Executive Summary

- Environmental, social and governance (ESG) considerations are integral to Mondrian’s investment process.

- Mondrian’s value-oriented approach is particularly well-suited to integration of ESG factors.

- ESG considerations have a significant impact on Mondrian’s investment strategy.

- Mondrian is a signatory to both the UN-supported Principles for Responsible Investment (PRI) and the PRI’s ESG in Credit Ratings Statement.

Mondrian’s ESG Methodology

As a value manager, Mondrian Investment Partners has always believed in conducting analysis that captures all potential material risks and opportunities; understanding and integrating the impacts of ESG factors has therefore consistently been part of our investment process. Mondrian became a signatory to the United Nations-supported Principles for Responsible Investment in 2016 and the fixed income sovereign process was awarded an A+ in the most recent (2019) PRI assessment.

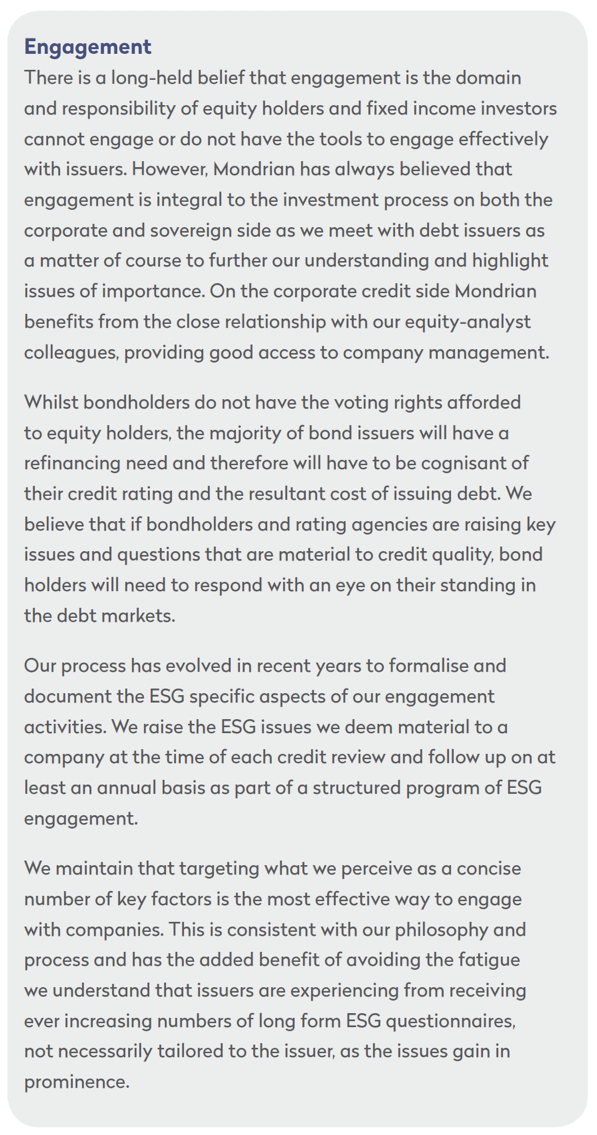

Integrated Approach

Though the term ‘ESG integration’ has only become commonplace in recent years, the incorporation of environmental, social and governance factors as part of broader fundamental investment analysis has been embedded in our approach since the firm’s inception in 1990.

The willingness of value investors to take positions in a broad range of sovereigns, companies and industries – including those that typically score very poorly with regards to certain ESG characteristics – has been taken by some to mean that a value investment philosophy is incompatible with the incorporation of ESG factors.

However, this needn’t be the case. We consider that in an integrated approach, all material factors that could impact an issuers valuation should be rigorously analysed and incorporated as part of an in depth research process.

The result of this integrated approach is that, much like any other risk incorporated into a bond valuation, the presence of ESG based risks need not preclude investment, provided they are adequately reflected in the market price.

Responsibility for ESG Analysis Rests with the Investment Team

As an extension of this integrated approach, ESG analysis is best conducted by those with detailed knowledge of the issuer; therefore Mondrian believes this work is best completed by the investment team rather than a separate ESG only analyst.

In-house ESG Analysis

Whilst Mondrian utilises a number of external research sources to inform ESG analysis, such as World Bank data for sovereign analysis and MSCI for corporate analysis, ultimately ESG analysis is carried out in-house. We caution against relying too heavily on external ESG scoring methodologies, as such methods tend to be designed with equity investing in mind and there is a lack of consistency between scoring methods. In an area that can ultimately be subjective, we believe that the key to an effective ESG analysis is an understanding of the factors material to that issuer in the context of the credit profile as a whole.

