Strong Equity Market Returns Challenge Valuations, but Selective Opportunities Remain in Markets

Equity markets have rebounded sharply in the last year, with the MSCI World index now 32% — above where it was pre- COVID. Post the Global Financial Crisis (GFC), world equity markets have now achieved a return of almost 10% per annum led mostly by the US market.

Global economic growth and corporate earnings should continue to be strong over the next twelve months as we gradually emerge from the lockdowns enacted to control COVID-19. While the trajectory of the recovery from the pandemic is likely to be bumpy, and the pace among countries uneven, the vaccine rollout supported by fiscal stimulus, pent up savings and ultra-loose monetary policy are likely to be supportive for economic growth, even if the virus re-emerges or central banks are forced to become less accommodative. However, the speed and scale of monetary and fiscal stimulus have led to current asset prices on an aggregate level more than reflecting this positive backdrop.

With the outlook for the post-pandemic pick up hopeful but still uncertain, and valuations stretched, it is natural to be wary about current market levels and future returns – raising the question of comparative investing opportunities in different markets, and the importance of diversification.

Sector Composition Supported by Structural Factors has Driven US Market Returns, but this is Increasingly Reflected in Market Valuations

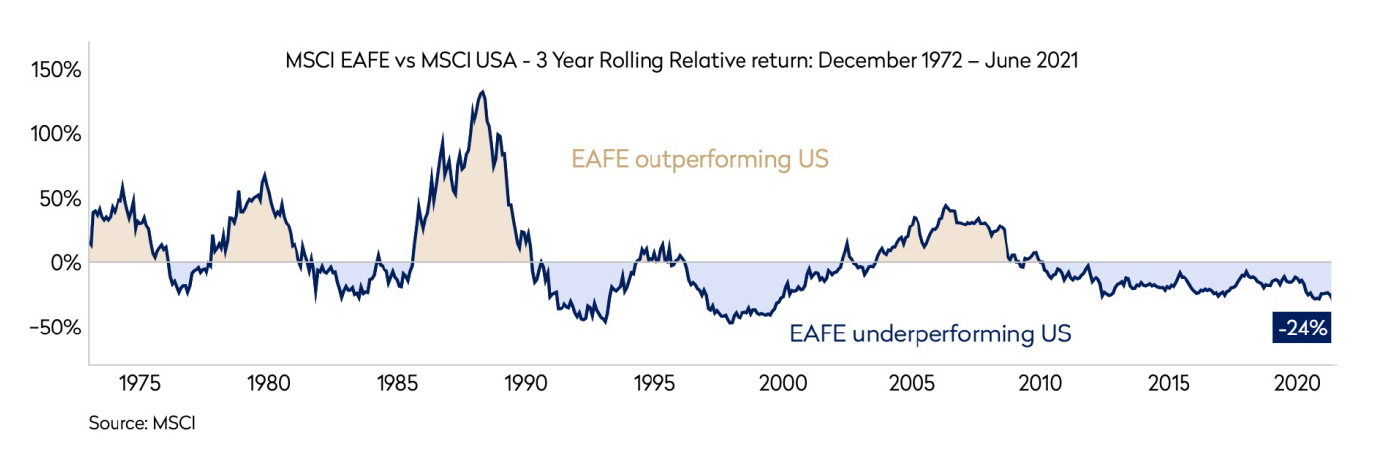

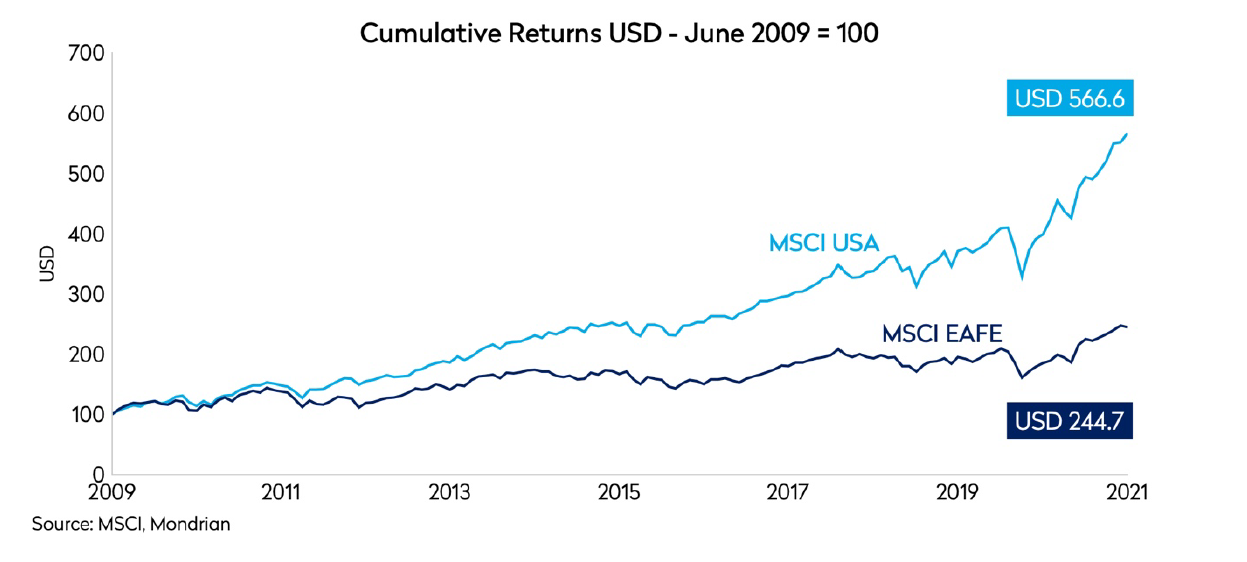

Historically, it is not unusual for returns from either the US market or international markets to dominate for a number of years and rotate due to relative valuations/growth and competitive cycles. Having meaningfully lagged in the period 2000-2010 – a so-called “lost decade” – the US equity market has been on a tear over the past ten years, supported by unprecedented central bank support and the recovery of the tech industry. As the chart below shows, international markets, as defined by the MSCI EAFE benchmark, have lagged the US market since the GFC. This period has been marked by the Eurozone Crisis (2011), Brexit uncertainty (2016-2020), political disruption in Hong Kong and a major earthquake in Japan.

