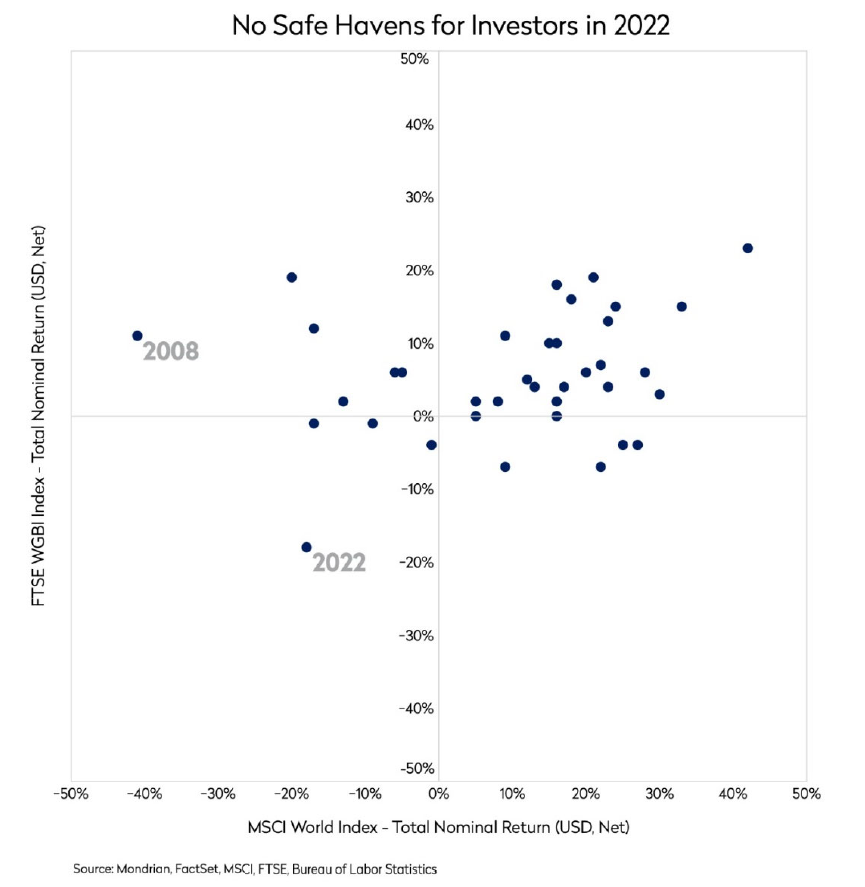

Established assumptions and models questioned as investors struggled in 2022 to find safe havens in public markets

After a challenging few years, Russia’s invasion of Ukraine in February made it clear that 2022 would not mark a return to the low interest rate and low volatility, post-GFC paradigm. Inflation and interest rates were on the rise and large blow-ups such as Credit Suisse, Tesla, FTX and the broader crypto-sphere dominated headlines. Against that backdrop, there was no place to hide in public investment markets. The scale of global market weakness in 2022 and the highly unusual correlation between bonds and equities is illustrated on the graph below.

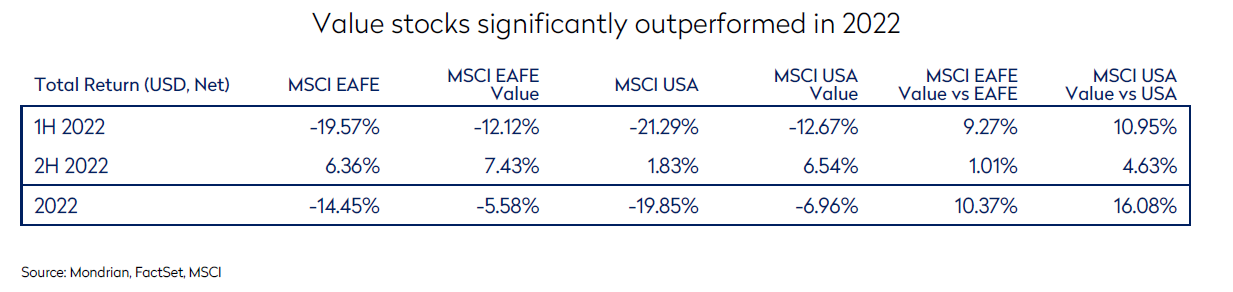

With the familiar framework breaking down, the publicly traded asset markets that held up the best, at least on a relative basis, were not the obvious suspects that have driven markets over the past ten years. Globally, “value” securities outperformed their “growth” peers. International markets, despite currency weakness, significantly outperformed the US equity market. And within international markets, the UK, despite its self-inflicted prime ministerial/budgetary crisis in September, fell less than 5% due to the heavy weighting in energy and mining companies. In contrast, traditional safe havens Switzerland and Germany lagged their international developed market peers. This is not surprising given their reliance on raw materials as inputs to their industrial focused economies, and their geographical proximity to Ukraine. More surprising perhaps, they both performed similarly or better than the broader US equity markets and particularly the tech-heavy NASDAQ.

