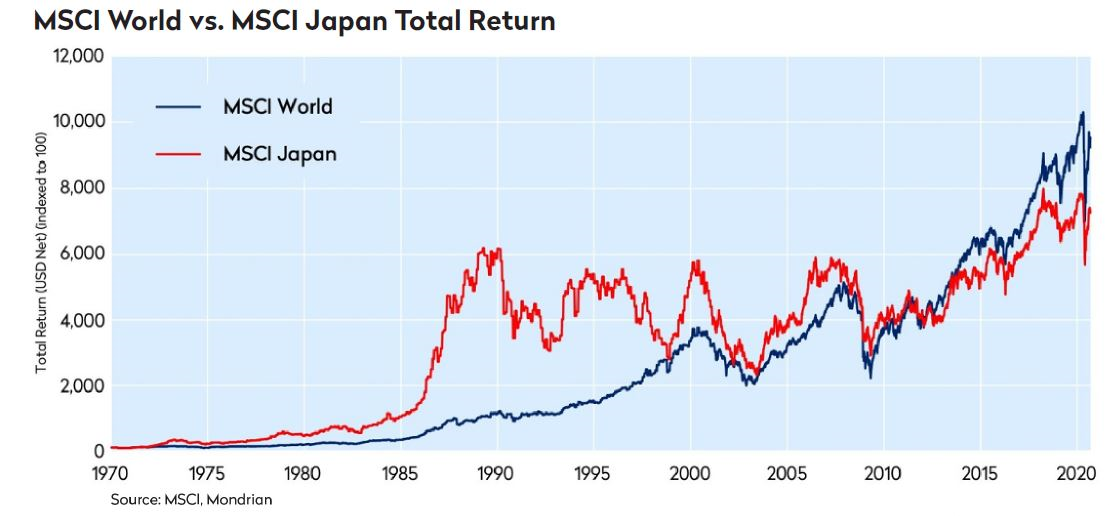

In Japan circa 1990 (before the collapse of the bubble), many investors argued that with interest rates at consistently low levels compared to other developed markets, and inflation apparently dormant, the high growth in the Japanese economy (sounds like an oxymoron today) supported stratospheric valuations. Japan was taking an increasing lead in sectors such as autos, semiconductor manufacturing and consumer electronics, all industries of the future and areas that the US had previously dominated. With Japan set to overtake the US as the world’s largest economy, it was argued investors felt justified in using lower discount rates for Japanese assets compared to other markets.

The problem, as we saw it, was that while an investor might be able to justify Japan’s valuation intellectually, given high future growth and low discount rates, to be right, the growth had to be achieved going well out into the future and, even if it did extend that far, the return (IRR equal to the discount rate to achieve fair value) would have been mediocre in comparison with long-term historic global equity returns. With hindsight, arguments supporting the Japanese market’s historic valuation sound ludicrous today, but they were widely held at the time. As the chart above illustrates, the total return of the Japanese market has only, in the last few years, exceeded the return at the peak in 1989. Investors who bought the Japanese market at the end of the 1980s have earned nothing for thirty years. The heady growth forecasts built into valuation models never materialized.

Is Value Defensive?

