In the Bleak Midwinter…

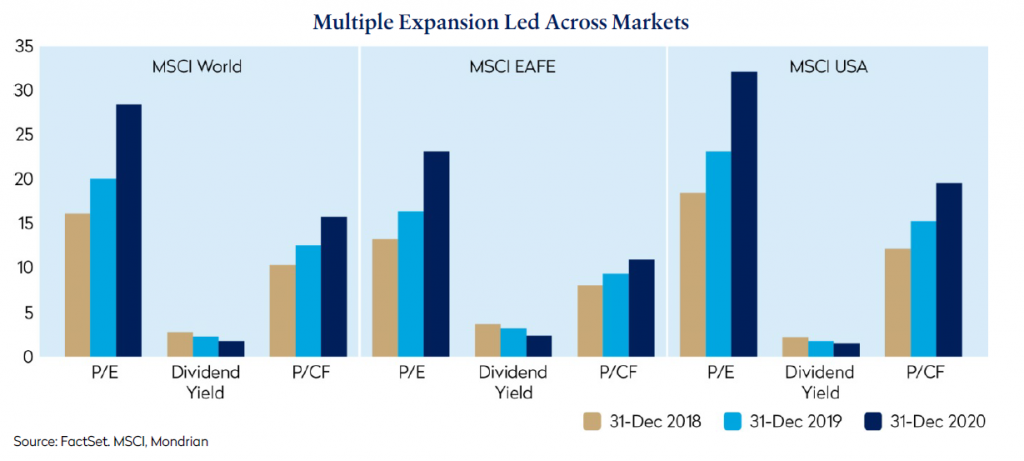

2020 has been a miserable year. In the UK, we are still largely confined to our homes, as a new super-contagious variant of the virus runs amok. And sadly, contemplating the past year in equity markets as a valuation driven investment manager offers no respite! Markets have seemingly de-coupled further from earnings and fundamental value. Supported by the necessary COVID emergency fiscal relief and the explosion of monetary stimulus, market multiples have expanded, underpinning returns despite weak earnings.

The returns for our valuation-based portfolio have struggled against a very strong market. While the portfolio returns are generally consistent with our earlier forecasts of the likely COVID impact on overall market valuations and returns, selective but significant market multiple expansion means that the portfolio relative returns have been severely punished over the past year.

Despite the COVID gloom, and well against most expectations earlier in the year, market-level investment returns in 2020 offered a positive alternative universe. Although the pandemic devastated economies around the world, most major global indices have achieved double digit returns. China, which first experienced the pandemic, is up over 30%, the MSCI World index is up over 16%, led by the 21% return from the US market. Even the laggard EAFE markets have returned 8% in aggregate.

Longer-term Challenges: Superpower Geopolitics, Stabilizing Economic, Fiscal and Political Systems, Inflation Risks and Opportunities, Confronting Climate Change

After the challenges and contradictions of the past twelve months, writing an outlook for 2021 feels somewhat presumptuous. While this is written with trepidation, we do believe there are a few things that can be said with some confidence. The quarter ahead looks bleak, but it is likely that the global roll out of the vaccines, while slow and beset with some uncertainty, will result in a sharp and globally synchronized increase in economic activity over the year as economies accelerate to some new normal. They will likely be supported in the near-term, at least in the developed world, by further fiscal and, where possible, by monetary stimulus.

The extreme devastation that COVID has wrought is likely to subside, but the political and economic uncertainty that preceded it will remain. The fight for global economic pre-eminence continues. The US relationship with China has only worsened through COVID. The relationship between the current and the emerging superpowers will remain subject to much speculation and uncertainty even with the change of administration in the US.

When COVID first struck, we noted how important the quantity and quality of the fiscal and institutional response would be to the eventual resolution. The response in developed economies, while challenging, has so far demonstrated both monetary and fiscal commitment. Particular success has been evident in Asia which has had previous recent epidemic experience, while Germany has so far been able to use their deep financial resources to maintain substantial capacity in its health care system and to offer fiscal support to its population, and to some extent to Europe more broadly.

