Introduction

This paper sets out the relevance of international small cap investment in a post Covid-19 world.

Economies across the globe are still beset with unresolved structural and residual effects stemming from the Global Financial Crisis (GFC) even though more than a decade has elapsed. Debt overhang, slow progress in deleveraging and lack of political will to adopt structural reforms and put in place adequate social safety nets to cater for populations disadvantaged by globalization and automation; coupled with unintended consequences of asset inflation driven by prolonged accommodative financial conditions resulting in widening wealth inequalities continue to plague the developed economies.

The emergence of the Covid-19 virus leading to implementation of aggressive restrictions across most countries has further weakened the sluggish global economic growth experienced post the GFC. Developed economies have announced expansive monetary and fiscal stimulus to protect jobs and businesses so as to position the economy for eventual recovery post Covid-19. Whilst the full impact of the virus remains unclear, one can only look to the countries in Asia to understand the trajectory from detection of the virus, restrictive measures implemented to normalization in activities and eventual economic recovery. When normalcy returns, it is expected that a short-term cyclical bounce is likely from the lows of economic activity driven by pent up demand and the lagged effects of the stimulus measures implemented. However, we believe that the economic recovery over the medium and long-term is likely to mirror the post GFC recovery – a continuation of modest growth with central banks retaining their current accommodative financial conditions in the absence of adoption of significant reforms, improvement in productivity and enlarged welfare safety net.

Questions arise on the challenges to performance facing small cap as an asset class in the short term as well as medium to longer term given expectations of modest economic growth against the backdrop of a continuation of the easy availability of cheap liquidity. This discursive paper attempts to revisit the role of small cap in international investing. It also raises questions on whether international small cap investment remains compelling as an asset class with alpha generation potential. It finally reviews how best to invest in this asset class highlighting Mondrian’s unique valuation approach which is well suited in identifying mispricing in this asset class.

Role of Small Cap

Small Cap is an inefficient asset class consisting of a large universe of stocks which we believe is relatively under researched. This creates mispricing which enables alpha generation potential through active stock selection. Moreover, it offers diversification benefits. We believe this makes it an appealing asset class with the potential for long- term outperformance which deserves a strategic allocation in a diversified plan.

A Review of Small Cap Performance

Studies show that over the long-term, performance has favored small cap due to a confluence of reasons, including:

- Better structural growth prospects compared to large cap companies

- A perceived risk premium due to their smaller size, generally less diversified product portfolio and geographical exposure

- The inefficiency of the asset class due to being relatively under-researched which creates significant mispricing. This inefficiency is sustained over time as the asset class evolves with new entrants

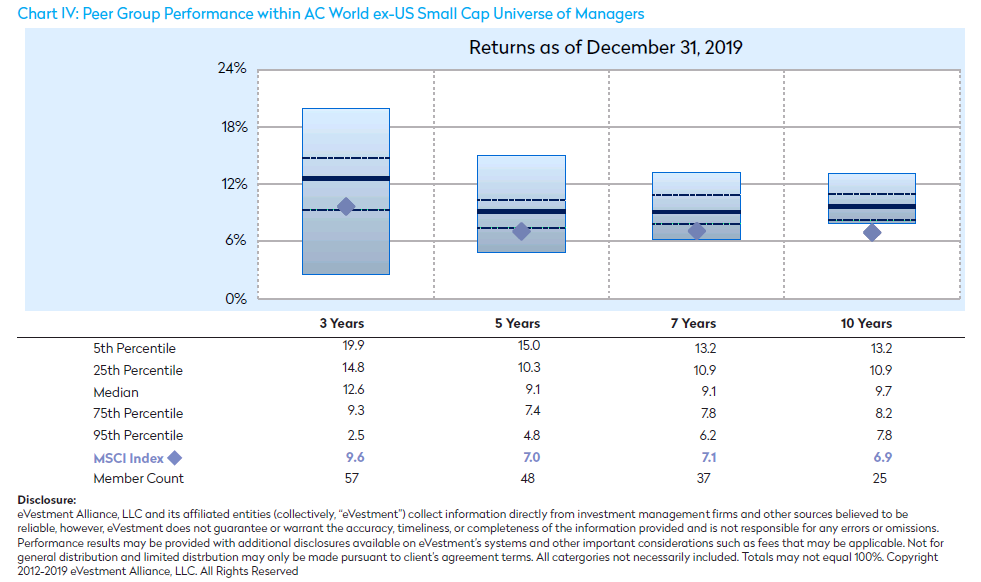

However, there have been short term periods when small cap has underperformed as observed in Chart I (overleaf):

- 1989-1999 when Enterprise Resource Planning (ERP) was adopted by large cap companies improving their operational efficiency while small cap companies lagged.

