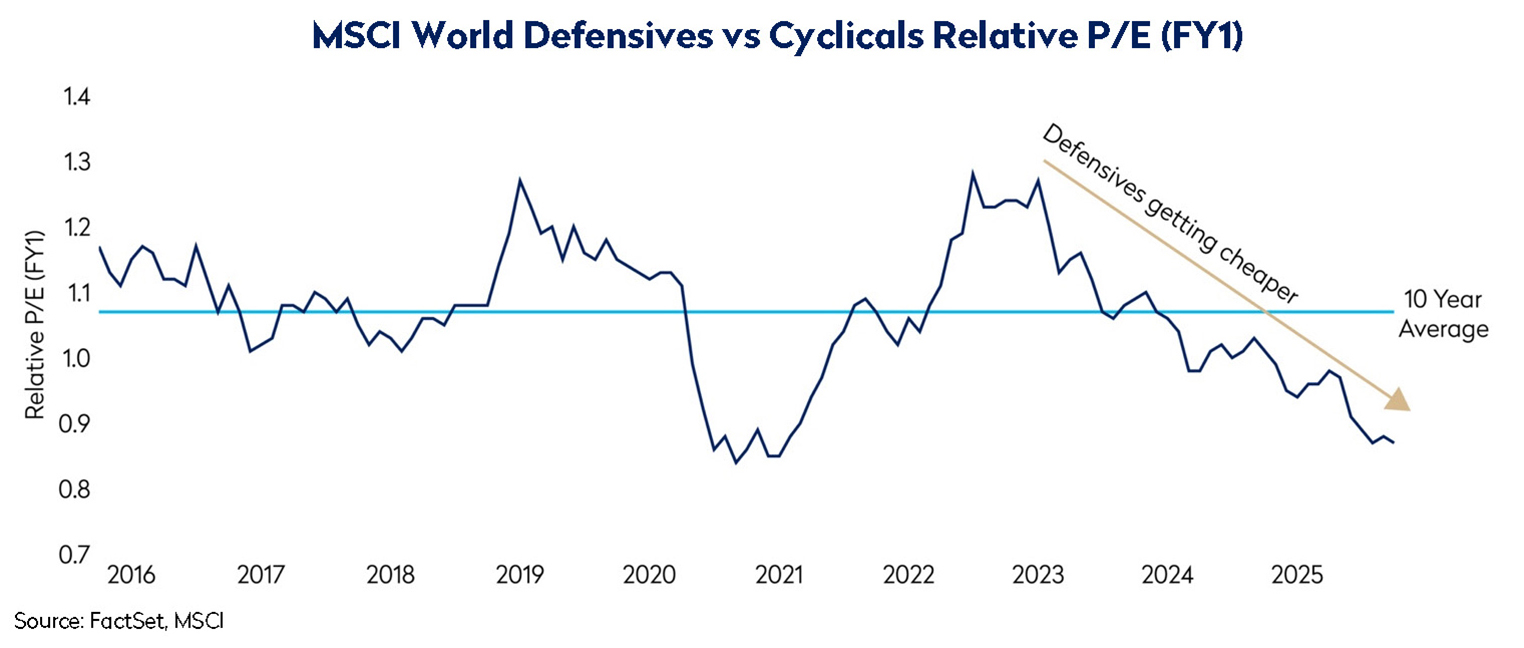

Global equity markets have risen strongly year-to-date, extending a rally that has seen the MSCI World Index reach multiple new highs. The rise has been driven primarily by cyclical sectors such as financials, industrials, and technology, which have benefited from improving economic sentiment, resilient earnings, and optimism surrounding the long-term growth potential of artificial intelligence. Economically sensitive stocks are now pricing in a stronger growth environment but are not always reflecting the ongoing risks to valuations, from geopolitical tensions to rising global debt burdens and the impact of higher long-term bond yields.

In contrast, the valuations of certain classically defensive stocks, which looked full a few years ago, once again look very attractive, while also typically offering more compelling risk profiles. For investors seeking a more balanced risk profile, this divergence presents an interesting opportunity¹.

Utilities: Long Duration Growth with Regulated Stability

Among defensive sectors, the utilities sector has been a notable exception, having outperformed even amid the broader preference for cyclicals. Investors have rewarded domestically oriented “safe havens” with earnings momentum that also offer long-duration growth from structural trends such as electrification, decarbonization and AI-led increases in power demand. Italian utilities such as Snam and Enel illustrate this dynamic.

