Although there has been much debate about what this stimulus means for inflation, our forecasts have only risen modestly. Inflation prints will almost inevitably step up during the course of this year as a consequence of a return towards normality and the possibility of pent-up demand meeting supply bottlenecks as COVID related restrictions gradually become relaxed. However, any rise should be limited.

There is still a great deal of spare capacity in the global economy. Unemployment continues to be above long-run averages, keeping a lid on wage growth and the vast build-up of both private and public debt in the face of the pandemic will likely weigh on economic expansion as balance sheets are repaired. In addition to this, the same secular forces that have driven a decline in trend inflation over the past forty years, such as globalization, the weakened bargaining power of labor in deindustrialized, service-dominated economies and technology-driven competition, are still very much in place. So, although we have increased our inflation forecasts, including that of the US, we continue to emphasize that our inflation forecasts remain modest.

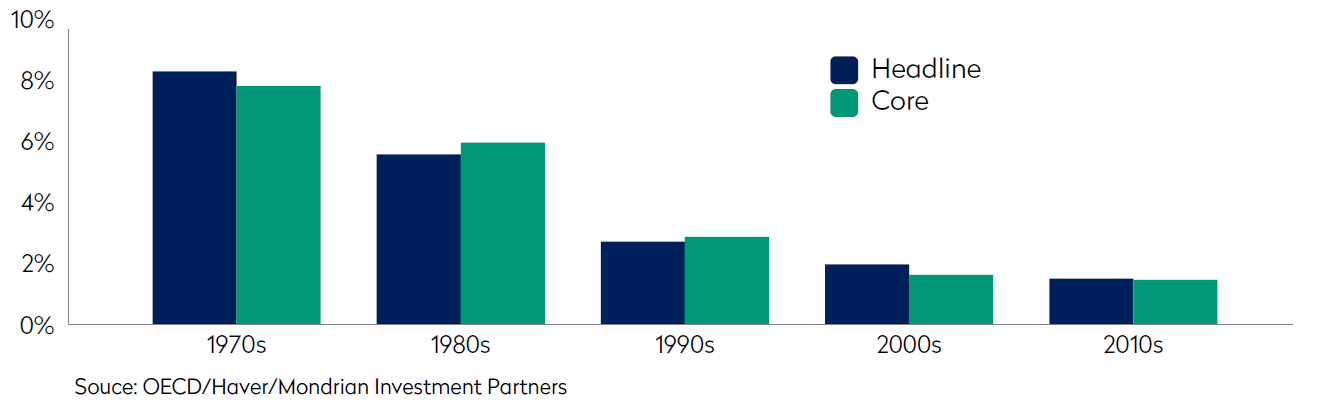

Average G7 Inflation

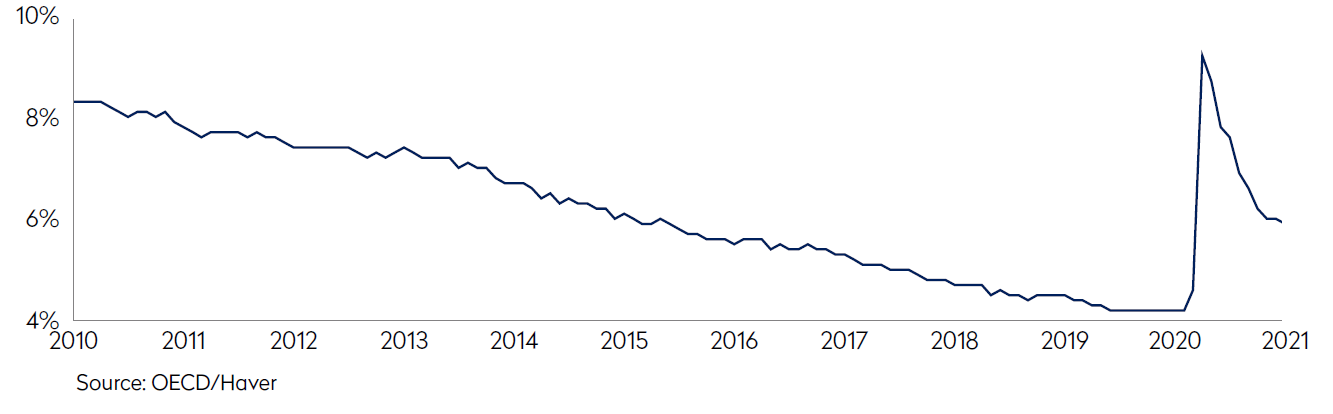

Average G7 Unemployment Rate

- Large policy stimulus (particularly in the US) means inflation risk has become a talking point. However, the risk of sustained acceleration in inflation is low in our view

- According to our forecasts, inflation will rise modestly this year as the economy recovers, perhaps exacerbated by temporary supply dislocations

- Structural changes in advanced economies over the last 40 years have led to a secular decline in inflation (chart 1)

- These factors continue to be relevant: globalization, deindustrialization, deunionization and reduced labor bargaining power, deregulation and technology

- Cyclical factors also likely to weigh on inflation, such as unemployment, which is above recent non-inflationary lows (chart 2)

Views expressed were current as of the date indicated, are subject to change, and may not reflect current views. All information is subject to change without notice. Views should not be considered a recommendation to buy, hold or sell any investment and should not be relied on as research or advice.

This document may include forward-looking statements. All statements other than statements of historical facts are forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results to differ materially from those reflected in such forward-looking statements.

This material is for informational purposes only and is not an offer or solicitation with respect to any securities. Any offer of securities can only be made by written offering materials, which are available solely upon request, on an exclusively private basis and only to qualified financially sophisticated investors.

The information was obtained from sources we believe to be reliable, but its accuracy is not guaranteed and it may be incomplete or condensed. It should not be assumed that investments made in the future will be profitable or will equal the performance of any security referenced in this paper. Past performance is not a guarantee of future results. An investment involves the risk of loss. The investment return and value of investments will fluctuate.