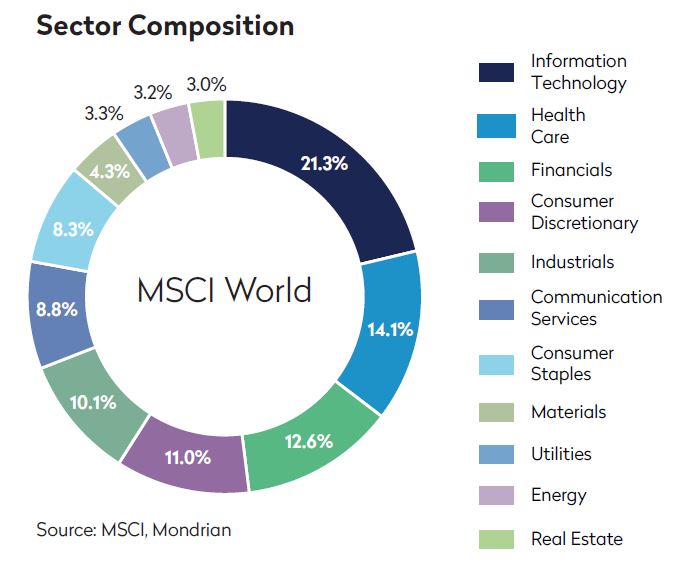

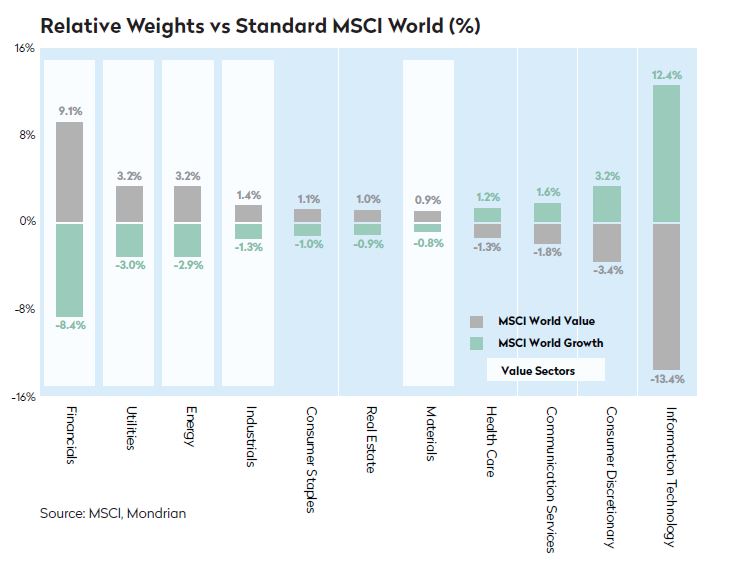

The MSCI World Value Index is currently over-indexed on the more cyclical sectors such as Financials and Energy and underweight the Technology and Healthcare sectors. It is therefore unsurprising that it has performed poorly this year given the nature of this most recent crisis. Given the composition of the value sub-index, it is clear why investors are questioning the defensiveness of value strategies.

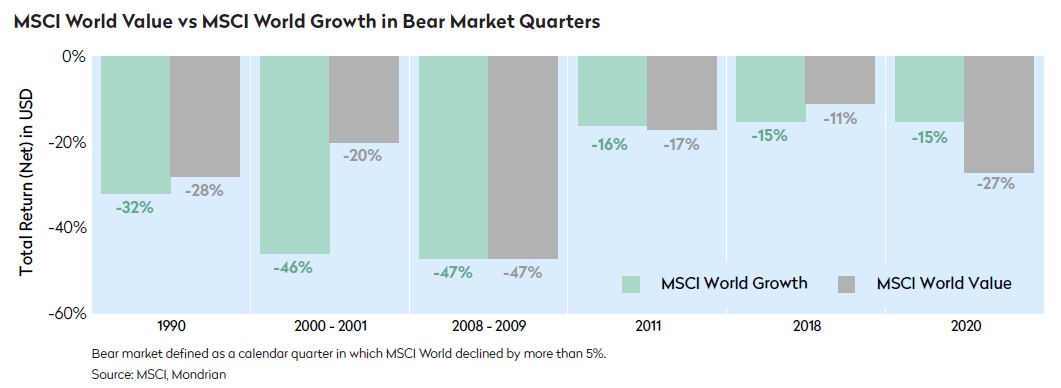

Based on our observations of the MSCI World index below, value as an investment style has historically been most defensive in weak market environments, where valuations are over-stretched. In the early 2000’s, despite real interest rates declining, value outperformed growth significantly.

We came into the COVID-19 crisis with growth already outperforming value by a significant margin over a considerable period of time. COVID-19 widened the performance gap further. While COVID-19 has reinforced certain technology trends, not all technology models are created equally or have the same earnings power. We believe that a significant number of specific growth names, particularly in the US market, are now trading at exceptionally high valuations.

Value and Growth Bifurcation Looking Increasingly Stretched

Looking forward, we don’t dispute that we would most likely expect faster growth from stocks in the growth sub index (and we do have higher growth rates in our models for these companies) but the problem is the price that we have to pay to access that growth. “Is there an alternative to Amazon, which is trading at an eye-watering 100x PE?” or “What about the Nissan electric car?” At Mondrian, we debate these issues every day as we build our valuation models, and we know that the range of answers to these questions can be very wide. We believe that the market is valuing stocks as if there were much greater certainty than there is, applying the best case and a low discount rate for one subset of stocks and the worst case for another. Clearly, given current multiples, future returns will depend as much on that growth as on the price that investors have to pay to get exposure to it.