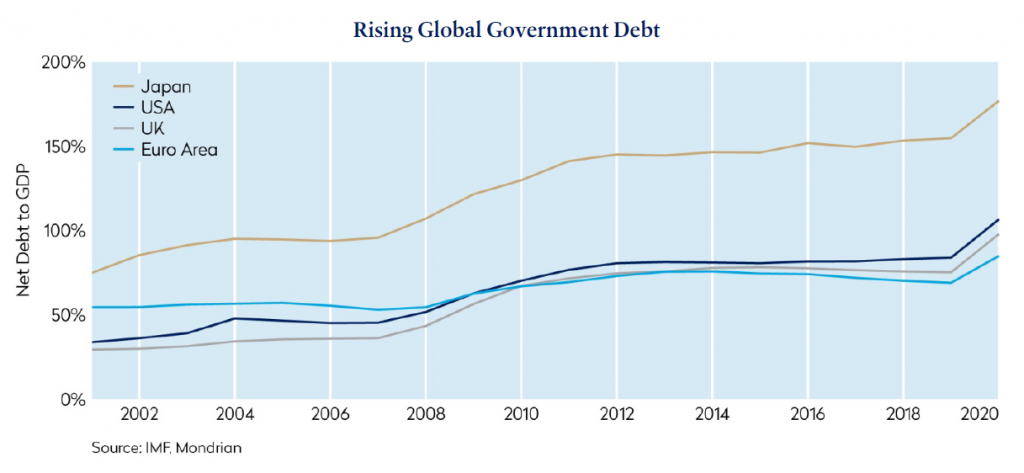

The sharp rise in government debt is only the most obvious manifestation of the economic crisis created by the pandemic. Economies and individuals are likely to struggle with significant scarring that may undermine future productivity and long-term economic growth. Higher and extended unemployment, the lack of training and education for workforces, corporate zombification from debt overload, ongoing de-globalization, additional workplace safety measures, and significant structural changes in some sectors have the potential to damage individual companies and overall economic productivity. The damage will not be uniform and some companies and countries will emerge far less scarred. The key for us is to understand the difference between the structural and cyclical impacts of COVID and to identify mispriced securities.

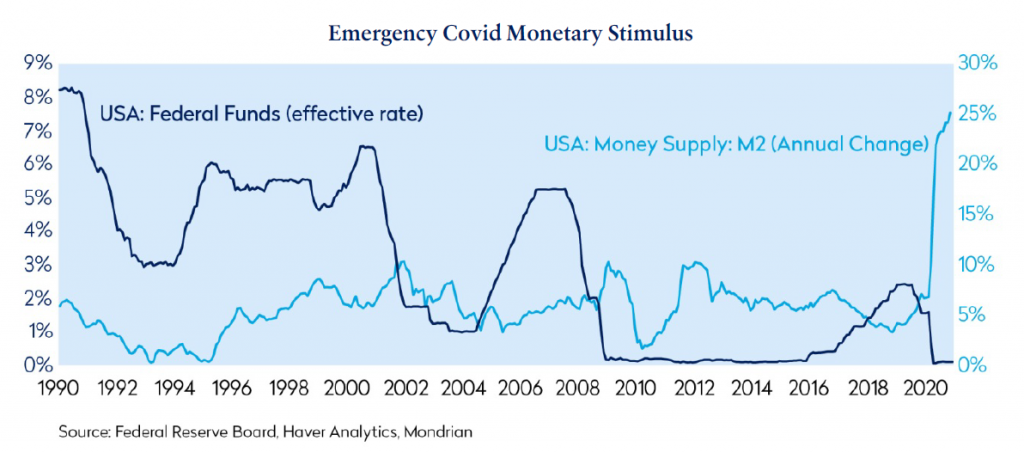

The accumulation of fiscal debt coupled with substantial monetary stimulus has also caused commentators to begin to countenance the prospect of inflation. While recent money supply indicators might cause investors to anticipate an inflationary boom, more likely in the near term, the large output gap created by the pandemic in most economies will make anything other than temporary supply-side driven inflation still a remote possibility. The economic history of Japan in the last twenty years illustrates how challenging it can be to try to create inflation. However, the sharp rise in M2 in the US, the change in the Fed’s mission and, in certain circles, the enthusiasm for Modern Monetary Theory are changing the dialogue. Can/will inflation help us “build back better” out of the devastation of the pandemic?