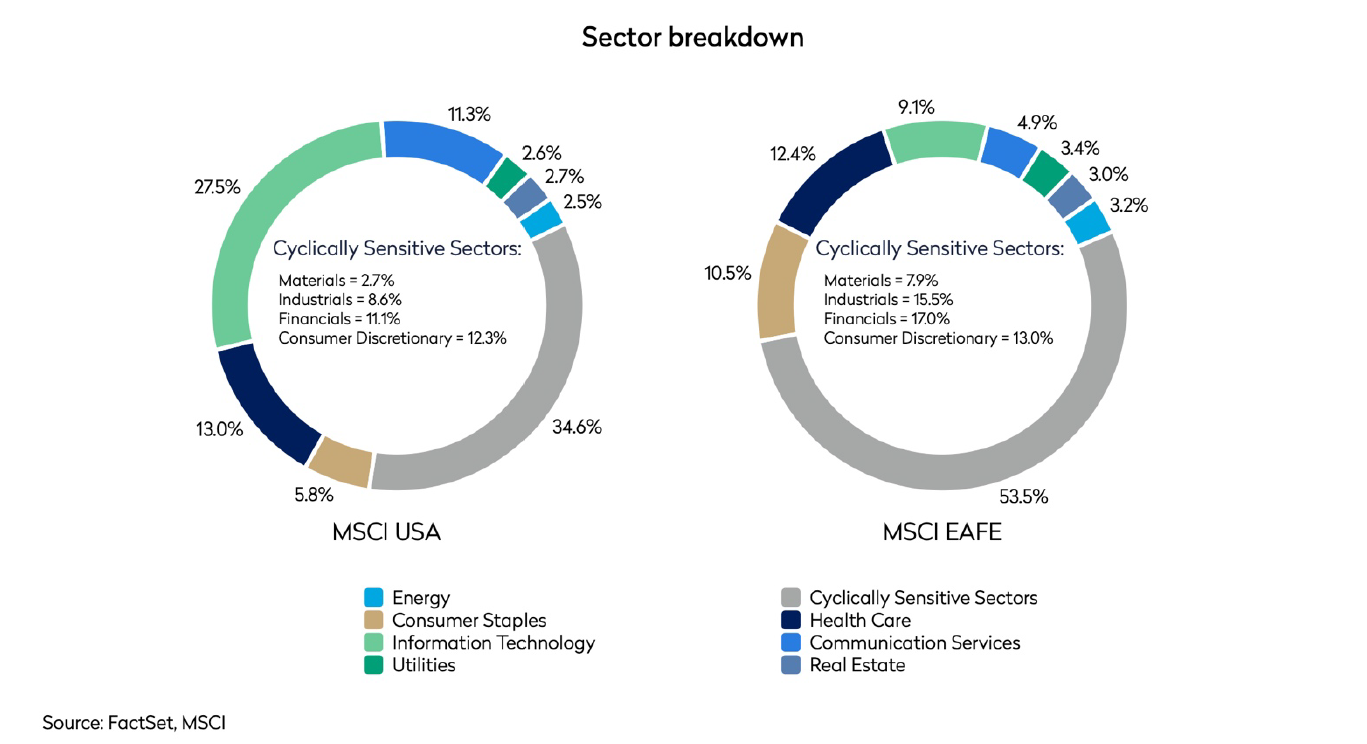

The structure of respective regional indices has also played a major role in the performance dispersion between the US and international markets. International markets have a higher exposure to traditional cyclically-sensitive stocks which tend to do less well in an uncertain economic environment. On the other hand, the US market is overweight in certain sectors currently benefiting from structural and secular growth drivers, including healthcare, communication services and IT, where the US represents more than 85% of the developed world opportunity set.