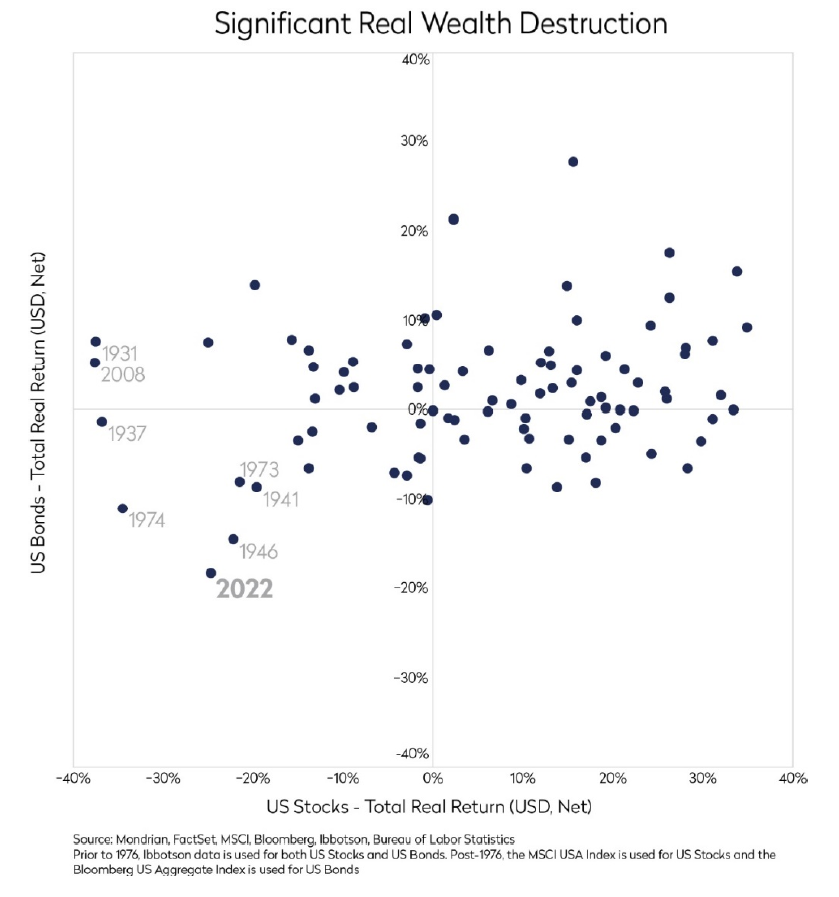

In real terms, publicly traded markets also experienced extreme historical battering

We also looked at the distribution charts in real terms to understand whether 2022 still looked extreme when compared with real returns in previous calendar periods and particularly in other periods of high inflation. We have focused on the US market which has a longer, deeper and higher quality data history. While the capturing of inflation means the number of data points where real returns for equities, fixed income or both were negative has increased, 2022 is still a striking outlier both because of the negative return correlation of equity and fixed income returns but also due to the magnitude of the negative real returns for both asset classes.

Economic and political outlook challenging and uncertain in 2023

In 2022, outside Asia interest rates rose sharply across developed economies, with the absolute levels of US dollar interest rates increasing by the fastest pace since the early 1980s. The rhetoric from global central bank leaders has continued to be hawkish going into the new year. Given the challenge they are facing with inflation, it is our expectation that their statements will continue to take a strong and hard line, until they don’t – making forecasts of the precise trajectory of interest rates challenging. Mondrian’s Fixed Income and Currency team do not forecast the levels of interest rates. We focus on the underlying real valuation of bond markets. Our proprietary econometric inflation models focus on inflation forecasts, and we use these forecasts to estimate the current Prospective Real Yields (PRY) across bond markets (nominal yield minus expected inflation over the next two years). Given the very sharp rises in interest rates in 2022, our estimates of expected PRYs have risen significantly. Our models indicate that in many markets, PRYs are moving towards longer- term normalized levels on the assumption that inflation should begin to stabilize. However, in the near-term, the outlook for broad inflation, driven primarily by energy costs and geopolitical events, remains challenging to model, and the range of outcomes for inflation is wider than normal and likely impacted by uncertain political as well as economic events. The peak and timing of interest rate policy remains uncertain.