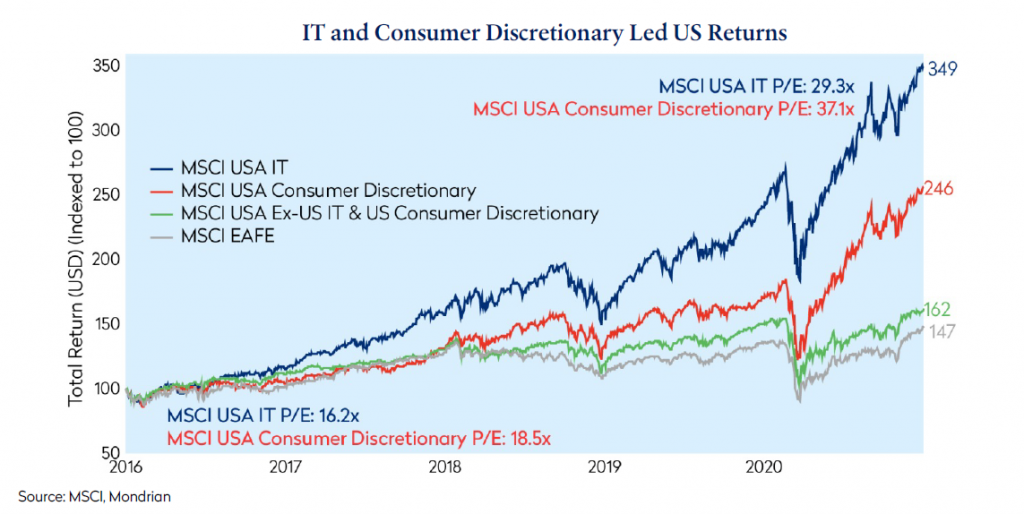

Alongside most investors, we have explained the strong returns from growth stocks as the result of sharply lower interest rates across the yield curve, a hugely uncertain economic environment, and an uncertain outlook for corporate profits undermined by a radical upheaval in traditional working and leisure practices because of the pandemic that has led to an almost total reliance on technology. This reliance has, in part, led to the increasing dominance of the famous FAANG stocks and a significant concentration in global equity benchmarks. The concentration risk of many passive investments may be far too high for most prudent investors. Benchmark concentration has certainly hurt our performance: we took the opportunity to invest in Apple at the beginning of 2019, and have recently exited the position following exceptional returns. Despite this, Apple, which makes up close to 4.3% of the index, has been a negative contributor to relative returns in 2020, given the size of the stock in the benchmark. While Apple, similar to the other FAANGs, is a beneficiary of the COVID pandemic that continues to beat earnings estimates, based on historical observations, it has been precisely the time at which a company can’t lose when the investor in common stocks should be most fearful. While growth is a desirable feature of stocks, future returns will depend as much on that growth as on the price that investors have to pay to get exposure to it. As the chart below shows, the US IT and consumer discretionary sectors have re rated significantly over the past five years. However, excluding these sectors, the US market has not outperformed the EAFE benchmark that significantly. While we believe that the overall US market is overvalued, attractive stock picking opportunities exist in the rest of the US market, and in other international markets, which have lagged this remarkable growth rally.

Scarred by the effects of the pandemic, a nervous population, while desperate for a return to normality, is likely to be risk averse especially as regards large structural risks like climate change. The current trend towards ESG, particularly environmental awareness and transparency, is likely to continue. Politicians who make sweeping promises to meet significant targets well out into the future may increasingly be held to account for progress in reaching those targets. Listed companies in particular will be forced to disclose and document their progress towards meeting these objectives. These added costs and bureaucracy could potentially act as a drag on their long-term returns, but it will also most likely make them more robust to meet future risks, and consequently less risky, at least on a relative basis, as investments.