Time Horizon

Integration of ESG factors into fixed income investing has the added dynamic of the time horizon of investment, potentially leading bonds of different durations to have different ESG considerations. This is illustrated by the approach that rating agencies are taking to ESG integration, where historically these factors have only been referenced if they have a material impact on the rating within their two year time horizon. However in practice, ESG considerations can impact credit quality over much longer time periods.

Distinction between Sovereign and Corporate ESG Analysis

Mondrian’s approach to integration of ESG in the fixed income investment process is consistent for both sovereigns and corporate credits in the explicit incorporation of ESG factors into an issuer’s credit rating. Indeed we have formalised our commitment by becoming a signatory to the PRI Statement on ESG in Credit Ratings. However, given the nuances in credit rating determination between sovereign and corporate issuers, and the way in which these ratings impact portfolio allocations, the process and resulting examples are detailed separately in the following section.

ESG integration in Sovereign Analysis

Mondrian’s investment approach allocates to those markets that best compensate us for both inflation and sovereign credit risk. Sovereign credit risk is assessed by an objective, unbiased and dispassionate analysis of the fundamentals that underpin the ability and willingness of a sovereign issuer to service its debts in a full and timely manner.

ESG risk factors form a critical and distinct facet of Mondrian’s sovereign credit risk analysis. Our ESG assessments synthesize numerous quantitative measures produced by international research bodies into an overall ESG score for each sovereign. Other things equal, a sovereign with elevated ESG risks will typically receive a lower allocation within Mondrian portfolios. While environmental, social and governance factors at a sovereign level are distinct, they are interrelated and there is feedback between them. All three ESG factors can impair a sovereign’s ability to service its debt but strong governance is the lynchpin. The government ultimately derives its power and legitimacy through a social contract to deliver security and prosperity to its citizens. Sovereigns borrow in order to fulfil their governance obligations to society and government policy in turn shapes both society and the environment in which it operates. International capital markets can be a disciplining force on sovereign issuers making them more accountable to not only domestic stakeholders but the world at large.