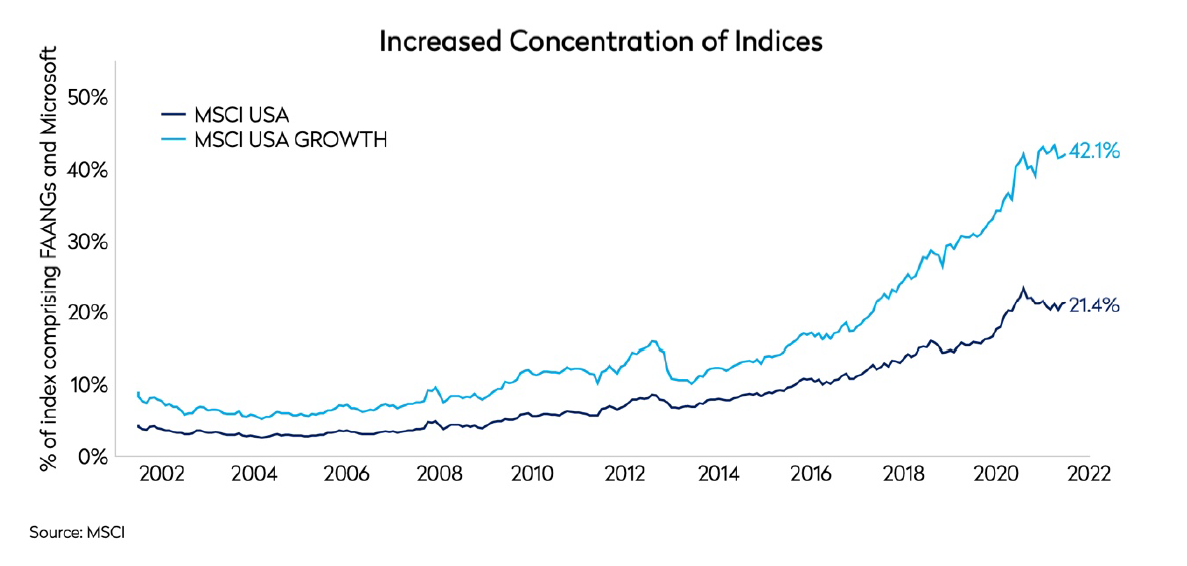

One additional factor driving the recent strength of the US market has been the rising pre-eminence of a select number of technology companies. The chart below shows the increasing dominance of the so-called FAANGs, and Microsoft, as a percentage of the MSCI USA and MSCI USA growth index. These six stocks now make up 21% of MSCI USA and 42% of the MSCI USA growth index, despite the recent rebound in cyclical value equities. While these companies are beneficiaries of the COVID-19 pandemic and have formidable business models, their outperformance has led to a concentration risk in many passive investments that may be far too high for more prudent investors.