Market Outlook: Valuation Gap Continued to Widen in 2020 as Multiple Expansion led Earnings Outlook

After the broad extent of the pandemic was apparent, our forecasts – as calculated in March 2020 – anticipated that, with a scenario much as has manifested, a COVID loss to underlying value, market-wide, was likely to be the present value of (on average) two years of earnings and dividends. While we acknowledge that a dividend-driven present value calculation could, in the COVID scenario, disproportionately impact higher yielding companies, based on our initial analysis of the pandemic’s impacts, and supported by lower portfolio valuations, we did not see the forecast returns for companies in our portfolio being materially damaged or any more impacted than the overall market in terms of underlying valuation-driven expected return. This view was supported by the portfolio’s lack of exposure to some of the worst hit sectors including hospitality, aviation, general retail, and tourism. Over the course of the year, the return and valuation gap between value and growth sub-sectors continued to widen as the charts below illustrate. Despite some improvement in returns from the value sub-sector recently, this gap has only closed very slightly in the fourth quarter.

We do not build portfolios based on static valuation metrics and do not necessarily believe that all the stocks in the value benchmark are undervalued or mispriced. As we have written before, some of these stocks are just lowly valued or very risky. Mondrian has a disciplined valuation methodology and our aim is to identify mispriced securities based on our long-term Dividend Discount methodology, within a structured scenario analysis framework. Our aim is to generate strong absolute returns with strong downside protection and low levels of volatility. Our forward-looking approach has helped us to outperform the value benchmark in every calendar year in the past 5 years, avoiding some of the weakest names within the value benchmark. Nevertheless, the chart above clearly illustrates the bifurcation of returns between the two extremes, in particular within the US market. Despite our ability to invest in lower dividend yield stocks or stocks which require higher growth assumptions, we have found that the prices of some of these securities incorporate extremely optimistic assumptions.

As the range of outcomes has widened across the market, Japan is increasingly attractive on a risk-adjusted basis