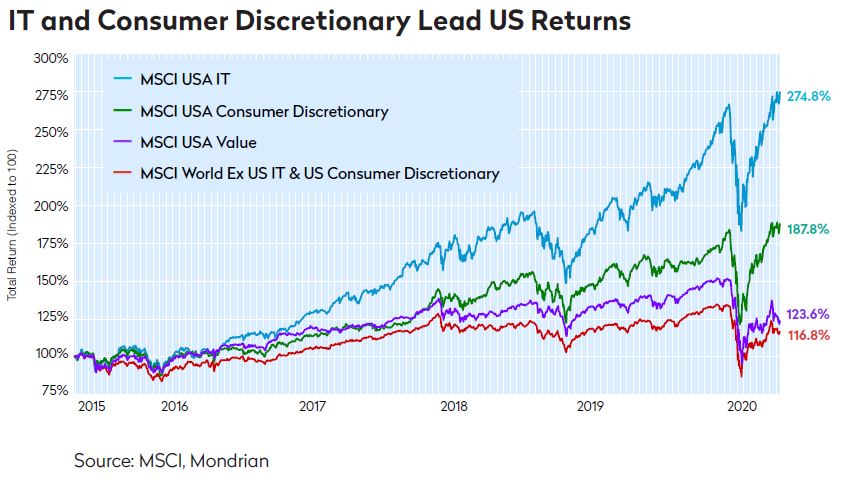

The chart below shows the outperformance of growth over value, led by growth stocks. The US equity market and the broader growth sub-sector have been the greatest beneficiaries of multiple expansion.

While the performance differential between value and growth stocks has been very substantial, the underlying stock earnings trajectory has not reflected a difference of such magnitude. This has opened a substantial valuation gap between the value sub-sector of the market and companies at the growth end as shown by this relatively simple analysis of Earnings Yield for the growth and value indices.

US Growth Leads World Market Returns

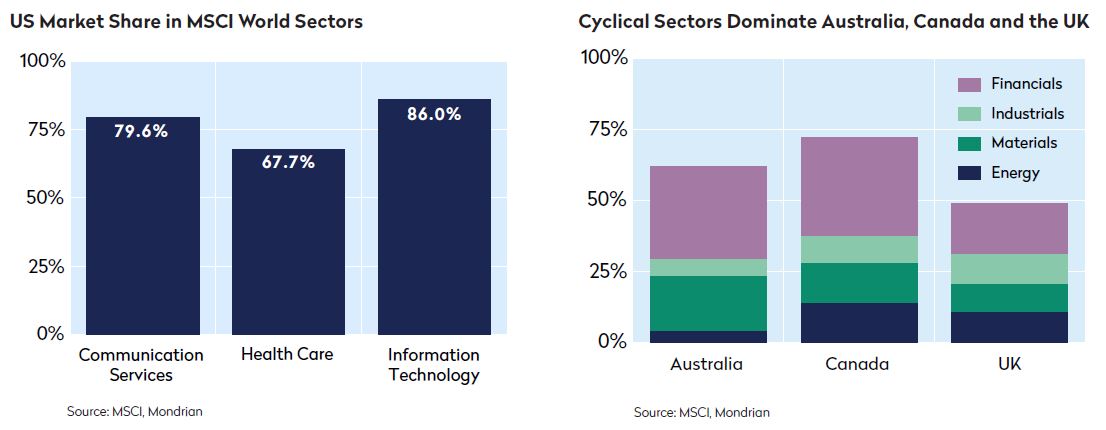

The US market has been on a tear, fueled by relative economic resilience, overweighting to sectors such as Healthcare and IT, as well as USD strength. In addition, US companies in this market are often very dynamic and have a particularly strong focus on shareholder returns. The US is a clear leader in certain sectors, including healthcare, communication services and IT where the US represents more than 85% of the developed world opportunity set. This is in sharp contrast with other markets – such as Australia, Canada and the UK – that are dominated by the traditionally more cyclical energy, materials, industrials and financials sectors.