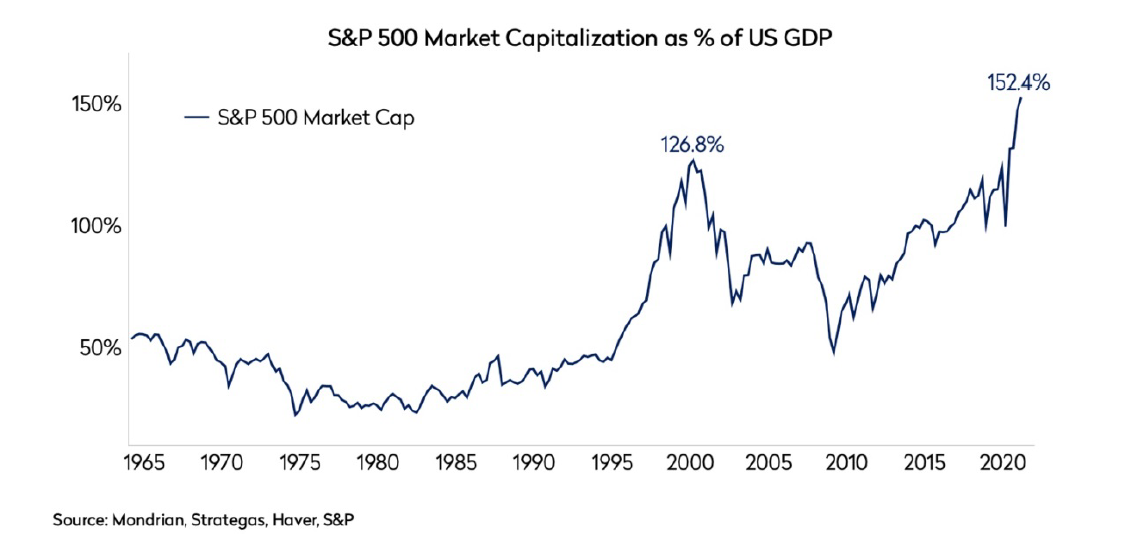

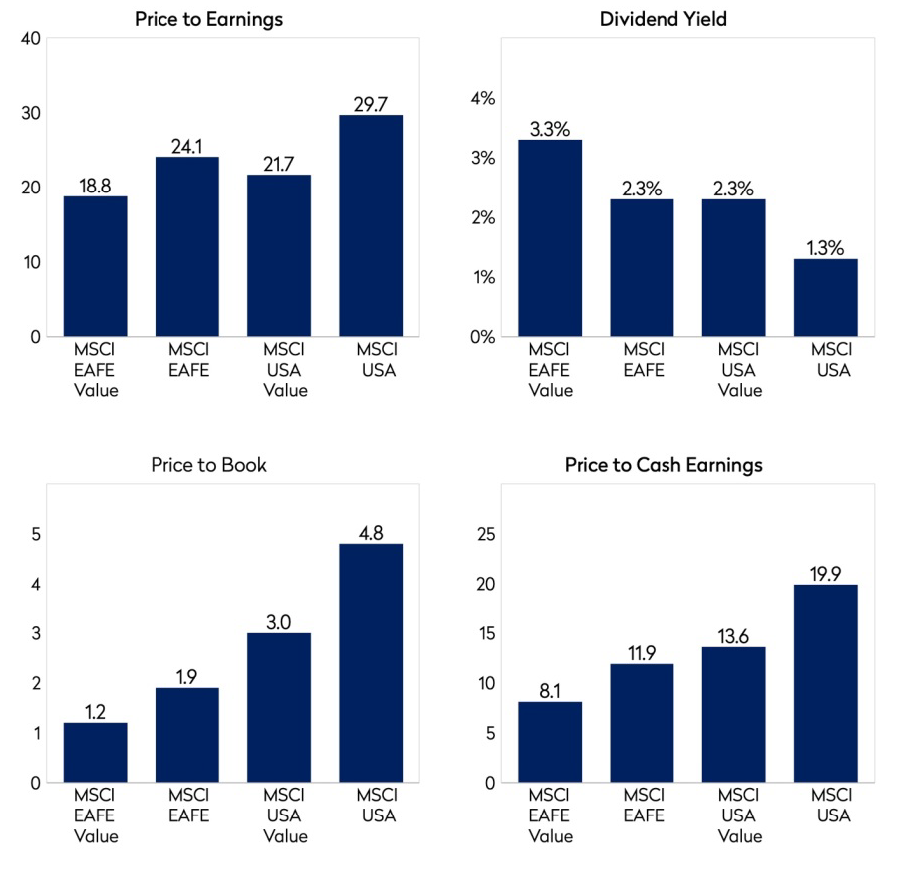

Moreover, the reduction in the US corporate tax rate in late 2017 increased post-tax free cash flows and, consequently, US company valuations. The US economy’s relative economic resilience as well as the particularly strong capital management discipline of many US corporates are also all likely to have contributed to this outperformance. As a result, we believe that there are segments of the US market that are trading at extreme valuations and this, coupled with the strong performance of a few expensive tech behemoths, has caused the overall US market to look increasingly fully valued versus other international equity markets. The charts below are simple, static, backward looking, but objective measures to illustrate the point. Mondrian’s forward looking dividend discount models also support this conclusion.