- In 2007 with expectations of economic growth peaking, followed by the heightened risk aversion during the 2008 GFC impacting small cap more than large

- 2011 during the European Sovereign Debt Crisis which caused significant risk

- From late 2017 to Q3 2019 during global macroeconomic and political uncertainty as well as trade tensions.

Year to date 2020 with the Covid-19 pandemic causing heightened risk aversion due to restrictive measures such as lock downs and social distancing creating significant global demand and supply shock affecting global aggregate demand resulting in a significant decline in global economic growth.

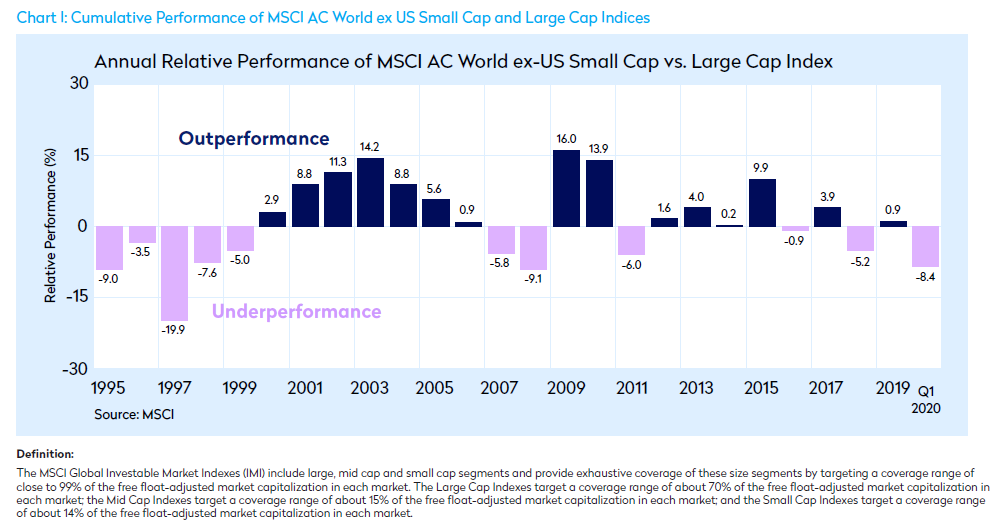

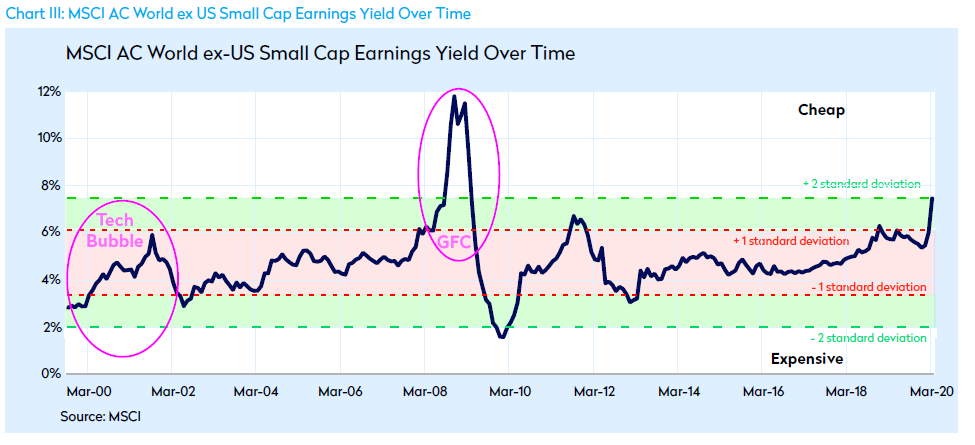

Relative Attractiveness of Small Cap

Financial assets including international small cap equities have benefitted from a decade of prolonged accommodative monetary and liquidity conditions post the GFC. One may question the relative attractiveness of small cap. Chart II and III below highlight that small cap appears attractive relative to its large cap peer as well as its own history.The relative valuation appears more compelling with the recent underperformance of the small cap asset class during the first quarter of 2020 following the Covid-19 pandemic. This is even more pronounced when one considers the exclusion of outliers during the technology bubble and the GFC.