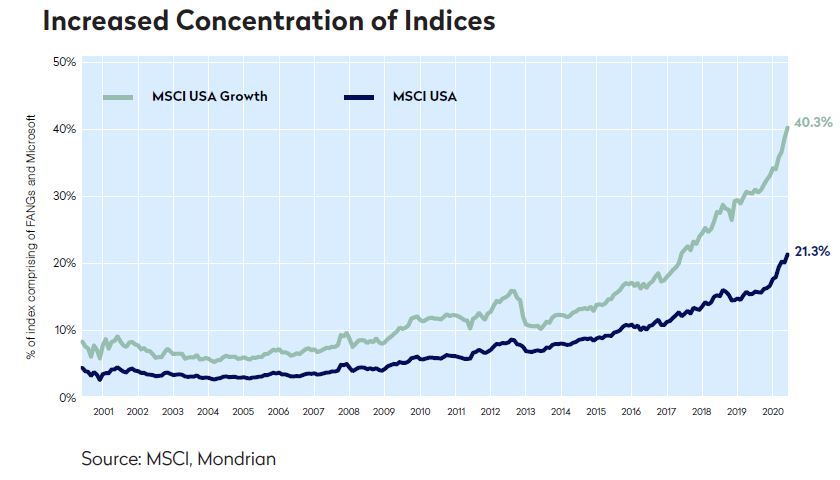

Given the structure of these respective regional indices, it is therefore unsurprising that the US market has outperformed in the past decade. The US market has outperformed significantly over the years, and our fundamental analysis indicates that the US market is currently overvalued on a relative basis. In addition, the US market is increasingly concentrated. The chart below shows the increasing dominance of the famous FANGs, Apple and Microsoft as a percentage of the MSCI USA and MSCI USA growth index.

These six stocks now make up 21% of MSCI USA and 40% of the MSCI USA growth index. The concentration risk of many passive investments may be far too high for most prudent investors. While these companies are beneficiaries of the COVID pandemic and are beating earnings estimates, based on historical observations, it has been precisely the time at which a company can’t lose when the investor in common stocks should be most fearful. In contrast, there are plenty stock picking opportunities in the rest of the US market, which has lagged in this remarkable growth rally. The US market is flat over five years excluding the IT and consumer discretionary sectors. As 2020 progresses, headlines around the US presidential election and potentially dramatic changes in US economic policy and regulation will likely prompt bouts of volatility that may cause the US market and the US growth names to underperform. Timing when the US market or the growth IT names might underperform is fraught with uncertainty. However we firmly believe that this represents a significant long-term opportunity for active integrated global equity investing. We therefore, do not believe that investors should completely exclude the US market from their asset allocation decision. Investing in global value equities should provide a good hedge to the US market continuing to outperform and at the same time access to many of the world’s most successful companies at attractive valuations.