International Currencies Remain Undervalued

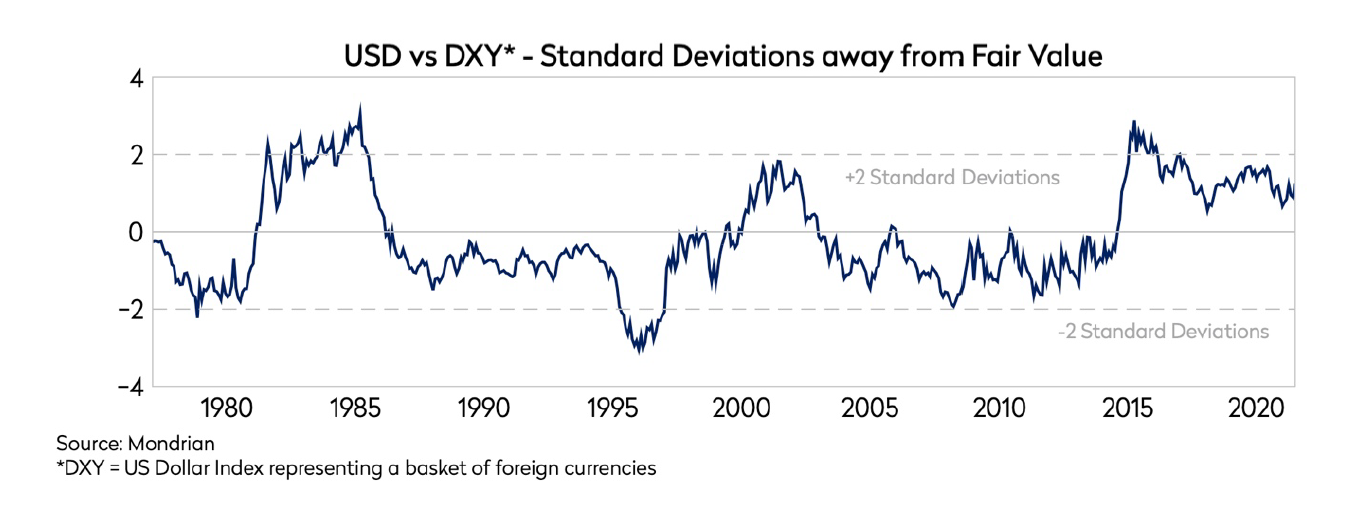

As we have commented previously, despite recent appreciation, international currencies still appear attractively valued against the US dollar. Currency movements are impossible to forecast with confidence over the short-term. At Mondrian, we adopt a Purchasing Power Parity (PPP) approach to focus on longer-term valuation relationships. Our long-run PPP valuations tell us that the US dollar is currently overvalued against most global currencies. This may be an additional headwind for domestically-focused US stocks in the long-term.