Active Management is Key

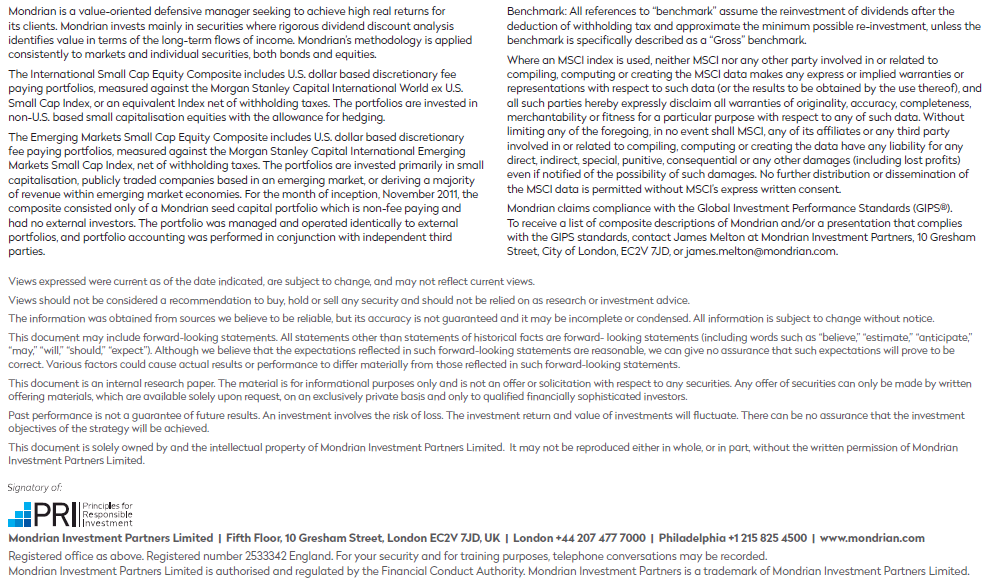

Technology and digitalization have had negative effects on some traditional industries but have also lowered entry barriers to pave the way for new services and products favoring small cap companies. It is inevitable that this evolution will observe some winners as well as losers. This reinforces the role of active management for alpha generation to be unlocked within this large and relatively under-researched opportunity set.Chart IV below highlights that active management thrives within small cap with its diverse array of managers typically leading to high dispersion in manager returns. However, this dispersion narrowed in the ten years since the GFC due to strong markets supported by loose financial conditions. In the last few years, we observed higher dispersion in returns with the increase in volatility caused by repricing of risk and cost of funding. Looking forward, we believe markets will continue to face periods of volatility with a weak economic outlook post the Covid-19 pandemic coupled with an accumulation of political and social tail risks as a result of the last GFC crisis. Thus, we believe this environment would continue to observe a relatively high dispersion between manager returns, underlining the importance of manager selection within active management.

Value Investment Style

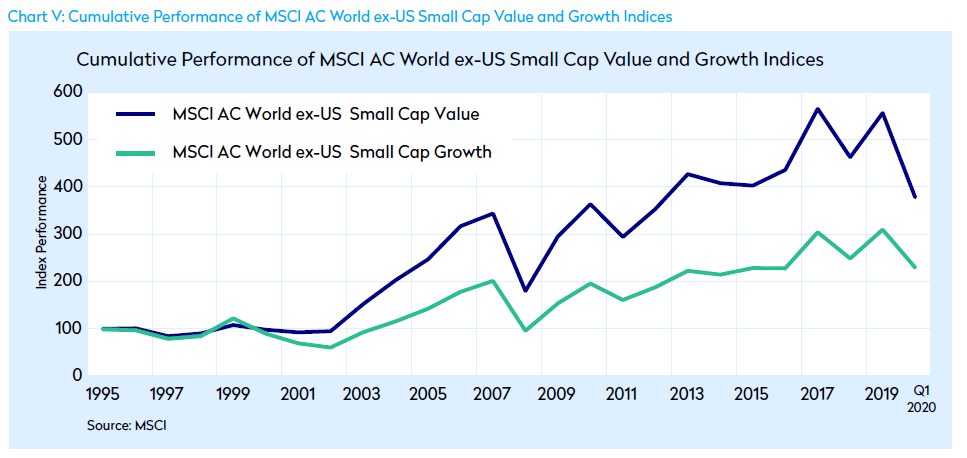

Within small cap long-term historical performance has favored the value investment style, similar to large caps.