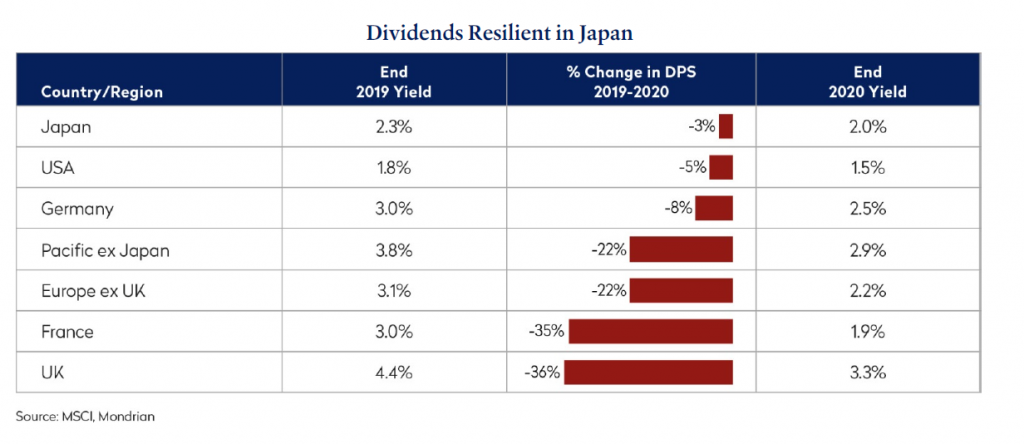

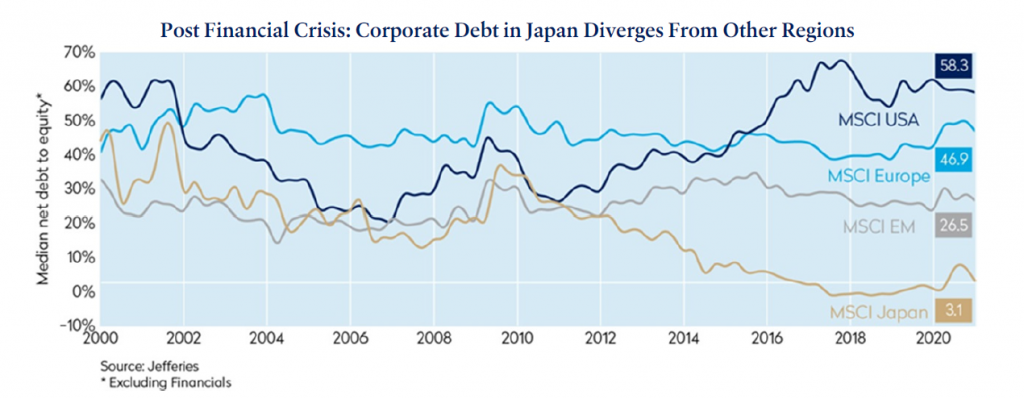

Underpinned by relatively stable dividends, and strong balance sheets, the Japanese equity market stands out as attractive on a risk-adjusted basis. As part of our increasing focus on the leverage of companies, the portfolio went overweight to the Japanese market in early 2017. Returns have subsequently benefited from positions in leading Japanese companies with strong balance sheets that support the skew of outcomes, such as Sundrug, Matsumotokiyoshi, Kyocera, Mitsubishi Electric, and the more recently purchased Toyota Industries. Our exposure to this market helped the portfolio to provide strong downside protection during the depth of the COVID crisis. We believe that Japan is a unique and attractive market, with plenty of stock picking opportunities.

Listed companies, having cut their dividends, will both be careful about how they reinstate them, but also cautious about taking on further debt to fund expansion. The steady state debt/equity ratio of companies may have to come down in most developed markets, with the exception of Japanese companies. Given our focus on normalizing leverage in our bottom-up stock models over time, we believe that this potential change in corporate behavior is, for the most part, captured in our long-term assessment of companies’ dividend paying capability. It was this focus, together with our downside scenario analysis that helped us to avoid some of the market’s weaker investments in the extremely stressed circumstances created by this crisis.

Conclusion

2020 was a head-spinning year for investors. COVID caused a seismic shock in countries across the world, leading to steep declines in global markets. A sharp recovery followed, driven by unprecedented fiscal stimulus. It was a recovery that widened the performance gap between value and growth stocks, as the market applied the best case, and a low discount rate, to a select group of growth-oriented names. Having already rallied strongly off of March’s lows, the MSCI World index charged still higher: MSCI World was up 16% in 2020 as markets reached new, all-time highs against the backdrop of the pandemic, and on the back of a better-than 27% return in 2019. The development and approval of several credible coronavirus vaccines in the quarter led to a wave of investor optimism that the global economy is poised for a strong rebound in 2021. There have been signs of investor euphoria in this latest stage of the rally, with expectations rising that the pandemic can be brought under control as aggressive stimulus measures continue. Investors appear to be focusing on pent-up demand, restocking supply chains, strong consumer balance sheets and easy comparisons to drive an earnings recovery in 2021. There remain risks of long-lasting costs to the global economy from the pandemic. Structural changes in different sectors of the economy, caused or accelerated by COVID, will inevitably lead to bankruptcies and job losses in 2021 as recent crisis-related programs and job retention measures roll off. Increased uncertainty and weak confidence may continue to keep precautionary saving elevated and hold back investment. The surge in borrowing in 2020, required to avoid a more severe contraction in the economy, has seen a massive extension of public and private debt. Recent investor exuberance leaves markets vulnerable to a setback. This exuberance has been seen, in particular, in growth-oriented corners of the market. Given lofty expectations, the valuations of many of these names, some of them the most obvious beneficiaries of the pandemic, now look extended. Mondrian’s time-tested philosophy has helped us to avoid bubbles and to invest in some of the of the world’s most successful companies at attractive valuations. There remain significant mispricing opportunities in markets today. We believe the skew is clearly in favor of defensive, value investing.

Views expressed were current as of the date indicated, are subject to change, and may not reflect current views. All information is subject to change without notice. Views should not be considered a recommendation to buy, hold or sell any investment and should not be relied on as research or advice.

This document may include forward-looking statements. All statements other than statements of historical facts are forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results to differ materially from those reflected in such forward-looking statements.

This material is for informational purposes only and is not an offer or solicitation with respect to any securities. Any offer of securities can only be made by written offering materials, which are available solely upon request, on an exclusively private basis and only to qualified financially sophisticated investors.

The information was obtained from sources we believe to be reliable, but its accuracy is not guaranteed and it may be incomplete or condensed. It should not be assumed that investments made in the future will be profitable or will equal the performance of any security referenced in this paper. Past performance is not a guarantee of future results. An investment involves the risk of loss. The investment return and value of investments will fluctuate.