Financial Risks have Continued to Accumulate in Equity Markets

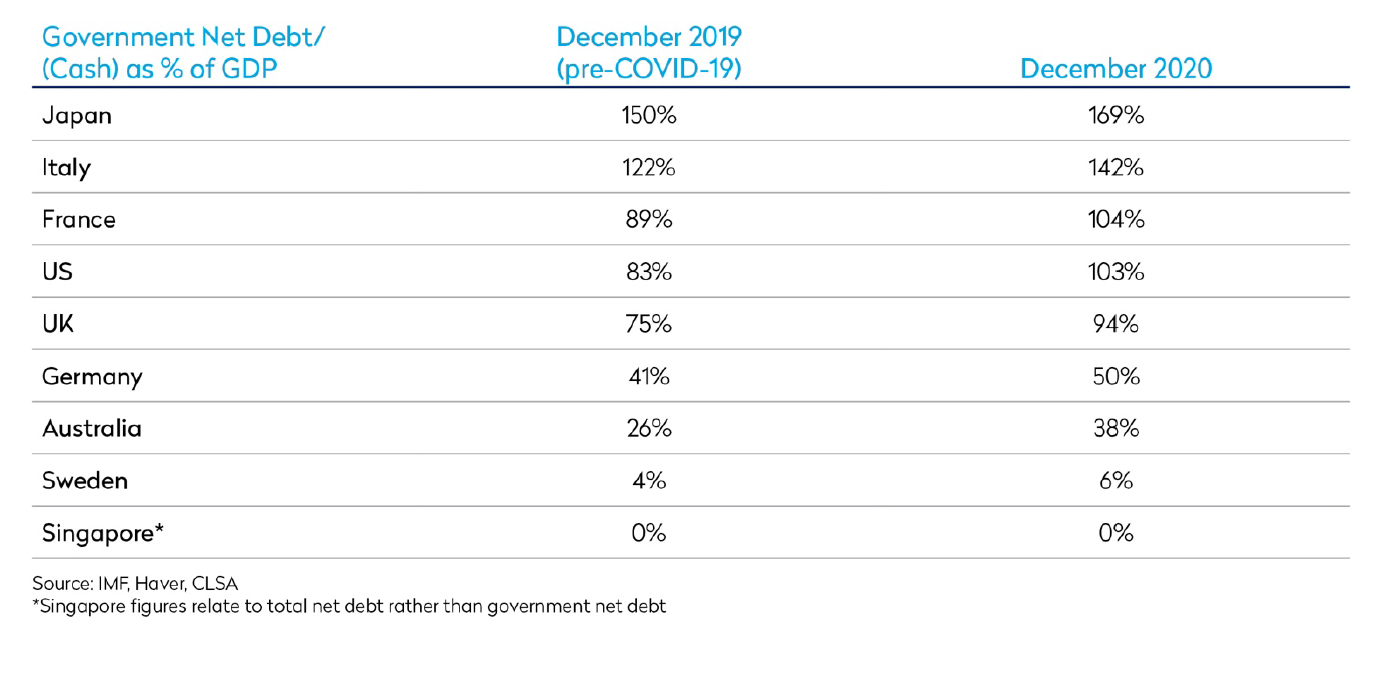

Global economies are still beset with unresolved structural and residual effects stemming from the GFC. Slow progress in deleveraging after the GFC has led to a build-up of financial tail risks, which have been exacerbated as central banks and governments focused on fiscal spending to both support businesses and employment during the pandemic, and foster a post-COVID-19 recovery. While fiscal support was necessary, elevated global debt levels make the economic system vulnerable to a sudden increase in interest rates, stemming from a rise in risk aversion, inflation or expectations of faster monetary tightening. While a way out of the current global health crisis looks increasingly visible, the longer-term economic challenges remain real, and the recoveries that are underway will be multi-speed, given differences between nations in the pace of vaccine roll-outs and the extent of domestic leverage and economic policy support.