Why Has Value Disappointed Recently?

Contrary to long-term history, since the GFC we have observed value investment style being out of favor within the small cap asset class with performance favoring growth style.

We believe this was the result of a number of factors including:

a. Market distortions driven by central bank policies. Low interest rates make growth stocks appear more attractive as expectations of strong growth sustained into perpetuity are discounted at lower rates, particularly for stocks that only produce cash flows in the distant future.

b. Technology and digitalization creating disruptions in a growing list of companies in traditional industries, such as financials, energy, industrials and real estate, who risk becoming structural losers if they do not adapt to seek new products, services or improve operational efficiencies.

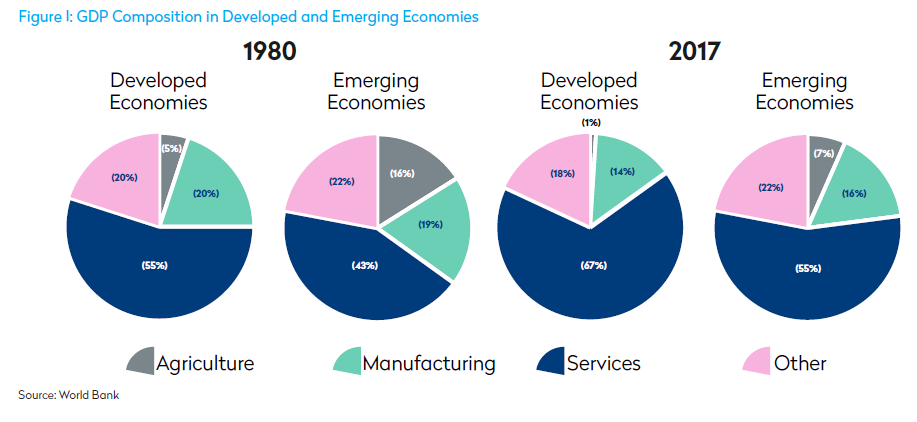

c. A transitional shift away from manufacturing towards services and technology, as reflected in the GDP composition of economies shown below in Figure I, has caused traditional sectors to lag the broad market as investors seek faster growing alternatives in the current environment of low growth and low interest rates.