Despite the recent optimism of the market, a recession looks likely in the US and across most other developed economies: central banks have raised rates sharply, the energy crisis and energy insecurity continue to weigh heavily on certain regions (notwithstanding the recent much-appreciated warmer weather in the northern hemisphere), and real wages are contracting sharply in many important countries. While there are some countervailing forces which could potentially moderate the severity of the downturn – tight labor markets, generally sound household and corporate balance sheets, possibly China’s re-opening – it is clear that 2023 will be a challenging year for economies.

If we needed a further reminder that 21st century market orthodoxy was breaking down, towards the end of December, the Bank of Japan (BoJ) raised the upper limit of its yield curve control (YCC) policy on the 10-year Japanese Government Bond (JGB) from 25bps to 50bps. Although the move was not wholly unexpected, we, and the market, were surprised by its timing given Governor Kuroda’s term as head of the BoJ ends in April 2023. During our recent research trip to Japan last month, our Japan specialists met with the Head of the Monetary Affairs Division at the Bank of Japan who indicated that they were seeing some structural changes in the price setting behavior which they had not seen in decades (possible signs of nascent inflationary pressures). In the near-term, the widening of the YCC band will likely support yen appreciation against the US dollar given our internal PPP analysis suggests the yen is at levels of extreme undervaluation. In the longer-term this could herald a significant and disruptive change for the Japanese economy and market, creating challenges for many widely used analytical frameworks. Given the portfolio’s exposure to Japan, we are following this issue closely, having added to domestic exposure which should benefit from yen appreciation.

Following on from two long years of COVID, the developments in 2022 – war in Europe, COVID chaos in China, inflation, sharply higher interest rates, significant public asset price weakness, and likely recession – represent multiple paradigm shifts from the post-GFC macroeconomic entente. The challenge for markets in 2023 is that both investors and policymakers may not be equipped with the analytical frameworks to anticipate the full range of possible outcomes. Hopefully twelve months from now we will be writing about the unexpected, but much appreciated, soft landing in 2023.

A focus on valuation provided cover in 2022 but valuation strategies remain attractive

Valuation-oriented strategies were one asset class in public markets that offered some cover from the worst ravages of 2022. This was particularly true in the US equity market where the value sub-universe significantly outperformed growth over the year as large, high-profile index companies such as Tesla and Amazon fell sharply.

Consistent with our investment approach, the returns from Mondrian’s Global and International portfolios demonstrated defensive characteristics in 2022, benefitting from the market’s renewed appreciation of fundamental valuation and our philosophical focus on the valuation of underlying long-term cash flows from businesses to shareholders.