Snam, Italy’s leading gas utility, operates with a high regulated component that supports visibility of returns and a narrow range of outcomes. Its business model provides a measure of protection against inflation or interest rate shocks through embedded adjustment mechanisms in the Italian regulatory framework. Enel, meanwhile, stands to benefit from long-term investment in electricity infrastructure. As grids evolve to accommodate decentralized and intermittent renewable energy sources, the company’s regulated asset base is expected to expand materially. Despite strong structural tailwinds, valuations for both names remain undemanding, reflecting investor caution over duration risk in the case of Snam and power price volatility for Enel.

Consumer Staples: Valuation Opportunities in an Overlooked Sector

Another area of opportunity lies in the consumer staples sector, which has been among the weakest performers over the past three and five years. The sector’s derating reflects softer consumer demand, disinflation, and the normalization of pandemic-era consumption patterns, all of which have pressured earnings and valuation multiples. However, such weakness has created select opportunities in companies with strong franchises and reliable cash generation.

Pernod Ricard, the second-largest Western spirits company, and PepsiCo, a leading global snack and beverage group, now trade at historically low multiples. Both businesses benefit from resilient brand power, stable end-market demand, and opportunities for premiumization in developed markets and deeper penetration in emerging economies. While recent disinflation and shifting consumer patterns have weighed on near-term performance, a gradual reversion to low-to-mid single-digit organic growth could drive meaningful upside.

Concerns surrounding the impact of weight-loss drugs (GLP-1s) on food and beverage demand remain an overhang, but evidence increasingly suggests the long-term effects may be more moderate than initially feared. For companies such as PepsiCo, the combination of strong balance sheets, diversified portfolios, and a track record of adapting to changing consumer preferences reinforces the case for long-term resilience.

In Asia, value is also emerging within Japanese drugstore retail sectors. Companies such as MatsukiyoCocokara and Sundrug benefit from low prices supported by an efficient cost base, convenient locations close to residential areas, and the high value-added nature of their offerings in pharmaceuticals and cosmetics. While broader Japanese retail growth has been subdued for years, drugstore sales have expanded steadily, gaining market share from traditional retailers and benefiting from the structural growth of the healthcare segment. The low-cost business models of these retailers leave them well positioned to benefit from rising healthcare spending as Japan’s population continues to age.

Conclusion

Overall, with the valuations of global equities elevated, the balance of opportunity may be shifting. Cyclical stocks, particularly in technology and financials, are priced for continued optimism, leaving little margin for error should growth expectations soften. Defensive sectors, by contrast, combine attractive relative valuations with steady fundamentals and, in many cases, structural growth drivers.

In periods when market leadership has been concentrated and valuations have become stretched, history has often favoured a rotation toward quality defensives. The current environment, with global equity markets near record highs and cyclical enthusiasm running strong, may again be setting the stage for that shift.

Disclosures

¹Defensive sectors include communication services, consumer staples, health care, real estate and utilities; cyclical sectors include consumer discretionary, energy, financials, industrials, information technology and materials

Views expressed were current as of the date indicated, are subject to change, and may not reflect current views. All information is subject to change without notice. Views should not be considered a recommendation to buy, hold or sell any investment and should not be relied on as research or advice.

This document may include forward-looking statements. All statements other than statements of historical facts are forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results to differ materially from those reflected in such forward-looking statements.

Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing, or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent.

This material is for informational purposes only and is not an offer or solicitation with respect to any securities. Any offer of securities can only be made by written offering materials. The information set forth herein is a summary only and does not set forth all of the risks associated with the investment strategy described herein.

The information was obtained from sources we believe to be reliable, but its accuracy is not guaranteed, and it may be incomplete or condensed.

It should not be assumed that investments made in the future will be profitable or will equal the performance of any security referenced in this document. Examples of securities will represent only a small part of the overall portfolio and are used to illustrate our investment approach. Any holdings are subject to change and may not feature in any future portfolio. More information on holdings is available on request.

Unless otherwise stated, all returns are in USD.

All references to index returns assume the reinvestment of dividends after the deduction of withholding tax and approximate the minimum possible re-investment, unless the index is specifically described as a “Gross” index

Past performance is not a guarantee of future results. An investment involves the risk of loss. The investment return and value of investments will fluctuate.

Mondrian Investment Partners Limited is authorized and regulated by the Financial Conduct Authority (Firm Reference Number: 149507). Mondrian Investment Partners Limited is also registered as an Investment Adviser with the Securities and Exchange Commission (registration does not imply any level of skills or training).