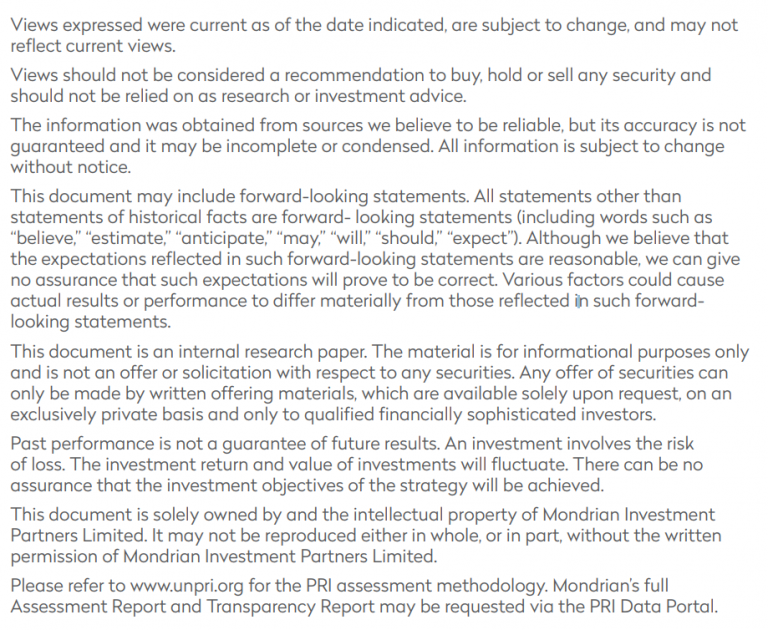

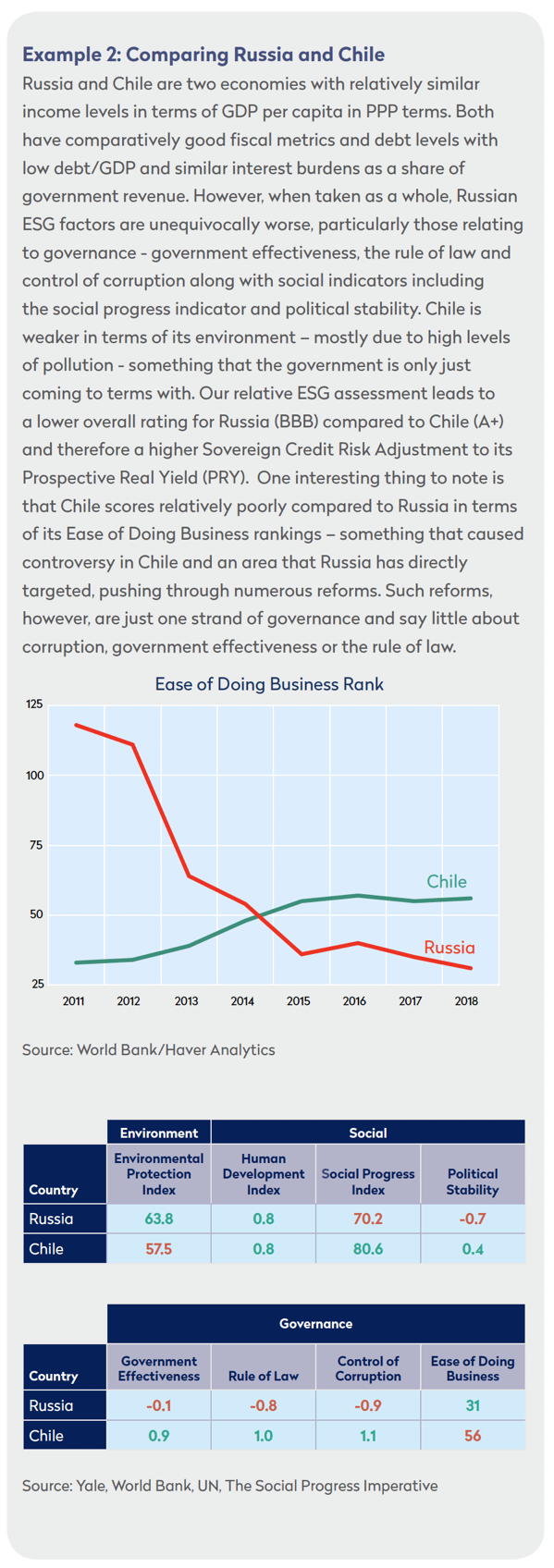

Sovereigns: Environmental Risk Factors

Protection and maintenance of the environment for the wellbeing of future generations is essential for the long run viability of the economic activity that supports the sovereign. In the shorter term, undiversified economies based on commodities, agriculture or tourism are prone to environment-related shocks, such as flooding and storm damage that can place additional burdens on the sovereign balance sheet. In order to assess environmental strengths we compare countries using the Environmental Protection Index compiled by the Yale Center for Environmental Law & Policy. This ranks countries on twenty-four different environmental performance indicators along two dimensions of sustainability – environment health and ecosystem vitality.

Sovereigns: Social Risk Factors

Social stability provides the setting for investment and long-term sustainable growth. Education, the development of human capital, health outcomes and protection from violence all affect the productivity of the workforce. Adverse demographic trends can put strains on public finances. Corruption inhibits the productive allocation of resources, depletes social capital (‘trust’) and exacerbates inequality. Cross country comparisons can be performed in terms of all these factors and we integrate each country’s Human Development Index (United Nations), its Social Progress Index (The Social Progress Imperative), Income inequality Gini Coefficients (World Bank) and Corruption Perceptions (Transparency International) into our measure of social risk.

Sovereigns: Governance Risk Factors

Good institutions—the rule of law, unambiguous property rights, efficient tax collection, the control of corruption and public good provision all aid productivity-driven economic growth and development. The best objective comparisons of governance are the Worldwide Governance Indicators produced by the World Bank which measure six different aspects of governance: Voice and Accountability, Political Stability, Government Effectiveness, Regulatory Quality, the Rule of Law and Control of Corruption. The general enterprise environment and quality of the regulatory environment is measured by the same institution’s “Doing Business” rankings.

