Managed appropriately, high quality global developed market fixed income offers investors enhanced yield, downside protection and diversification beyond their home market. Currency risk can either be mitigated via hedging or productively managed in order to provide an additional source of potential return. As we shall explain, the case for the asset class is particularly compelling for European investors, both at a strategic and at a tactical level. Moreover, global fixed income is an asset class in which prudent active management provides ample scope for additional return above that offered by a simple passive approach without taking undue risk. In order to stretch returns, many asset managers are quick to establish a structural overweight to higher yielding and sometimes relatively illiquid corporate or emerging market issuers. Whilst there is certainly a place for investment in such assets, it can often negate the traditional role of fixed income, which is to provide a cushion against the downside of risky assets. High quality fixed income should be there when you need it most.

The Case for Global Bonds

The strategic case for global fixed income rests on diversification. With the global bond asset class encompassing a wide range of countries, it provides opportunities for diversification versus domestic bond portfolios, and the characteristics of global bonds also provide excellent diversification against riskier asset classes such as equities and high yield credit.

In the short-term, global bonds have outperformed during periods of market turmoil. As a result, they can help stabilize portfolios during times of crises. By their very nature, market crises are unpredictable and will always occur. Global bonds therefore should act like an insurance policy – helping to cushion against losses in riskier asset classes such as equities.

Over the long-term high quality global bonds have tended to be countercyclical, so offer excellent long-term diversification benefits to domestic portfolios. As the table below shows, global bonds are more negatively correlated to equity markets than their respective home bond markets. Indeed, in the case of Italy and Spain, domestic bond markets have been positively correlated to their equity markets. Global bonds can therefore reduce the volatility of domestic portfolios.

Bond and Equity Market Correlations

The strategic case for high quality global fixed income is clear. But what of the tactical case? In other words, what do current valuations suggest about global fixed income and why should an investor be particularly interested in global fixed income right now? After all, bond yields are near their all-time lows and indeed even negative in many European countries.

As we write, the world is in the grip of a global pandemic, an economic shock of unprecedented scope and magnitude. The initial response was a flight to safety. Risky assets – whose valuations depend upon uncertain future cash flows – severely suffered. Equities, corporate bonds and real estate all sold off sharply. We are now living in a world of ineffable and unquantifiable uncertainty. In such an environment, inflationary pressures are likely to remain weak and bouts of risk aversion frequent – these alone are good reasons to hold high quality bonds.