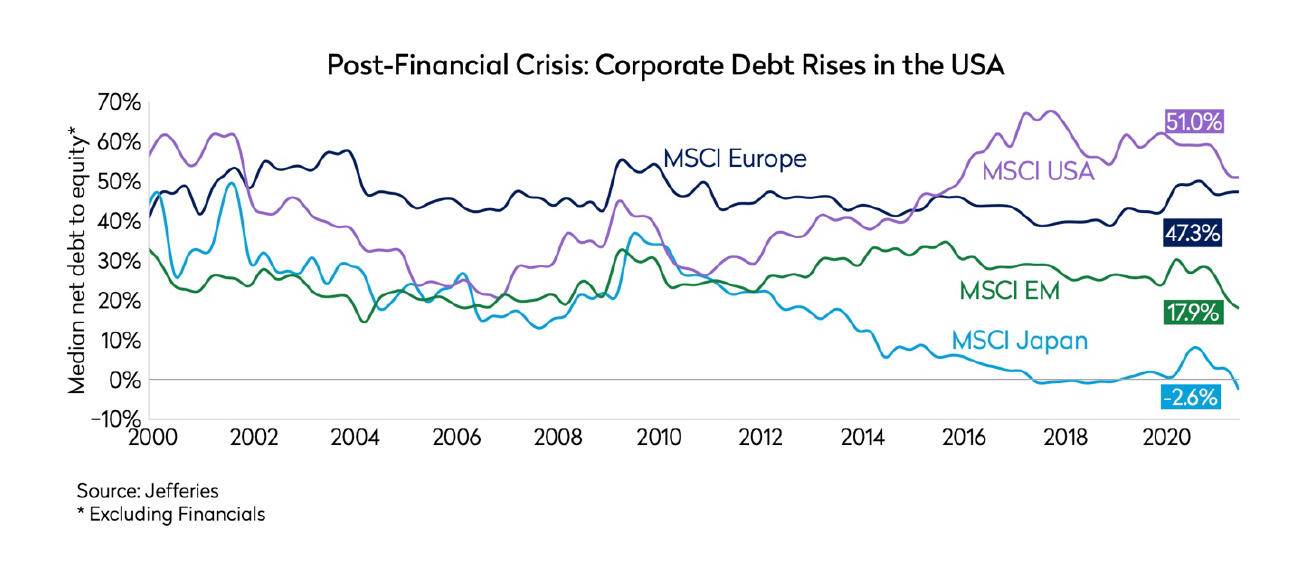

The US appears to be well-positioned on a relative basis. Among advanced economies, it is expected to surpass its pre-COVID GDP level this year; many others will not return to pre-COVID levels until 2022. Nevertheless the US is unexceptional in relation to its debt overhang. Following the pandemic, the US has seen its combined budget and trade deficits approaching 20% of GDP with indebtedness increasing sharply at both the sovereign and corporate level. Much of the increased corporate leverage in the US has enabled buybacks and driven strong share performance over the past few years. The US Congress is currently weighing whether to make adjustments to the 2017 tax law, which supported corporates and their investors. The positive US tailwinds of recent years could go into reverse as a greater focus on corporate taxation and investments become central.