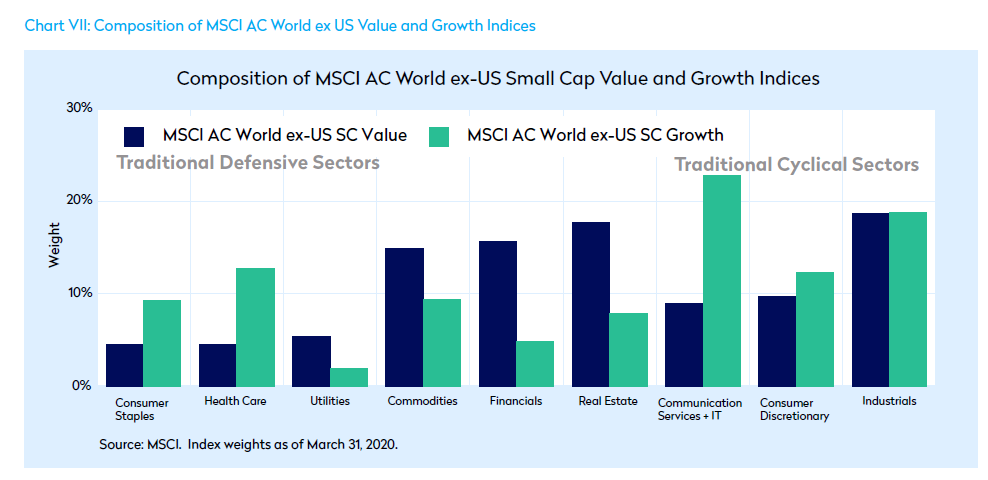

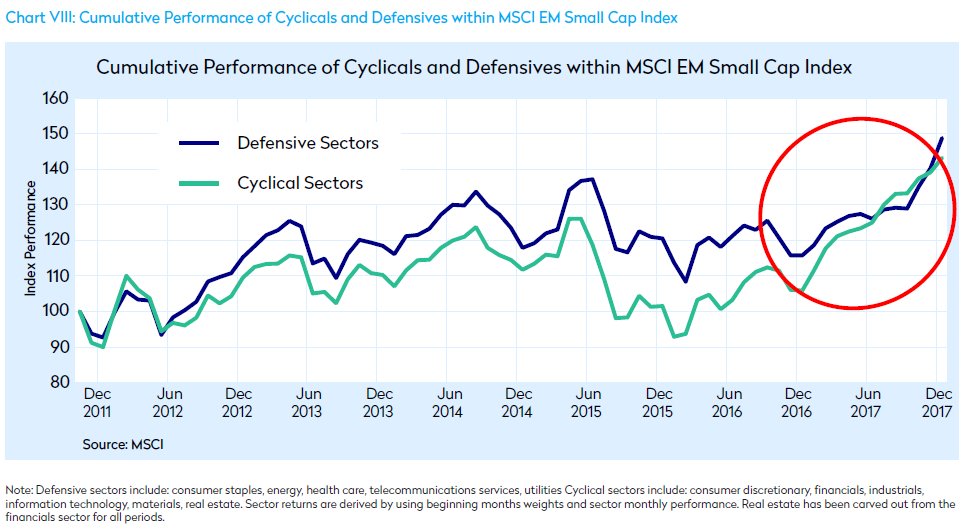

d. There are important differences in the composition of value and growth indices, as examined in Chart VII The value index has a higher exposure to traditional cyclical sectors such as commodities, financials, and real estate compared to the growth index, performing less well during periods of economic uncertainty and outperforming in periods of reflation and when the economy is improving. This was reflected vividly in the emerging small cap asset class during the synchronized cyclical recovery from late 2016 – mid 2017 as evidenced by the strong performance of the value index primarily led by cyclicals which were further supported by their attractive valuations while defensives lagged (Chart VIII).

Note: We are not addressing the debate on how to classify value and growth stocks and simply utilize the MSCI style data in this paper

Mondrian’s Unique Valuation Approach

The basic goal of value investing is to exploit mispricing – buy stocks trading at a discount relative to their fundamentals and their peers which have upside potential due to strengthening fundamentals, improving operational efficiencies, and cyclical or structural recovery which will drive earnings and cash flow growth to support an expansion in valuations.

There are many ways to value a company. It is interesting to note that the definition of value has been adapted over the years to meet different investment styles since the early valuation framework introduced by Graham & Dodd to analyze the relative attractiveness of stocks. The general categorization identifies value stocks as those that are cheap with low valuation multiples using price as a numerator (price-to-earnings, price-to-book, price-to-cashflow, price- to-dividends) relative to market and vice versa for growth stocks. Value and Growth stock baskets have been adapted to include factor based loadings on momentum, sales growth, quality and low volatility.

An accumulation of investment experience over the years and since the GFC and risk aversion cycles, has highlighted that any investment style – value, growth, momentum, quality, low volatility or numerous other style factors that are in vogue will swing between cycles of being cheap and expensive and back again. This only reinforces the need for a consistent and disciplined investment valuation approach across market cycles.

Mondrian is a manager that is unusual in the industry as it has stayed true to its philosophy, process and valuation framework across market cycles since its inception as a firm in 1990. The Mondrian framework combines a quantitative approach with qualitative input to address mispricing and opportunities.