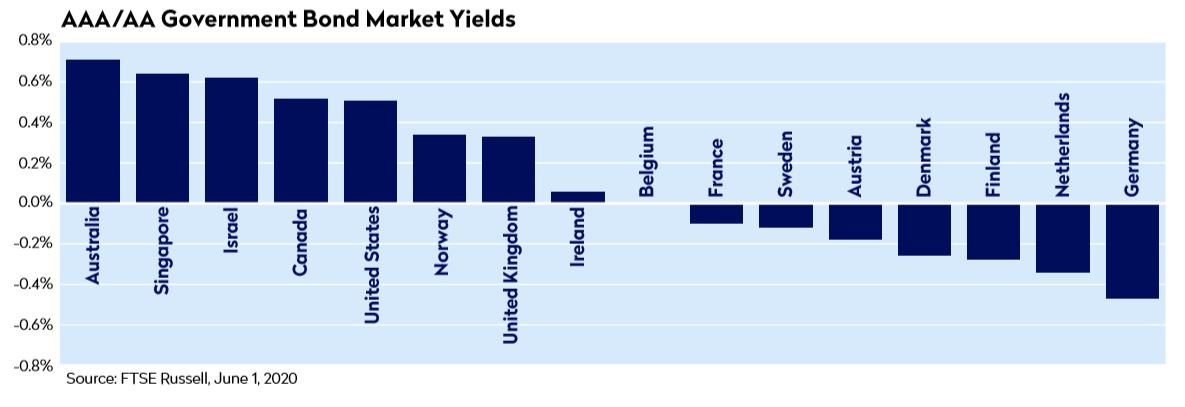

However, many investors remain biased to their home bond markets and in Europe these are yielding less, both in nominal and real terms, than many bond markets of equivalent quality elsewhere. For instance, German savers are currently being offered a negative yield from the German government bond market. By casting their net more widely, they can pick up additional yield without foregoing quality. For instance, the government bonds of Australia, a AAA-rated country, yield more than 1% more per year than those of Germany on average. Of course, there is no such thing as a free lunch and, admittedly, the investor is subject to currency risk when investing internationally but this can be managed and even turned to one’s advantage. The independent manipulation of currency exposure according to fundamental value unlocks another potential source of return. Rather than be biased to any particular market that can be subject to its own idiosyncratic shocks, we believe it makes more sense to hold a diversified basket of high-quality instruments.

It is instructive to note that bond yields for governments of equivalent quality, although low by historic standards, vary widely by country.

The Mondrian approach to global fixed income management is to provide investors with a diversified portfolio of global bonds that overweights those markets that deliver the highest risk-adjusted Prospective Real Yields. In other words, those markets which have a nominal yield that best compensates investors for both inflation and sovereign credit risk. To that end, we forecast inflation across all the markets we look at, as well as conducting a thorough sovereign risk assessment.

Mondrian’s proprietary sovereign credit risk assessment follows a disciplined process, incorporating a range of factors including environmental, social and governance (ESG). Although we look at similar factors to the external rating agencies, the nature of our approach allows us to be nimble, identifying a change in sovereign credit risk as it is occurring. This has enabled us to add value, particularly in lower rated markets such as the Eurozone periphery in recent years.

Currency is another key strand of the process, we consider FX valuations using our own real exchange rate approach and modify currency exposures accordingly by hedging exposure to those currencies we deem to be expensive and increasing exposure to those that we deem cheap.

We also have the ability to overweight corporate credit and Emerging Markets Debt to pick up additional yield, but only use these opportunistically when being adequately compensated to do so. Our disciplined approach to credit avoids running a structural overweight, instead we are guided by our quantitative measure of value as to when to allocate. As a result we came into this period of extremely volatile markets with no credit on our government benchmarked funds, moving to an overweight only at the end of March.

Mondrian has used this approach to global fixed income for almost thirty years to provide investors with consistent long-term outperformance that does not sacrifice the clear portfolio protection characteristics that we believe a high-quality fixed income mandate should provide.

Views expressed were current as of the date indicated, are subject to change, and may not reflect current views. Views should not be considered a recommendation to buy, hold or sell any security and should not be relied on as research or investment advice. The information was obtained from sources we believe to be reliable, but its accuracy is not guaranteed and it may be incomplete or condensed. All information is subject to change without notice. This document may include forward-looking statements. All statements other than statements of historical facts are forward- looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results or performance to differ materially from those reflected in such forward-looking statements. This document is an internal research paper. The material is for informational purposes only and is not an offer or solicitation with respect to any securities. Any offer of securities can only be made by written offering materials, which are available solely upon request, on an exclusively private basis and only to qualified financially sophisticated investors. Past performance is not a guarantee of future results. An investment involves the risk of loss. The investment return and value of investments will fluctuate. There can be no assurance that the investment objectives of the strategy will be achieved. This document is solely owned by and the intellectual property of Mondrian Investment Partners Limited. It may not be reproduced either in whole, or in part, without the written permission of Mondrian Investment Partners Limited.

Mondrian Investment Partners Limited | Fifth Floor, 10 Gresham Street, London EC2V 7JD, UK | London +44 207 477 7000 | Philadelphia +1 215 825 4500 | www.mondrian.com Registered office as above. Registered number 2533342 England. For your security and for training purposes, telephone conversations may be recorded. Mondrian Investment Partners Limited is authorised and regulated by the Financial Conduct Authority. Mondrian Investment Partners is a trademark of Mondrian Investment Partners Limited.