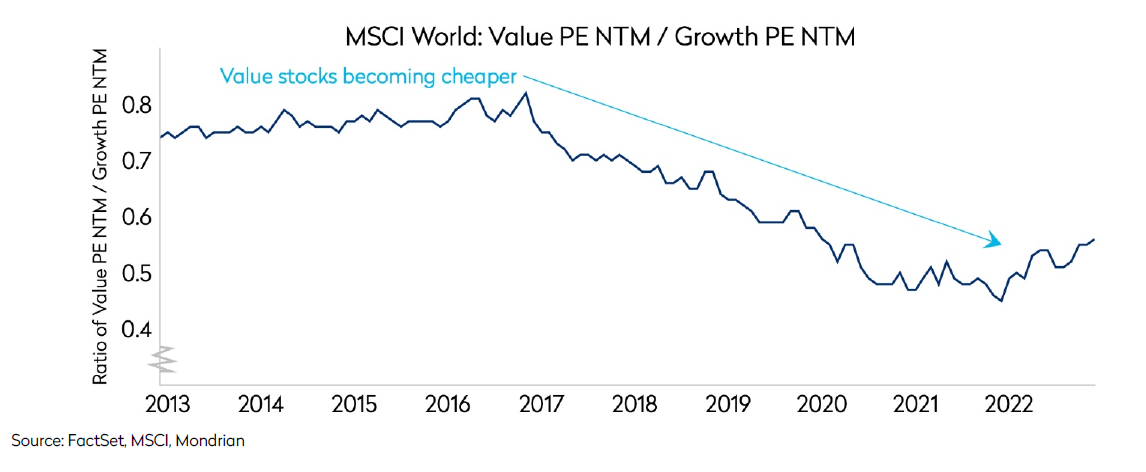

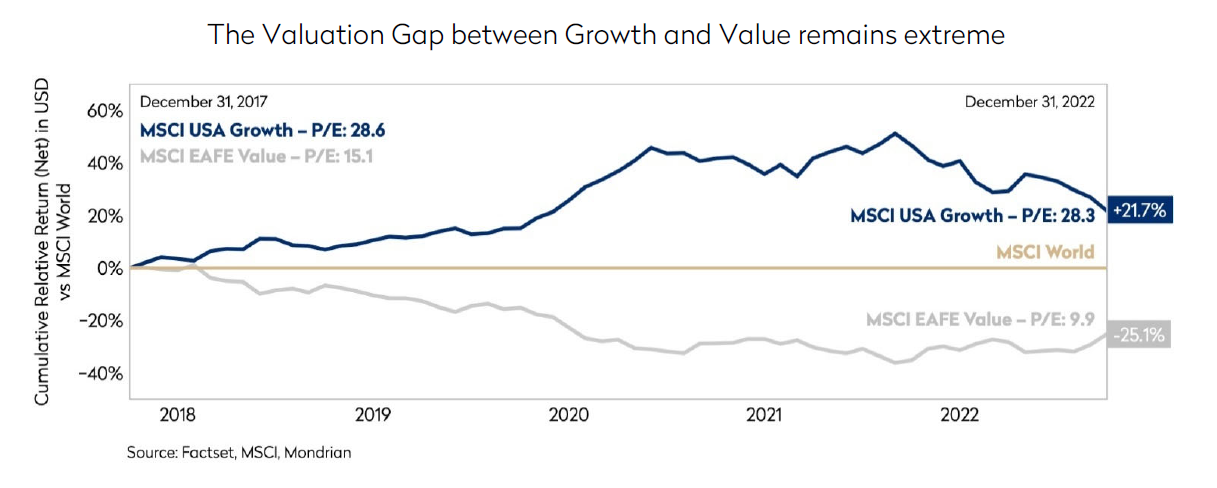

While we appreciated the market’s focus on valuation this year, our analysis indicates that globally, “value” securities have not yet experienced a material re-rating relative to their “growth” peers, particularly in markets outside the US. The chart below shows that over the past ten years, the relative PE of the value sub-sector of MSCI World has declined significantly compared to the P/E the market has paid for growth securities. Despite the recent outperformance of value securities, there remains a significant bifurcation in valuation between the two sub-segments of the market.

“Value” remains attractively valued

Looking forward, one conundrum which we have been wrestling with in recent months is that for a universally forecasted recession, market earnings forecasts appear generally sanguine about the outlook for future corporate profits. We think one element of the explanation is that inflation will likely provide some support to nominal earnings even if earnings fall in real terms. Beyond that, we would caution that our analysis of market forecasts indicates that there is more undue optimism at the growth end of the market and, in contrast, much more realism in forecasts for the more value end of the market.

Publicly traded markets have been hit hard. Investment portfolios are now even more heavily exposed to less liquid and non- market-priced assets. This creates both a risk and an opportunity in public markets. Over the next few months and years, investors are going to need to decide where to focus for liquidity needs. The recovery in equity markets in the past quarter will provide some respite for investors with short-term cash needs, but the very sharp rise of almost 20% in the fourth quarter likely reflects a rebound from highly oversold foreign currency valuations and some inflation adjustment to underlying equity values. Overall, our models suggest that international equity markets, and especially the value sub-universe, remain on very attractive valuations. Looking at the chart below, P/E ratios for the MSCI EAFE Value Index remain below where they were five years ago while those of the MSCI USA Growth Index are unchanged. International securities still look very undervalued on most valuation measures and the growth excesses of the past five years have not really begun to close.

Disclosures

Past performance is not a guarantee of future results. An investment involves the risk of loss. The investment return and value of investments will fluctuate.

For investment professionals only.

Purchasing Power Parity Valuation are calculated using proprietary Mondrian models. Further information on these models can be provided on request. Information and data is correct as at 31 December, 2022. Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent.

Mondrian Investment Partners Limited is authorized and regulated by the Financial Conduct Authority. Registered in England No.2533342. Mondrian Investment Partners Limited is registered as an Investment Adviser with the SEC (registration does not imply any level of skills or training).

Views expressed were current as of the date indicated, are subject to change, and may not reflect current views.

All information is subject to change without notice. Views should not be considered a recommendation to buy, hold or sell any investment and should not be relied on as research or advice.

This document may include forward-looking statements. All statements other than statements of historical facts are forward looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results to differ materially from those reflected in such forward-looking statements.

This material is for informational purposes only and is not an offer or solicitation with respect to any securities. Any offer of securities can only be made by written offering materials, which are available solely upon request, on an exclusively private basis and only to qualified financially sophisticated investors. The information was obtained from sources we believe to be reliable, but its accuracy is not guaranteed and it may be incomplete or condensed. It should not be assumed that investments made in the future will be profitable or will equal the performance of any security referenced in this paper.