Mondrian believes that the value of a company lies in its future income stream as dividends represent the most tangible form of cash flow to long-term investors. Mondrian utilizes a proprietary inflation adjusted dividend discount model (DDM) to determine the valuation of companies. It uses a consistent real discount rate in contrast to the traditional use of long bond yields adjusted to include risk premium. The process avoids distortions caused by mispricing in the bond markets to value companies. As the process focuses on the future ability of a company to pay dividends to shareholders, it encompasses both current yield and future growth. Its forward looking process incorporates the understanding of company management skills and ambitions, its business plans and long-term growth prospects as well as risks. Mondrian utilizes scenario analysis to capture a range of expected outcomes to better understand the skew in returns of base against best and worst outcomes. Every valuation for a company consists of base, best and worst case expected returns within which material impacts of environmental, social and governance (ESG) factors on forecast earnings/cashflow generation assumptions are analyzed over the short, medium and long-term. In simplistic terms, the process focuses on the sustainability of expected growth assumptions and to price growth correctly so as not to overpay for it. In short, a stock with a high dividend yield (often equated as a measurement of cheapness but not necessarily undervaluation) but with deteriorating fundamentals eroding its dividend paying capability over the long-term may have a lower valuation as per Mondrian’s in- house valuation methodology than a stock with a lower yield but with a sustainable and predictable long-term cashflow generating potential supporting a progressive payout policy. Further, Mondrian’s long-term fundamental focus and investment horizon gives it an advantage to exploit mispricing created by short term factors as well as those created by material ESG factors which typically influence over the medium term.