In a post COVID-19 environment, rising sovereign debt and a potentially greater focus on corporate taxation are by no means just a US problem. However, there are a number of economies within the international markets which were in better fiscal health entering the COVID-19 pandemic, enabling them to push ahead with post-COVID recovery. They are also likely to be insulated from future significant tax rises and fiscal retrenchment, thereby supporting a positive long term outlook. These top-down factors are incorporated into our bottom-up stock models when identifying attractively valued securities.

The Japanese Market Continues to Stand Out as Attractive on a Risk-adjusted Basis

One market which stands out from the table above is Japan. While Japan has high levels of sovereign debt, the ongoing willingness of Japanese savers to hold on to Japanese government bonds combined with the aggressive bond purchasing schedule of the Bank of Japan has meant that government bond yields continue to test new lows. Crucially, and important for equity investors, the private sector’s well capitalized balance sheets are the mirror image of the Japanese government’s high debt levels, as shown below. We have written before how, as part of our increasing focus on the leverage of companies, the portfolio went overweight the Japanese market over the last few years. Japan was a COVID-19 success story in the early months of the pandemic, with mask-wearing and social distancing familiar concepts in the country. However, the slow start to its COVID vaccine rollout has seen the Japanese equity market lag the most recent rebound. Earnings and dividend growth, have been strong in Japan in the post-GFC world and are likely to continue to be sensitive to any global economic recovery. We continue to believe that significant value remains in the market. This creates a significant opportunity for long-term investors like Mondrian.

Valuations Support the Case for Fundamental, Bottom-up Equity Value Investing

Both the US and international equity asset classes have benefited from a decade of prolonged, accommodative financial conditions. The speed and scale of recent monetary and fiscal stimulus, led by the US, to support a post-COVID-19 recovery has seen markets rebound strongly from the lows of March 2020. Expensive high growth names, especially those in the US market, have benefited from record low interest rates and structural changes in the economy that have led to a multi-year rise in their multiples. More recently, deep “value”, cyclical stocks have enjoyed a recent sharp rebound as equity markets extrapolated a near-term cyclical earnings recovery into the future. In most cases, the share prices of equities at both these extreme ends of the market are now higher than they were pre-COVID. As a result, overall equity market valuations are looking increasingly stretched and strategically, we are seeing more opportunities in international equities where aggregate valuations are relatively more attractive. However the current environment underlines the importance of identifying investments through fundamental bottom-up valuation-focused analysis.

As economies recover equity markets, especially those that are highly priced, are likely to face volatility with the repricing of risk and cost of capital. In such an environment, valuations become increasingly consequential and this reinforces the importance of a consistent and disciplined valuation framework to identify mispricing. An environment of uncertainty and the presence of tail risks present opportunities for a manager like Mondrian, which uses a disciplined valuation framework to produce attractive real rates of return with defensive value performance characteristics. There are significant mispricing opportunities in markets today, and we believe the skew is clearly in favor of defensive value investing.

Views expressed were current as of the date indicated, are subject to change, and may not reflect current views. All information is subject to change without notice. Views should not be considered a recommendation to buy, hold or sell any investment and should not be relied on as research or advice.

This document may include forward-looking statements. All statements other than statements of historical facts are forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results to differ materially from those reflected in such forward-looking statements.

This material is for informational purposes only and is not an offer or solicitation with respect to any securities. Any offer of securities can only be made by written offering materials, which are available solely upon request, on an exclusively private basis and only to qualified financially sophisticated investors.

The information was obtained from sources we believe to be reliable, but its accuracy is not guaranteed and it may be incomplete or condensed. It should not be assumed that investments made in the future will be profitable or will equal the performance of any security referenced in this paper. Past performance is not a guarantee of future results. An investment involves the risk of loss. The investment return and value of investments will fluctuate.