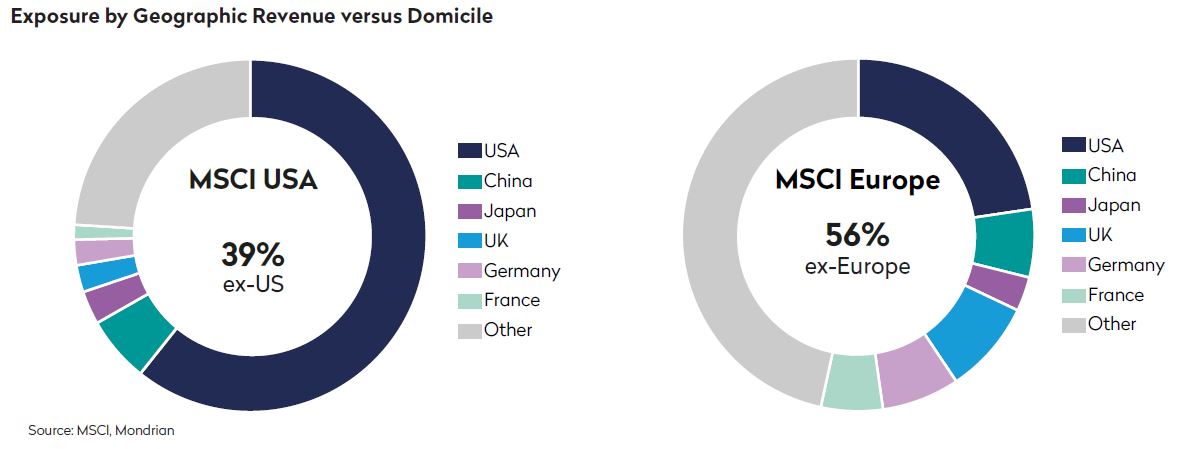

COVID reinforces the importance of Global Equity Investing

As we write, COVID-19 is causing a seismic shock in countries across the world, unsettling risk assets and potentially accelerating the decoupling of global economies. The current pandemic has caused some to question whether globalization itself is in ill health. Populism, simmering tensions between the US and China and the drive for self-sufficiency in certain sectors, regardless of competitive advantage, all point to a retreat from the recent period of international trade and co-operation: we have seen this in the last few months, for example, in countries’ struggles to obtain medical supplies or antivirals to treat coronavirus amid calls to ensure sufficient capacity at home. The progress of protectionism is unlikely to be uniform, however, and any future weakening of economic and market linkages across countries should only increase the benefits to a truly integrated approach to global investing, which allows companies to be assessed and compared at a more granular level.

Integrated global equity mandates give investors access to world-class companies, regardless of where they are domiciled. There are many outstanding multinationals domiciled in different markets: in consumer staples, think of Nestle, Unilever and Procter & Gamble; in autos, Daimler, Honda and Tesla; in healthcare, the likes of Roche, GlaxoSmithKline and Medtronic. There is an opportunity cost of buying a lower conviction idea if one is constrained to certain regions.

Conclusion

The past decade has undoubtedly been very challenging for defensive, value-oriented global investors like Mondrian. Mondrian has a disciplined, value-oriented and defensive investment approach. ‘Value’ to Mondrian is not determined by a simple valuation screen. We have a different definition of Value from the backward-looking and metrics-based MSCI World Value index. Mondrian’s methodology is forward-looking, taking into account today’s dividend yield and future real growth in dividends. Many of the companies in the Value index have higher risk business models, or carry more leverage than their fundamentals truly warrant. They are, therefore, lowly valued and not necessarily undervalued or mispriced. Our disciplined, value-oriented and defensive investment approach and detailed scenario analysis has helped us to avoid the weakest names in the value segment, a clear testament to our success in discerning the relative strengths of different companies, and in finding truly undervalued or mispriced securities.

The market has assumed that the current exceptionally low yields, government support and growth outlook for certain segments of the market will continue in the foreseeable future. It was just two years ago, in December 2018, where we witnessed a sharp reversal in performance between value and growth as the Fed started to raise interest rates. While it is difficult to envisage bond yields rising in the current environment, the deflationary skew in yields and the lofty expectations in growth names make markets very vulnerable to any increase in inflation or other unforeseen events. There are significant mispricing opportunities in markets today and we believe the skew is clearly in favor of defensive value investing. Basic math tells us that all we need is for discount rates to stay flat, or for the expectations for growth names to normalize, for value portfolios to produce strong risk-adjusted relative returns.

Views expressed were current as of the date indicated, are subject to change, and may not reflect current views.

Views should not be considered a recommendation to buy, hold or sell any security and should not be relied on as research or investment advice.

The information was obtained from sources we believe to be reliable, but its accuracy is not guaranteed and it may be incomplete or condensed. All information is subject to change without notice.

This document may include forward-looking statements. All statements other than statements of historical facts are forward- looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results or performance to differ materially from those reflected in such forward-looking statements.

It should not be assumed that investments made in the future will be profitable or will equal the performance of any security referenced in this paper. Mondrian will furnish a list of all investments made in the composite over the periods referenced upon request. Examples of securities bought or sold do not represent a complete list of all transactions. Holdings are subject to change.

This document is an internal research paper. The material is for informational purposes only and is not an offer or solicitation with respect to any securities. Any offer of securities can only be made by written offering materials, which are available solely upon request, on an exclusively private basis and only to qualified financially sophisticated investors.

Past performance is not a guarantee of future results. An investment involves the risk of loss. The investment return and value of investments will fluctuate. There can be no assurance that the investment objectives of the strategy will be achieved.

This document is solely owned by and the intellectual property of Mondrian Investment Partners Limited. It may not be reproduced either in whole, or in part, without the written permission of Mondrian Investment Partners Limited.