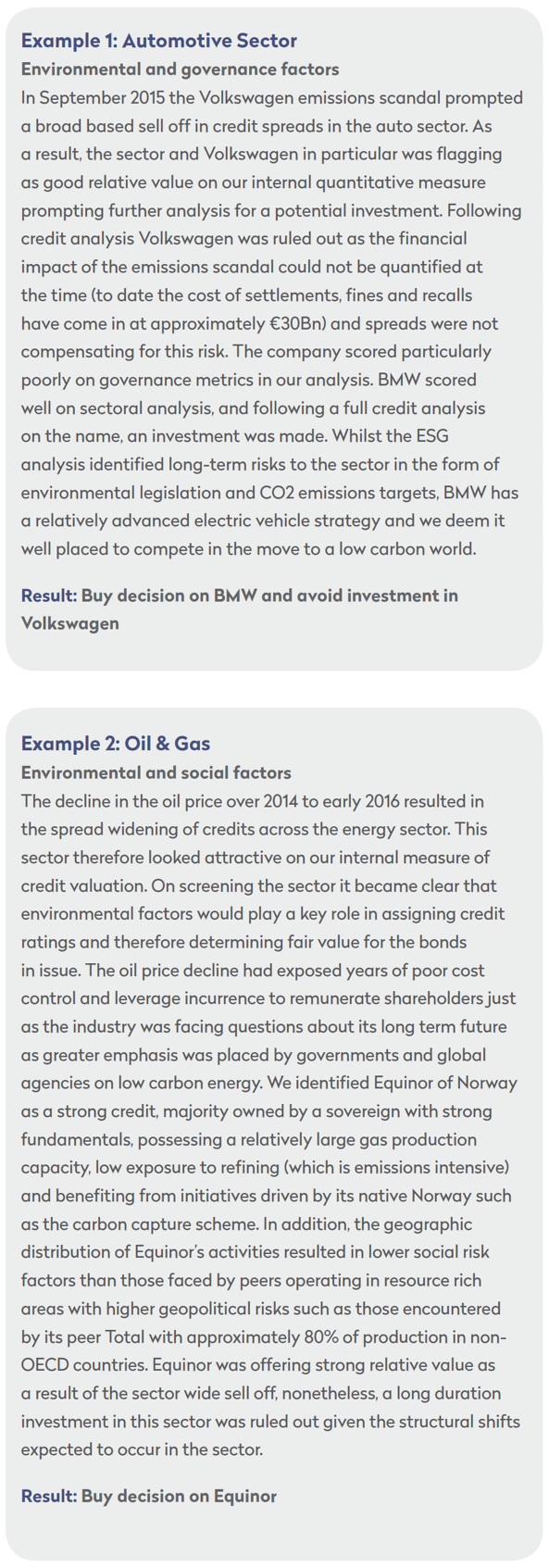

ESG Integration in Corporate Analysis

Mondrian’s credit process necessitates that all corporate bond issuers undergo corporate credit analysis culminating in an internal credit rating before being placed on our buy list.

In determining Mondrian’s corporate credit rating, all material factors that could influence credit quality are analysed as part of our research process. Each factor is assigned a credit rating which contributes to the overall company or issuer level credit rating.

We have long believed that environmental, social and governance concerns must be included in this process, otherwise the analysis overlooks a critical component of credit risk. Therefore an ESG rating is assigned as an integral part of Mondrian’s corporate credit analysis. We assign an ESG rating, based on a scale similar to that of S&P’s (i.e. AAA is ‘well above average’, BBB is ‘average’ and BB and below is ‘well below average’). The weights placed on each component will vary depending on industry and company specific factors.

The ESG rating contributes to our corporate credit rating for each issuer in the same way as all other factors considered in our analysis, which in turn directly impacts how much of that issuer’s debt can be held across our portfolios according to our issuer diversification limits.

Normally, a credit should achieve a satisfactory ESG rating during our internal ESG review before it will be considered to be included on our buy list, as Mondrian believes that these factors could materially impact a business, its credit rating, and in extreme cases, its ability to repay lenders.

The forward looking sensitivity analysis component of Mondrian’s credit research is used to quantify the impact of material credit risks on the credit rating over the investment time horizon. This therefore provides a method to quantify the impact of ESG risks over the short, medium and longer term.

Meeting with company management is an integral part of Mondrian’s due diligence and ongoing monitoring process. This is an ideal forum for direct engagement on areas where Mondrian has identified specific concerns, including those related to ESG factors. The close working relationship with Mondrian’s equity teams is a direct benefit as they meet regularly with company representatives.

Corporates: Environmental Risk Factors

The impact on credit quality from environmental risk factors varies greatly by industry. Environmental factors can present both fundamental business risks, for example that posed by the shift to renewable energy on the oil & gas industry; and reputational risks, for example those faced by Bayer/Monsanto on the impact of pesticides on the environment. In order to assess environmental risks to credit quality we reference MSCI ESG research in addition to information collated through credit analysis from sources such as annual reports, rating agencies, discussions with management and industry research reports.

Corporates: Social Risk Factors

The impact of social risk factors on credit quality again varies by sector. Whilst the perception of social risks tends to be that they are largely reputational in nature and therefore difficult to quantify, in some instances they can be material to the financial profile. For example, the miss- selling of PPI by UK banks has had a material financial impact on the sector with in excess of £30Bn in fines and repayments to date.

Corporates: Governance Risk Factors

An assessment of governance is key to understanding credit quality. The independence of the board, management’s strategy, track record, remuneration and incentive structure are of utmost importance to gauging the future credit strength of a company. From a bondholder’s perspective, an understanding of management’s standpoint and balance on equity holder remuneration versus preservation of balance sheet strength and therefore credit quality is essential.