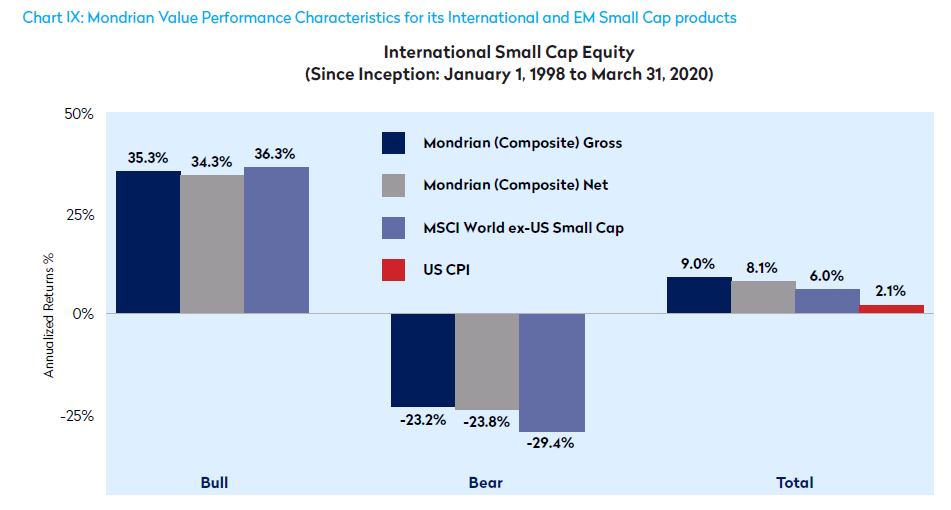

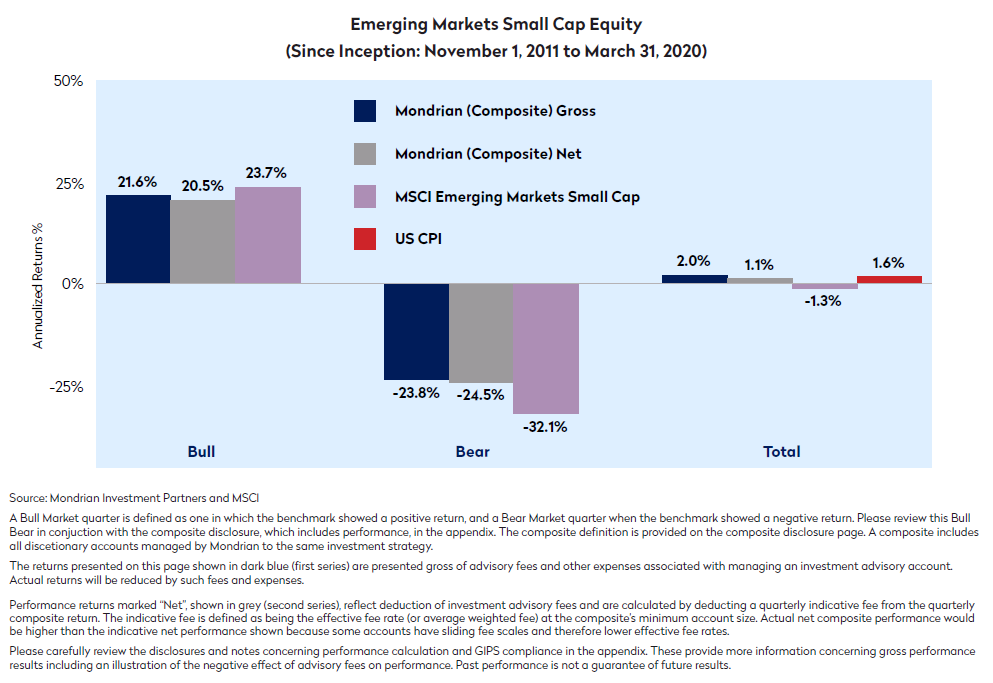

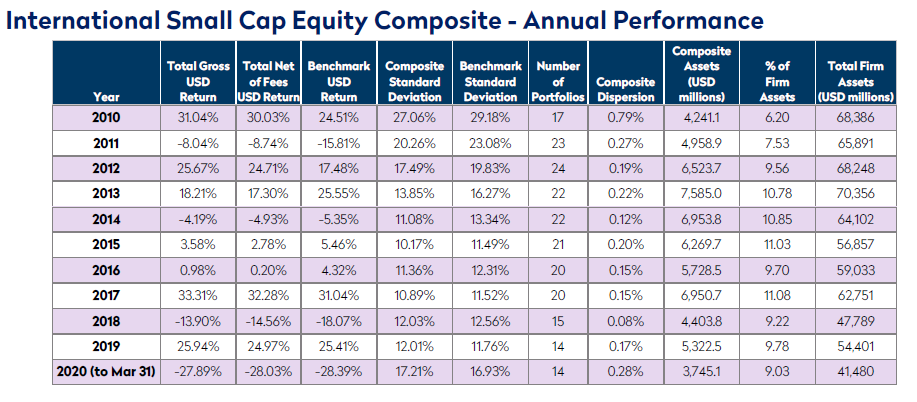

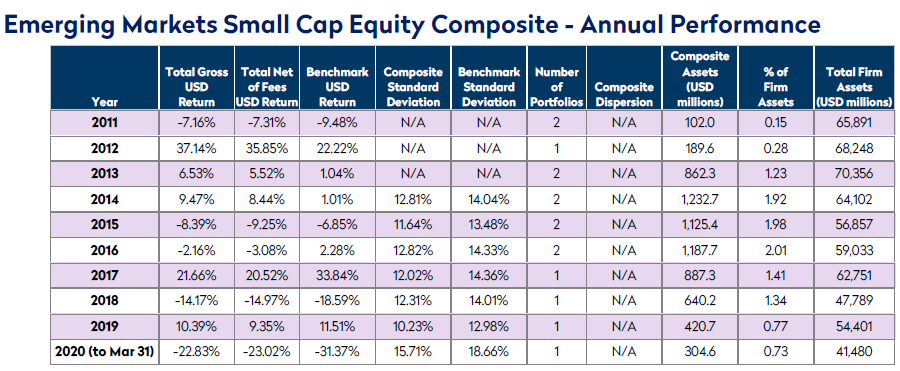

Mondrian’s disciplined investment framework is adaptive utilizing detailed fundamental analysis incorporating extensive top-down and bottom-up understanding of economies, currencies, sectors and industries to value companies both across their life cycles and their global value chains. We believe this disciplined process provides an idiosyncratic source of return to Mondrian’s long-term performance against its peers and benchmark. Mondrian has delivered a successful track record of consistent value performance characteristics of emphasizing upside performance with downside protection and minimized volatility (Chart IX).

Conclusion

The continuation of a protracted period of modest global growth post Covid-19 with accommodative monetary and liquidity conditions will continue to drive the ongoing search for yield and investments providing growth. This favors investment in inefficient asset classes such as developed and emerging small cap which offer structural growth prospects. The investment case for developed and emerging small cap is made compelling with their attractive relative valuations coupled with the overvaluation of the US dollar against most currencies. Further, the small cap asset class with its large universe of relatively under-researched and often mispriced stocks creates alpha generation potential which can be realized through a methodical approach to active management. The current environment of uncertainty and the presence of tail risks present opportunities for a manager like Mondrian. Mondrian’s disciplined investment framework is adaptive utilizing detailed fundamental analysis incorporating extensive top-down and bottom-up understanding of economies, currencies, sectors and industries as well as including ESG factors to value companies both across their life cycles and their global value chains. This disciplined process provides Mondrian its idiosyncratic source of return with a successful track record of consistent performance with minimized volatility.